Oh man, finding the best forex EAs or robots is really hard. I don’t even know where to begin. I literally searched everywhere to find them but the more I searched the more I figured out that this area of forex is FULL OF CRAP.

Half of the EAs out there for sale that had websites, or at least a one-page site, one day; let their domains expire and don’t have a site anymore, let’s say they’re so-called out of business.

They’re the good ones though. Some others seem up but when you dig deeper and read the stuff on their one-page sites, you’ll notice that they haven’t updated that for months or years.

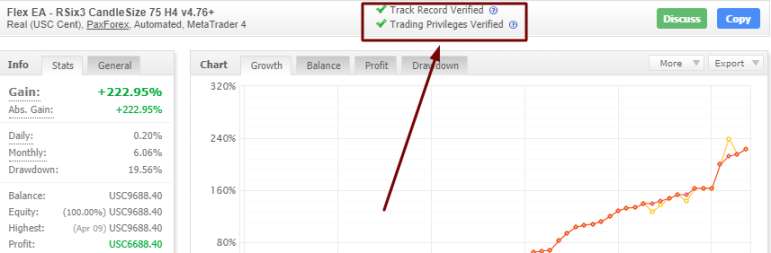

For instance, there’s a result from a third-party website such as Myfxbook (see this section), which is actually a positive sign; however, the results are different from what‘s written about them.

That’s kind of funny though

For example one says, this strategy has gained 500% and when you take a look at the graph on Myfxbook, you see it took a nosedive and when you look into the results, you’ll figure out that there are lots of trades that had been kept open for a long time (floating loss) and when the EA closed them, the account blew up.

Anyway, I checked out hundreds of expert advisers or forex robots and examined some worth looking into and found some of the best EAs in 2026.

First, let’s become familiar with these best forex robots, and then I’ll show you how you can choose the best EAs and what factors we should look at when choosing forex robots.

Best Forex EAs (Forex Robots) in 2026

After spending several days looking into lots of forex EAs, I finally found a handful of them that you can put in the category of the best forex robots or expert advisors.

Here’s a list of the best forex EAs or robots in 2026:

1- Flex EA

The oldest trading result that I found about Flex EA gets back to 2015, so I assume that this product has been around since then.

There are lots of features in the package of this EA that I like including excellent support, private forum for clients, transparent and verified results and stats on Myfxbook, and constant free updates to name a few.

Results

The EA has several settings that you can choose from, however, you can pick the best one either by listening to the suggestion of the creator or by finding that through the private forum where users disclose their experiences and offer the best settings they’ve found and the one that’s brought them the most profit.

There are several results of different settings on the Flex website from the past to the present.

SRV1/SRV2 is the setting that I like better and it has interesting results.

The account shown on Flex site as the result of SRV1SRV2 has a 14-month history with 869 closed trades. A drawdown of 17.55% and a profit factor of 2.48. It has gained 194.26% within the 14-month time frame.

It’s an ideal result that a forex robot holder or buyer can think of. It’s not too risky (rather a low drawdown), has a reliable profit factor, and has generated very good profit.

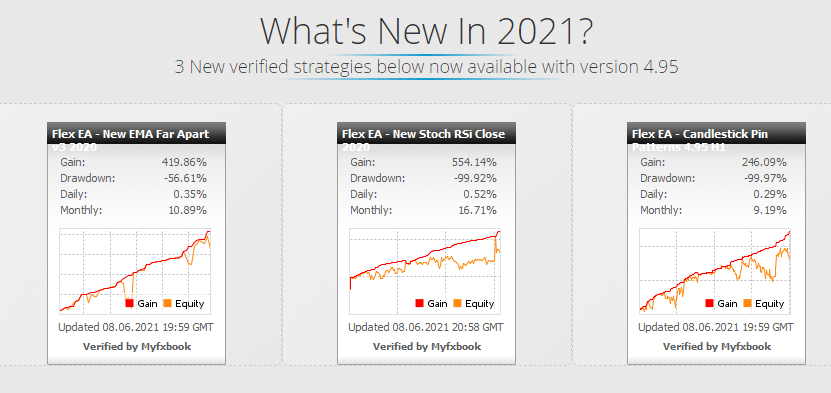

There are 3 other settings related to 2021 but I think they are risky. They seem too aggressive and as a result, we can see higher drawdowns in their stats. Having said that, if you have an aggressive risk appetite or just want to risk more on a portion of your money, there’s a high potential for profit in those settings.

