In this review, we are going to look into an EA called August Forex Golem which is one of the low drawdown EA in our list; however, it doesn’t actually have low drawdown!

We’ll talk about that more, later in this review.

Note: The stats in the table of low drawdown EAs on the list (above link) are related to another account that’s been removed from the EA’s website

The website doesn’t look flashy or even well-designed but I think these things don’t matter as long as an EA is profitable, so we ignore that and want to see the performance of the EA that this site promotes.

With that said, we’re going to study and analyze the results and stats of August Forex Golem in this review to see how it might bring us profits and whether it’s worth buying or not.

You'll See in This Article:

August Forex Golem Overview

| System | Grid/ Fibonacci Retracement |

| Platform | MT4 |

| Timeframe | M1 |

| Currency pair | All FX Pairs, Suggested: EUR/USD |

| Min Deposit | Any |

| Real Account Test | No |

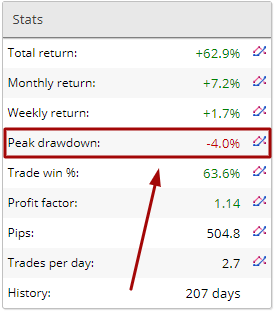

| MAX Drawdown | Balance: 4%, Equity: 45% |

| Average Expected Return | 7.2 Monthly |

| Price | $197 |

| Website | August Forex Golem |

August Forex Golem Trading Strategy

Unfortunately there isn’t much information about the system of August Forex Golem on the website of the EA.

The vendor has just stated general info about the strategy of the EA. It’s mentioned that the strategy is based on Fibonacci retracement and some indicators. We don’t even know what indicators they are talking about.

In the FAQ section, there’s a question about the system and the answer is that the EA is based on a grid strategy.

Most grid systems are dangerous because they keep trades open until either all of them are closed in profit or with a few losses. That makes most grid EAs too risky and you might lose your entire account if an EA is a pure grid.

So the trading system of this EA is not my favorite and is among commercial forex robots that try to lure prospects by showing them a few losing trades and lots of winning ones.

August Forex Golem Results

I always prefer the results of a real account connected to Myfxbook, a third party website offering analytical tools. There are other websites such as FXBlue or FXStats that offer such service but they are not as reliable as Myfxbook.

Unfortunately, Forex Golem neither has Myfxbook results nor has any results from a real account.

There used to be a result from a real account on their website but it seems that the account was removed from there and I couldn’t find it — it might be blown up so they removed it.

All that you can find is related to a demo account from FXBlue. Since the result is from a demo account, it’s not worth much. If a vendor is serious and confident about his/her EA, they at least test and run it on a real account.

The only positive aspect of the result is that it’s current and it’s not related to a specific time period in the past.

Anyway, as long as this demo result is the only one that we have, we examine and review the result and stats of August Forex Golem based on that.

Age and Number of Trades

The minimum age that we can rely on for an EA is one year, although it depends on the number of trades. Sometimes less than that is acceptable as well but in general the longer the better.

And the minimum trades that I consider as somehow reliable is 300 closed positions.

As of this date, August Forex Golem EA has traded for 207 days in this account and closed 562 trades.

The age is below our standard but since there are more closed trades than the minimum that we consider, the EA has enough data to be analyzed.

Gained Profit

August Forex Golem EA has gained 62.9% in total so far. The monthly return is 7.2% and the weekly gain is 1.7%.

First off, I have to say that you should avoid those EAs that have gained thousands of percent per month or per year. Those kinds of results are not gonna happen in reality and are just for commercial purposes.

If an EA can generate 50% as consistent profit annually for 3 to 4 years, you can call it the best EA in the industry. So when you see a vendor claiming 1000% profit per year or sometimes per month, just grab your money and run away because you’re about to be ripped off.

Anyway, Forex Golem is not in that category with unbelievable claims so we can give credit to it in this case

Max Drawdown

We take this factor into consideration because we want to know how risky an EA is.

