If you want to know whether Arbitron EA is worth buying or not, the answer is in general no but you may make some profits in a specific situation. In this review of Arbitron EA, our focus is on the results of this forex robot to see if it’s really profitable, what situation may make it profitable, and how honestly the creator of Arbitron is trying to promote this EA.

Arbitron EA is among the forex robots that claim to gain unbelievably large profits so alarm bells ring when I see such a tall order which is almost impossible to pull off in the long term.

So in this review of Arbitron EA, we’re gonna see how much of what they claim is realistic.

Arbitron EA Developer

Arbitron is one of the products of LeapFX, one of the EA developers in the industry.

They’ve developed and promoted several EAs since 2012 and have other services such as selling trading courses.

I reviewed two of their EAs that I think they are worth trying, you can see the review here.

Arbitron EA System

I’m not going to talk about the system behind Arbitron EA because first, most developers don’t say what strategy they’re exactly using and a few that give some info, don’t teach you the system step by step.

Second, if they do say the tools of their strategy, for example moving average or RSI, you can find lots of systems using those indicators or oscillators, some are profitable and others are fruitless.

Third, the creator may be dishonest and lie about that and since he’s not going to teach his system, no one figures it out.

Anyway, the developer claims that the system of Arbitron EA is based on arbitrage.

In arbitrage trading, you are supposed to have access to data or market prices a few seconds or probably minutes sooner than others so you can take advantage of the differences between price feeders.

That’s a controversial subject though and some people believe that first, there’s no such a thing as price feeders’ difference and second, even if there was something like that, brokers have problems with it and if you use such methods, they won’t let you withdraw your profits.

All in all, the developer rejects those arguments and believes that there’s price feed differences and brokers don’t understand if you use an arbitrage method so they don’t have any problems with Arbitron EA.

Arbitron EA Results

There are some results related to the Arbitron EA on its page from different accounts on Myfxbook and FXBlue which are the two main websites offering statistical service to forex robots.

Well, something like that is always a good sign because if there aren’t any third-party results, we don’t know anything about the performance of an EA in the first place.

Some of the results are from demo accounts but 9 of them are related to real ones. Since demo results are worth nothing, we skip the Arbitron demo results and only consider real accounts.

Age and Trades

First, one thing that all of them have in common is a short time period. The ages of the accounts are between 2 and 5 months.

However, the number of trades in some of them is high, compared to the age of the accounts.

Overall, the ages of the accounts are short and for some reason, the vendor didn’t let the account grow older.

Of course, the reason could be since the accounts have gained large percentages of profit and given the vendor enough material to promote them, why risk it and blow them in a few days or months.

By the way, since the number of trades is rather large, if you decide to try this EA, use a broker that has a rebate system so you can cash back a portion of spreads that you’ve paid.

Drawdown

As you probably know the lower drawdown a strategy has the less risky it is. We consider max drawdown below 30% as low risk.

As I said before, there are 9 real accounts, probably with different settings.

6 of the accounts have max drawdowns lower than 30%, however, others are above 30% and in some cases, it goes up to 75%.

But you can’t see the real drawdown in the info section of the results on Myfxbook.

The reason is that when there’s a gap between Gain and Abs.Gain, it means the account is deposited more than once in order to decrease the drawdown of the account.

So basically we can’t detect the real drawdown from there, however, there’s a drawdown tab on the chart part where it shows the equity drawdown, the drawdown before trades are closed, or floating drawdown.

With all that said, four of the accounts have more than 30% drawdown and others are below 30%. It shows that some of the settings are more aggressive than others.

Profit Consistency

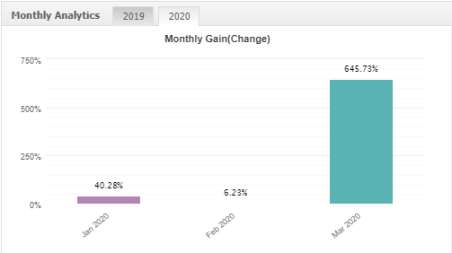

The next factor that reveals another aspect of Arbitron EA is monthly gain which shows what profit percentage the EA has for each month.

For example, let’s take a look at the following pictures which are the monthly analytic of the different accounts of Arbitron EA.

The above pictures are related to the monthly gain for different accounts of Arbitron EA. As you can see, the gained profits are not distributed equally between the months and a large chunk of the profits are connected to one month and when you dig deeper, you can figure out they actually come from a few trades in one or two days where the EA traded large lot sizes.

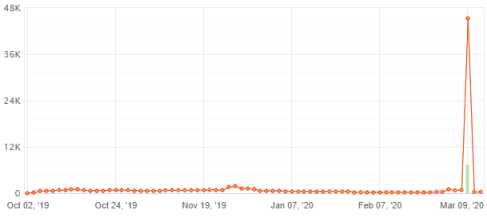

For instance, in the Arbitron Sprinting account, you can see that the first lot size on 10/2/2019 is 0.01. It gradually grows with the steps of 0.01 or something like that, no dramatically large lot size change, until 3/6/2020 that we have the lot size as large as these:

Then on 3/9/2020 the lot size are hugely increased and you can see these lots:

It’s not only lot sizes that increase but the number of trades goes up to a very large extent. As a result, you can see a graph like this:

(the falling part is related to three withdrawals)

And as you can see on the gain picture above, picture2, the EA makes 15000.512% (15.512k %) which almost all of it is related to 3/9/2020.

Having said that, you won’t see those astronomical profits, if there’s anything like that, unless you raise lot sizes hugely in a specific day that you probably won’t know when it is.

Arbitron EA Price

They have two types of purchase plans: three month payment and lifetime.

For three month payment, you need to pay $347 every month while you can pay a one-time fee of $799 for the lifetime plan.

They also have a 30-day money back guarantee

The Bottom Line

In this Arbitron review, I tried to look at this EA from different angles and see if it’s worth buying.

I think this EA won’t bring you a persistent profit and you may make some money every now and then, if at all.

The reason is Arbitron doesn’t have a long term performance on any of its real accounts and the profits gained from those few months are also related to a particular period of one month where we see increased lot sizes.

If you knew when to increase lot size, you might be able to gamble and try to grow your account abnormally but first, I doubt that they let you know when you should increase lot size…

…and secondly, if they do inform you, there’s no guarantee that things go well and you make profits but you would blow your account with high probabilities.

All in all, if you want to gamble, this might be a choice. Just make sure to use some kind of money management by dividing your investment into several deposits so that if you lose some, you might win one or two to make up for them.

And use a broker that first, don’t have problems with frequency trading and second, has a rebate system so that you can cash back some of your money.

I got Arbitron, open a new account with them with 2k. And .03 lot size. The EA blew my account in 1 week. The EA does automatically increases your lot size without notifying you. And opens multiple positions at once but goes and opens like 5 to 7 positions of the same pair, all in drawdown for days and keeps adding other pairs. Its insane because the system apperantly doesn’t recognize your deposit, leverage nor it’s own drawdown and keeps adding until until everything starts to close and you lose it all. The system always keeps you in drawdown since day one and increments.