As you can see from their Gain, although you risk more you can potentially gain twice the first setting, SRV1/SRV2.

Note that they are not the only profitable settings. As you can see in the next section, there is a forum where you can ask other buyers about the best settings they’ve found and used so that you do the same.

Support

Other than a 24/7 support that you receive through ticket and email, there’s a private forum where you can be in touch with other people who’ve bought the Flex EA and are using it so you can share your experience with each other.

The forum is active and has thousands of posts and tons of views so you can ask your questions and get answers from one of the members who have been using the EA for a while.

People also share their experiences and ask for a good strategy or more profitable settings and learn a lot from other users.

The discussions are only available for the clients of Flex so if you want to see what’s going on there, you need to purchase the product first.

Price and refund policy

Flex EA has three types of plans: Flex EA x1 MT4,Flex EA x1 MT5, and Flex EA x2 MT4 + MT5

There is no difference between EA x1 and EA x1 MT5 except for their trading platform, MT4 and MT5.

But there are 4 differences between those two and Flex EA x2:

- Number of live accounts

- Price

- A hedging EA in Flex EA x2

- Number of trading platform

You are allowed to run Flex EA x1 on one live account but you can have 2 live accounts if you buy the x2 plan. Plus you can have both MT4 and MT5 versions of the EA in the x2 bundle. The price of Flex EA x1 is $399.96 while it’s $594 for the x2 plan and you receive a hedging EA if you buy it.

Flex EA has a 30-day money-back guarantee if you are not happy

2- Night Hunter Pro

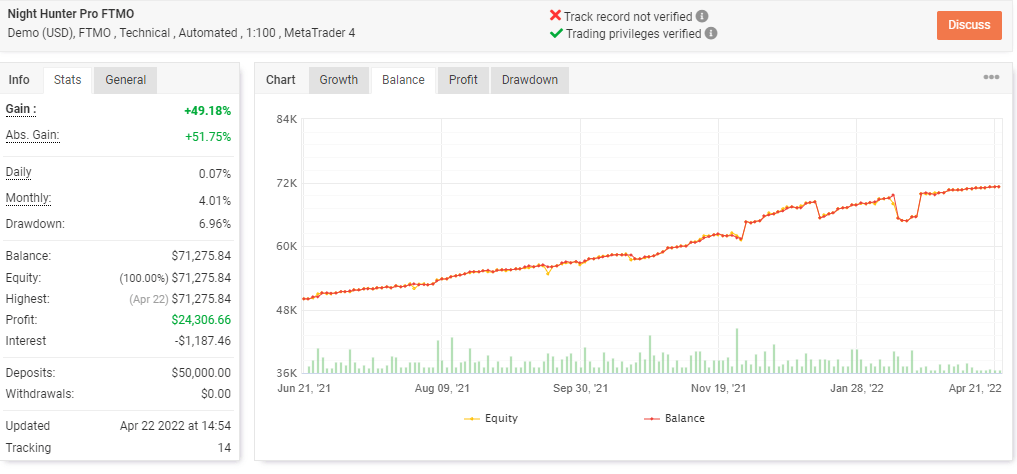

The next EA that we’re going to review is from a developer called Valeriia Mishchenko. I found several real accounts on Myfxbook related to 4 EAs that this developer offers. One of the EAs that caught my attention is called Night Hunter Pro which is actually a scalping Forex robot.

The reason that I got interested in this EA in the first place was the results of one of the accounts on Myfxbook. The account is related to the FTOM challenge.