As a general rule of thumb, the EA with the MAX drawdown of lower than 30% is considered low risk, the lower the better.

There‘s a tricky part in the drawdown index of analytical sites like myfxbook or fxblue that you should pay heed to when you study this factor.

The drawdown that you see in the general stats of those sites is related to the balance drawdown. It means that it’s calculated after positions are closed. As a result, open trades are not taken into account so you may have a large current drawdown but the general stats shows a small one.

We have the same situation here for August Forex Golem.

As you can see in the following picture, the peak or Max drawdown of the account is 4% which is considered very low and puts this EA in the low drawdown category.

But when we dig deeper and see historical floating P/L which is actually the drawdown of equity, simply put, the drawdown of open trades; we can see that the real MAX drawdown is something around 45%.

It’s important because it shows that this EA is prone to endanger 45% of our account, not 4%, so the EA is considered risky not low drawdown or low risk.

You see this kind of situation in the EAs with grid or martingale strategies where the EAs keep losing trades open for a long time and since August Forex Golem is a grid based bot, so we see a gaping difference between balance drawdown and equity drawdown.

You can see that losing trades are kept open for a long time by the trade length of this EA as well. Forex Golem trades in the one-minute chart (M1) so technically it must be a scalping EA with short length positions.

But when we look at the average trades’ length of the EA, we see the positions are kept open for 31.6 hours on average while this time is less than half an hour for scalping EAs.

With all that said, the EA is in the category of high risk forex robots.

Profit Consistency

There are some commercial EAs that have traded for a short period of time but the age of their accounts shows that they are 1, 2, etc years old.

The reason is that the vendor runs the EA on an account for a few months and after getting his/her desirable results, stop running the EA for a long period of time and then reruns it for a few more months or does it in situations that he/ she knows the EA performs well.

That way, the EA has a fresh long term result but in reality, the result is for a few months.

That’s why I check the consistency of the results of EAs to see first, if they have traded every month and second, whether the traded positions are distributed equally or they’re from a specific part of EAs’ statements.

August Forex Golem has traded every month on this account since it was run and there isn’t a single month that the EA didn’t trade.

The balance of EA has grown every month more or less, except for one month, so the profits don’t come from a specific month. The largest growth is related to November 2019 where it grew around 12% and the worst month was February 2020 that the EA suffered around 1% loss.

All in all the distribution of trades and growth is acceptable.

August Forex Golem Price

August Forex Golem is not pricy and is among the average price EAs in the industry. There’s only one purchase plan for this EA and you can own it at $197.

My problem is not with the price of this EA but I don’t see any trail version or refund plan so that you can check their product.

Most of the time, you see such a thing when an EA is cheap, something like $40 or $50 but when the price goes higher there’s normally a refund plan.

I don’t know why they haven’t included that for august forex golem EA.

Forex Golem Support

The only way that you can contact them is through email. It’s stated on their website that they are available 24/7 so I sent an email and asked a few questions to see the level of their support as well as proficiency but it’s been 24 hours since then and I haven’t received any answer.

As a result, I don’t think that you would get strong support from them, which is very important especially if you are new to automated trading.

The Bottom Line

In this review of August Forex Golem, I tried to look into the different aspects of this EA especially the result and stats to find out more about the pros and cons of it.

In general, I don’t put this EA in the best forex EAs category because I think its disadvantages are more than the pros of the EA.

Although the result of the account that the EA’s been running on is showing profits and the general stats are acceptable to some degree, the account is a demo one which makes it unreliable to a great extent.

Plus, as I mentioned early on, there used to be another stats on their website related to a real account on FXBlue but it’s been removed which is a bad sign. The reason might be losing money by the EA and the loss of the account.

The price of the EA is reasonable, however, there’s no refund plan or trial version, therefore, you don’t have a chance to see the performance of the EA in your account and test it live before buying it.

There are other EAs that are more reliable and have strong real account performances. You can find them in this article.