FTMO is a prop firm that provides you with capital if you can pass its challenges. Since these types of firms don’t put their money at risk, they have a very tight risk management that the participants need to follow. One of the main metrics that they’re very strict about is low drawdown. That’s why the drawdown of the aforementioned account is low, around 7%.

Ok, let’s look into the results of Night Hunter Pro EA.

Result

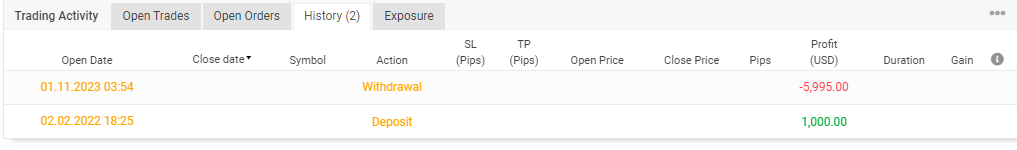

I found several results on myfxbook related to this EA. All have rather low drawdowns, however, some have more than one deposit, which can reduce DD if made when the accounts were in the red. With that being said, the FTMO account has intact results, as you can’t manipulate such accounts or deposit into them.

The Demo label is because the first stage of the FTMO challenge is demo. I usually don’t consider demo accounts’ results valuable but since this account is related to the FTMO challenge where you need to pay some fee to enter, I consider it like a real account.

The EA has traded on his account with a total of 293 positions for almost 1 year which is a reasonable time period.

It’s gained around 50% which is a very good profit considering a very low risk that the account had been facing, A max DD of 6.96%.

The profit factor that the EA has recorded in this account is 2.47 which is both reasonable and promising.

All in all, I think Night Hunter Pro is a decent EA with acceptable results. The EA has the potential to bring you profit while it doesn’t put your account at high risk.

Support

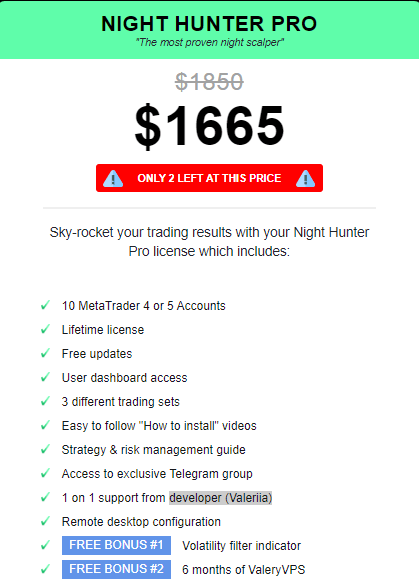

There are several ways that you can be in touch with the developer of Night Hunter Pro such as email and Instagram. You can also join her Telegram channel and also receive one to one support from the developer (Valeriia).

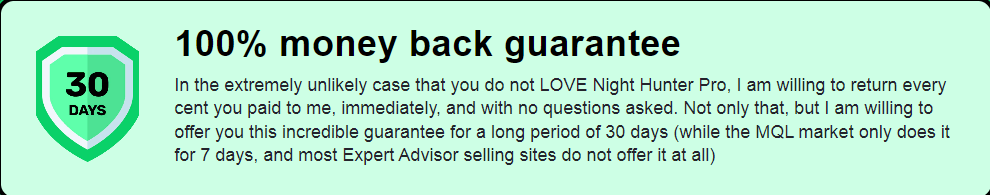

Price and Refund Policy

The price of all the EAs from this developer seems above the average price of EAs in the industry. However, they come with 10 licenses which means you can run Night Hunter pro on 10 accounts. That’s important because most EAs, including this one, have different settings with different levels of risk. The more you risk the higher your profits can go. However, the chance that your account blows up with high-risk settings increases as well. On the other hand, low-risk settings are safer but your gains would be way less.

Therefore, when you have the chance to run an EA on different accounts, you can divide your capital between high and low risk settings and acquire a reasonable profit in total.

Moreover, when an EA has several licenses, you can share it with other people/friends and pay far less.

Anyway, the price you need to pay to have lifetime access to Night Hunter Pro EA is $1665. As mentioned, you can run the EA on 10 MT4/MT5 and the EA comes with a 6-month free VPS.

A 30-day money-back guarantee is included in the refund policy of this EA.

3- News Action Trader

News Action Trader is one of the EAs of LeapFX which is one of the famous forex robots developers in the industry and has been around since 2012.

As the name implies, this EA trade on news events and tries to catch sudden volatile movements generated by the release of important news events.

Results

The EA is backed by fully verified results on Myfxbook and FXBlue. It’s been tested for more than 2 years on a real account and has gained a profit of 229.56% within that timeframe.

The drawdown of the account is 20.07% and a profit factor of 1.34.

The result is not bad in general; however, there are some things that I don’t like about this EA.

First off, the recovery times of drawdowns are not interesting although it’s not terrible. In some cases, it took 4 months before the EA could recover a drawdown but if we consider trading a long-term investment, it’s not a big deal; all in all, I prefer shorter times.

The second thing is that there’s a big gap between gain and abs gain on the Myfxbook stats. When you see something like that, most of the times it means the person is injecting money into the account in order to decrease the drawdown, therefore, the actual drawdown of this EA is probably more than 20.07%.

And third, the profit factor is not what I get excited about.

With all that said, I’ve placed this EA on the list of the best forex EA because the overall condition of this EA is acceptable for me plus it has a confirmed track record of more than 2 years with 1111 closed trades.

I definitely put it on my portfolio as a long term news trading EA

Support

You can have access to the creator of this EA by email, Skype, or Telegram and ask your questions. You will also receive a lifetime update for the EA whenever the developer releases one.

Price and Refund Policy

There are two plans available for purchasing News Action Trader EA: 2 monthly and one-time payment.

All the features between them are similar except for the price. 2 monthly plan costs you $247 per month or $494 for 2 months, which is billed monthly, but you pay a $397 one-time payment if you buy the other plan.

News action trader EA has a 30-day money-back guarantee and the developer claims that he willingly takes your money back if you are not satisfied with the EA for any reason.

4- The Money Tree

The Money Tree is another EA of Leap FX that caught my eye while looking into the EAs of this provider. On the page of Money Tree bot is mentioned that it can be run on 15 forex pairs and there is a Myfxbook result related to a real account that backs this claim.

Ok now let’s dig deeper and see what we can perceive from the result of this real account.

Results

As mentioned, the result is from a real account on Myfxbook. The account is completely verified which makes it reliable.

The account was opened with a $1000 deposit and this is the only deposit it has. It means there hasn’t been an extra deposit in order to lower the drawdown.

Although there is a difference between gain and abs.gain we can be sure that this difference is for withdrawal not deposit, since there is only one deposit and also we can see a withdrawal in this account.

The EA has grown the account by more than 7000 % in the time span of 1 year which seems too aggressive however the drawdown is around 21% which is not too high. Of course, you can’t always obtain such a result and you probably blow some accounts down the road but if you divide your money between several accounts and withdraw periodically, this EA has a very good potential to give you chubby profits in the end.

I’m normally very skeptical about the EAs with such enormous percentage gain and look deeper into the result of them. I did that for Money Tree as well. Since I didn’t find any suspicious thing in the result, it made me believe that such gains are possible with this EA.

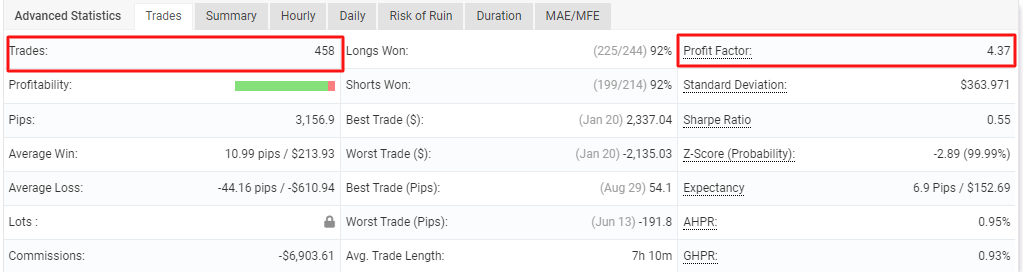

Anyway, The EA has traded 458 positions and has a profit factor of 4.37 which is rather high and shows the EA can gain large profits.

Overall, I think the result of the EA is promising and it can bring you some good profits if you follow a suitable money management plan, as mentioned earlier.

Support

As mentioned in the News Action Trader EA, you can be in touch with Leap FX support via email, Skype, or Telegram.

Price and Refund Policy

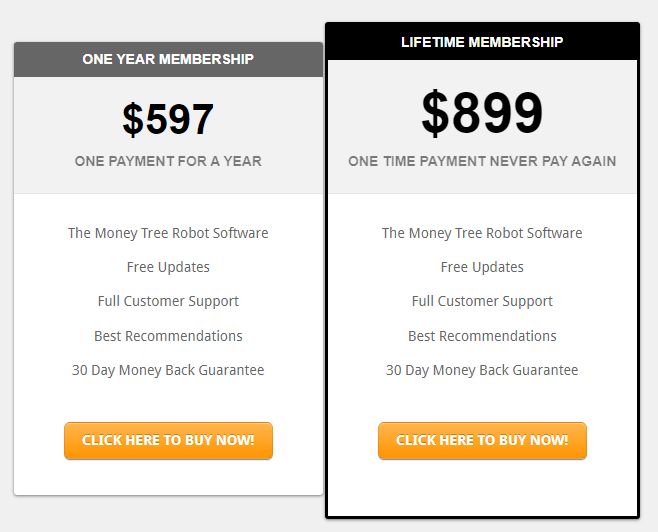

Money Tree EA has a steeper price compared to the other EA of Leap FX. It’s probably because this bot has a way better result.

Of course, the price of an EA, apart from its performance, should be considered in the context of account size as well. For example, an $800 EA seems expensive when you want to run it on a $500 account while it’s nominal if your account is $50k.

Anyway, if you want to have this account for 1 year, the price is $597 but if you don’t want to pay again, you can purchase it for $899.

Like News Action Trader, Money Tree also comes with a 30-day money-back guarantee so you have plenty of time to test it.

How to Choose the Best Forex EA or Robot

There are lots of measurements that you can take to remove a bunch of scams and eliminate many unprofitable forex robots.

Some of them are external factors which means they are not related to the strategies that EAs are built based on such as transparency of vendors and some are internal metrics connected to the stats of forex EAs which we’ll talk about later on this article.

You don’t need to necessarily be an expert to figure out many of these factors and even if you are a complete newbie and haven’t used forex EAs so far, you can detect a lot of them after this article.

So let’s find out more about them…

For choosing the best forex robots or expert advisors you should consider these factors:

1- Look for Transparency in Results

As I mentioned early on, this part of Forex is cluttered with scams who try to tamper with the results of their EA even on a third-party website such as Myfxbook and FXBlue.

Those are the websites that you can connect your manual strategy or automated ones such as EAs to them, and they provide various statistics about your strategy, however, you can choose not to show some info or hide something that might interpret as the flaws of your trading strategy or expert advisor.

You see some people demonstrating a hand-picked section of their robots’ results which has performed well in a specific condition of the market to show the profitability of the EA that is not actually profitable.

Some present a one-month performance that is worth nothing and others go even beyond that and only depict a photo of their so-called results.

That’s yet the bright side and there are some vendors who don’t bother presenting any real results. They either refer to a demo account on those third-party websites or just put a bunch of histories and statements and say THEY ARE MY REAL RESULTS, BELIEVE ME.

Most of the time, the cheaper a forex robot the less transparent and you’ll be given less reliable information.

Anyway, having a real account connected to one of those third-party websites can be the first positive sign although it’s not enough.

The most reliable third-party website is Myfxbook because it takes some measurements to verify accounts.

They have two levels of verification, track record, and trading privilege. Those confirmations indicate that the stats of an account are correct and whether they are coming from a demo account or a live one.

When you see green ticks for those items, it means that the account is fully verified by Myfxbook and the results are real to a great extent.

Although those verifications remove 90% of misinformation, there are still some tricks people do to show better results.

For example, when you see there’s a gap between Gain and Abs. Gain, it can be the result of money injection to the account in order to decrease drawdown and convince others that an EA or strategy has low risk — Of course, the difference might come from money withdrawal as well which in that case it’s not a deceptive move.

All in all, make sure that the forex EA you want to choose has been tested or is being tested on one of the third-party websites that is mentioned early on — the more recent results the better.

2- Check out the Reviews of EAs

The condition of the websites reviewing forex EAs is not better than EA sellers’ community and they promote whoever that pays them the most.

It turned out that even one of them that I thought he’s trustworthy to some extent isn’t really true to his words when it comes to promoting his own products.

For instance, he keeps saying in his reviews that he can’t rely on the result of this or that forex robot because they are not backed by a third-party website but he’s all blind while reviewing his favorite EA, or his EA to be exact, and doesn’t mention about the EA’s unconfirmed stats.

Read those kinds of websites but use your common sense to distinguish right from wrong.

There are other review sites where you can see the reviews of some people who either have bought EAs or claim to be a buyer.

You shouldn’t give these kinds of reviews the benefit of the doubt either because there are various reasons that their arguments can be incorrect or their claims may be false.

First of all, almost all people lodge a complaint when they believe they’re scammed but a few people go to a review website and thank them for a product that they’ve bought.

Secondly, it’s kind of weird but some companies try to besmirch the reputation of their competitors by writing defamatory comments on review websites.

Again, you need to apply your common sense to see which one is legit and who’s fake, however, if you see a majority of people are not satisfied with their purchases, you should be very cautious about that product.

You can also ask some questions to see if the reviewers are telling the truth or just nagging unreasonably or slandering intentionally.

3- Check out Customer Service and Support

Being supported by the creator of forex EAs after your purchase is very important and sometimes vital because something may go wrong and you might not be able to fix it even if you are somehow experienced let alone being fresh to automated trading.

Moreover, reliable support can help you find the best settings of an EA after changing the conditions of the market which can be against the strategy of the EA by releasing new updates and informing you asap.

The last thing you want is a vendor who wants to just sell his/her product and then disappears or tries to upsell by not giving you all the available settings in the first place.

For example, let’s assume you pay $200 for an EA and after 6 months you see the EA is not doing well. Then you contact the seller and he tries to charge you for an update.

If there’s such a fee, you should know that in the first place before buying the product.

Some of the best expert advisors not only offer those kinds of supports but also have additional services such as private forums where buyers can take advantage of the experience of one another.

4- Check for Refund Policy

The vendors who are confident about their products provide you with a guaranteed money-back plan and hold on to their promise if you are not satisfied with their service or products.

Make sure to understand the conditions of their refund policy. It’s not always like they pay all your money back. Sometimes a refund policy is bound by some conditions.

For example, you can take your money back if the EA suffers a 25% drawdown, simply put, if you lose 25% of your account.

So first see if there’s a refund and if so, what the conditions are.

5- Examine the Statistics of EAs

This part is the technical side of choosing the best Forex EAs, however, we are not going deep and checking out the formulae or where they come from, there’s a link in each section where you can find out more about them.

Instead, we look for the numbers to see how profitable a forex robot is or if it could be in the future.

Obviously, there’s no guarantee that what has happened so far will repeat in the future. In other words, past performance is not necessarily indicative of future results.

Having said that, the following metrics can shed light on the path of finding the best forex robots or EAs and can help us to eliminate some of the EAs that are too risky and have the potential to wipe out our account easily.

Account Age and Number of Trades

Anybody who can write a few lines of MQL codes (the programming language of Metatrader) can create an Expert Advisor that is profitable for a few weeks by over-optimizing it.

But creating an EA that is profitable for months and years is not something that every EA coder can pull off and needs a ton of experience.

As an account gets older, it’s exposed to the different conditions of the market and is tested by the many waves of the market so it becomes more reliable if it can pass all those exams.

Now the question is how old is sufficient for a forex robot to be considered reliable.

Actually, there’s no unique answer to that question but in general:

The older the better

6 months is the least I can think of, however, one year is the period that makes me take an EA seriously.

The same goes for the number of positions or traders taken by an EA; I mean the more the better.

An EA with only 50 trades is not acceptable even if it’s one year old or more.

300 trades is the minimum number that can shows something and make me confident in using a forex robot to some extent.

Maximum Drawdown

For MAX drawdown, or drawdown in Myfxbook, I look for the forex EAs with less than 30%. Max drawdown basically indicates how risky a forex robot is. The higher the riskier.

In simple words, that number tells you how much money a robot is prone to lose before it starts gaining money.

Let’s say you have an EA that has shown 100% profitability within the last year with a drawdown of 80%. Are you willing to take that risk and lose 80% of your money before getting 100% profit which may not even happen?

Robots with high drawdowns trade too aggressively and have the potential to raze your account to the ground with high probabilities.

Drawdown Recovery Time

The time that an EA can recover from a drawdown is also important when we are dealing with drawdown.

Let’s say an EA has suffered a drawdown of 30% in one month. What if it takes 4, 5, or even a larger time period for it to recover the loss and break even?

Basically, we don’t earn any money for several months, and worse than that, it reveals that recovering from losses is very hard for the EA.

You can simply look at the graph of an EA and see how long it took that to come out of its drawdowns.

Floating Profit/Loss (P/L) or Current Drawdown

This is another important metric that we need to pay attention to. It’s one of the factors that disclose some hidden facts about a strategy.

It’s basically the difference between balance and equity. The results of gain, drawdown, or other stats are calculated when trades are closed but what if a forex robot keeps the losing trades open?

Well, you can’t see the real numbers for different metrics and you need to look at either floating P/L, current drawdown, or the difference between equity and balance — different websites may provide you different names or metrics so one of them does the trick.

If you see the stats of a forex EA shows, for example, $1000 as balance and $500 as equity, it means there’s a $500 floating loss or 50% drawdown so the account might be on the verge of blowing up.

Profit Factor

Profit factor means the amount of profit an EA makes to the amount of loss it suffers. The more profits a forex robot gains and the less loss it suffers the more reliable it is.

I look for EAs with a profit factor of 1.5 or higher — the larger the better.

Imagine an EA has a profit factor of 3. It means for every $4 that the EA trades it generates $3 as profit and loses $1 on average.

It tells us if something goes south and the EA starts losing money, there’s plenty of space for that to turn from a winner to an unprofitable robot.

You should provide ideal conditions for an EA to see its best performance so make sure to read best forex brokers for EAs and VPS articles.

Conclusion

The best forex robot or EA is the one that has results confirmed by an unbiased third-party website. It doesn’t hide its metrics or at least shows most of them.

It doesn’t have terrible reviews all over the net and has an acceptable level of satisfaction among its users.

The level of support that we receive after purchasing the EA is up to par and we can have access to the seller via various options.

It has a fair refund policy so if we are not satisfied with the EA, we can give back our money without going through big hassles.

We prefer an EA with a MAX drawdown of less than 30%, not a gaping time for recovering from its drawdowns, more than 1 year old, at least 300 trades, No large floating loss, and last but not least a profit factor of larger than 1.5.

Hi David,

Thanks for the info. WHat are your views on the latest robots that are released by Valeria. I am referring to the Waka Waka and the newer one that has been just released – Perceptrader AI robot?

Thanks

You’ve mentionned “The account shown on Flex site as the result of SRV1SRV2 has a 14-month history with 869 closed trades and a drawdown of 17.55%” as you’ve shown on the screenshot,yet looking at myfxbook,Flex SRV1/SRV2 account shows 7.29 drawdown.

How do you explain these differences in these figures?

I’m strict while looking at the EA,once it has not less than 10% drawdown it’s not meeting my criteria.

Help me to understand this,please!

Regards,

Derrick.

Hey Derrick,

That must be a bug in myfxbook because I checked its history, nothing has been added after they closed that account and withdraw their profits. Plus, the account is fully verified and the broker, trader’s way, as I know them, they don’t tamper with results. Even if it were a fishy broker they could’ve done something like that when the EA was running on the account not 2 years later. I think that’s just a bug on myfxbook. After all it’s a free service and you can’t expect everything works like clockwork. What I’ve understood from Flex EA after looking into many accounts and hearing from people who’ve bought it is that you can change its risk factor. You can pick a setup that gives you 100% drawdown and you can also change the setup to have drawdowns below 10% however your profit can drop as you decrease risk.

Hi David, there is something suspicious about NCM signal, myfxbook reports max floating p/L about 8% on the dd graph, but on the review they report 18%. However NCM themselves report max equity usage 35% and that’s what was also reported on forexpeacearmy…. unfortunately monthly avg. gain looks the same, around 4% ( on myfxbook and 8%/15% dd as well as on forexpeacearmy 35% dd ).

Moreover, it seems in the last year avg monthly profit was only 2 and something %. Still better then nothing, but…

Hi Igor, well nothing fishy in terms of what you’ve mentioned. Regarding DD on myfxbook, it’s how it works and a bit confusing. The DD reported on the graph part is MAX dd and the one on the stat is the floating P/L or current dd which is around 17% now, it’s different from MAX dd which is calculated in relationship with your initial balance which is around 8%. Regarding different DD and gain in different accounts (or different analytical services such as myfxbook, FPA, etc) that’s possible since you can set the level of your risk when you register with NCM, it’s on their website. If you risk more you have a larger DD but you can gain more as well. That’s why you see different results in different accounts.

Thanks David your review hold waters and are very good advice for newbies who are interested in EA.

Thanks, happy to hear

Thanks, I wish to buy a reliable EA with good profit margin

thank you David, the information you’ve provided is very helpful.

Thanks David for the work you have taken, for your letters without economic interest gives us more confidence, and invested in several EA all without any failure work only for the one who sells them, I will take your annotations I will review the most appropriate to my expectations. I’ll let you know in a while. and thank you very much again Carlos P

Thank you, looking forward to hearing from you

This is an investment fund, no EA

There is a FCA warning

Company dissolved in 2012, UK address book

32406 companies registered at that address

Company declines credit cards for security reasons.Chargeback?

Bank in Thailand

Not regulated offshore broker?

Removing thr review??

@styx Thanks for the info but you didn’t mention which one. We have 2 EAs here that are for investment and I wrote that in their reviews, however, regarding “not regulated” I assume you mean ROFX. I touched on some of the issues you mentioned to some extent and I have more on others but since I’m not from that company, I can ask them and if they answer, I’ll leave it here. Anyway, the review is also about their results from myfxbook which is fully verified and really impressive. There is no manipulation of that account because I checked different factors.

Its not impressive if you look at the broker. Its a unregulated not trustworthy broker. I think they work together to scam people.There is something like that more often.

By the way NCM is really impressive, full verified and icmarkets as broker.

Hi David, did you get a reply from RoFX?

Did you consider using their service (given your excellent review)?

And just for transparency: is your link to RoFX above an affiliate/referral link to them?

Because it seems so. When you connect to RoFX URL from your link, there is an affiliate code into that (#885245). And indeed, RoFX sponsors on their website that they give a % of the clients’ deposit to those who introduce new clients. (From their website: Each time you refer a client to us, you receive 2% of each deposit to your account balance).

Please note that I do not imply anything by this and I do not know if you are affiliated to RoFX, mine is a question. Indeed, I do appreciate your work and reviews, but since you stated that you are not from that company, I would appreciate any disclosure of possible conflict of interests with those guys (whoever they are, as noted by others, they seem to be a bit secretive).

Thanks for your reply and information.