Cryptocurrencies have surged in popularity over the past few years, with more traders and investors using them for transactions and trading. As a result, an increasing number of forex brokers now accept Bitcoin for deposits and withdrawals.

However, while some brokers have embraced Bitcoin as a payment method, many in the industry have yet to adopt it. In this guide, we’ll explore the top 10 best forex brokers that accept Bitcoin in 2026, helping you find the most reliable and secure platforms for crypto-friendly forex trading.

Best Forex Brokers Accepting Bitcoin for Deposit and Withdrawal

Here’s a list of top 10 Forex brokers that accept Bitcoin for deposit and withdrawal.

Why Do Traders Use Bitcoin for Deposits and Withdrawals?

There are several reasons why traders prefer using Bitcoin for forex deposits and withdrawals. Let’s break them down:

1. Bitcoin Is the Only Available Option

For some traders, Bitcoin isn’t just a preference—it’s a necessity. Many countries impose strict regulations on forex trading, making it difficult to fund trading accounts through traditional methods like credit cards or bank transfers.

For example, in the United States, forex brokers regulated by the Commodity Futures Trading Commission (CFTC) enforce a maximum leverage of 1:50. While this rule protects retail traders from excessive risk, experienced traders who understand money management and leveraged trading may find it restrictive.

To bypass such limitations, traders often turn to offshore brokers that offer higher leverage. However, these brokers may not support conventional payment methods due to regulatory restrictions. In such cases, Bitcoin and other cryptocurrencies become the primary funding option.

Similarly, in certain countries where forex trading is heavily restricted or exists in a legal gray area, traders rely on cryptocurrencies for transactions. Since crypto transactions are decentralized and harder to track for tax purposes, they provide an alternative for those facing regulatory challenges.

2. Avoiding Document Submission

Another major reason traders opt for Bitcoin deposits and withdrawals is the desire for privacy and anonymity. Many traders prefer not to share personal documents with forex brokers for various reasons.

Why Do Brokers Require Documents?

Forex brokers request proof of identity (ID) and proof of address due to regulatory requirements aimed at preventing money laundering and financial fraud. Regulated brokers must comply with these Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

Why Do Some Traders Avoid Document Submission?

- Privacy Concerns & Identity Theft

Some traders worry about exposing their personal information, especially with concerns over data breaches and identity theft. While this is a valid concern, it’s important to note that well-established and regulated brokers have strict security measures to protect customer data. - Lack of Required Documents

Some traders simply don’t have the necessary documents. For example, if a broker requires a utility bill or bank statement as proof of address, traders without these documents may face verification issues. - Preference for Anonymity

Some traders, especially those in regions with restrictive forex regulations, prefer to remain anonymous. Cryptocurrencies like Bitcoin offer a decentralized payment method that does not require verification through traditional banking systems.

Do Any Brokers Allow Trading Without Verification?

All regulated forex brokers require document verification. It’s a legal requirement enforced by financial authorities, and brokers have no choice but to comply. Even most unregulated brokers follow these procedures.

However, there are a few offshore brokers that allow trading without submitting documents—and one of them is featured in our Top 10 Best Forex Brokers Accepting Bitcoin list.

3. Lower Transaction Fees

Another key reason traders prefer Bitcoin for deposits and withdrawals is to reduce transaction fees compared to traditional payment methods.

How Do Forex Brokers Charge Deposit & Withdrawal Fees?

Most forex brokers impose fees on bank transfers, credit/debit cards, and e-wallets. These fees vary based on the broker and payment provider. Wire transfers, for instance, can be expensive due to intermediary banks.

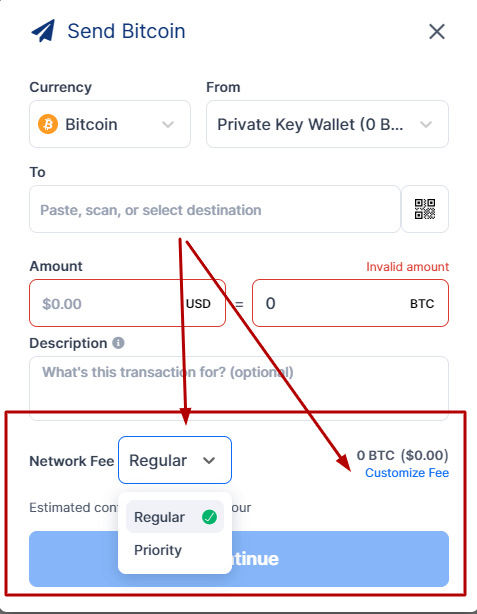

How Bitcoin Transaction Fees Work

Bitcoin transactions also come with fees, but they function differently from traditional banking fees. When sending Bitcoin, fees depend on the network congestion and transaction speed you select.

- Fastest Transaction → Higher fees but quicker processing.

- Normal Speed → Balanced fee and processing time.

- Custom Fee → Set a lower fee but experience slower transaction speeds.

Some crypto exchanges and forex brokers charge additional fees for Bitcoin deposits and withdrawals. However, by choosing a broker with zero or low BTC transaction fees, traders can significantly reduce their costs compared to traditional banking methods.

Fixed Bitcoin Transaction Fees at Forex Brokers

Unlike personal Bitcoin transactions, where you can adjust fees based on network speed, forex brokers apply a fixed BTC transaction fee for deposits and withdrawals. This fee is determined by the broker, meaning you can’t manually lower it.

Do Any Brokers Reimburse BTC Transaction Fees?

Some forex brokers cover the transaction fees as part of their promotional offers. If a broker provides a “no-fee” deposit/withdrawal policy, it typically appears as a bonus or incentive for traders. In our comparison table, “No” under the “Deposit/Withdrawal Fee” section means the broker does not charge for Bitcoin transactions.

Is Bitcoin the Cheapest Deposit/Withdrawal Method?

The cost-effectiveness of using Bitcoin vs. traditional payment methods depends on how much you deposit or withdraw:

✅ For Small Transfers ($100 or Less): Cards, PayPal, or e-wallets are better. Most charge around 2–3% per transaction, meaning you’ll pay just $3 on a $100 deposit. Meanwhile, many brokers charge a flat 0.0005 BTC fee (approx. $17.50 at a BTC price of $35K), which is expensive for small amounts.

✅ For Large Transfers ($10K+): Bitcoin is the cheaper option. Most credit cards and e-wallets charge around 2% per transaction, meaning a $100K withdrawal costs $2,000. With Bitcoin, you’d still pay the fixed 0.0005 BTC ($17.50 at $35K BTC price)—a massive cost savings.

Bottom Line: Which Payment Method Should You Use?

If you’re trading with smaller amounts, use credit cards, PayPal, or e-wallets to avoid high BTC fees. But for large withdrawals, Bitcoin is by far the most cost-effective option.

| Brokers | General Info | Regulation | Platform | Deposit Fee&Time / Withdrawal Fee&Time | Documents Verification | Banned Countries |

Visit Coinexx | MAX Leverage: 1:500 Min Lot Size: 0.01 Spread: Floating Min Deposit: 0.001BTC Min Withdrawal: 0.001 BTC OPEN DEMO ACCOUNT | None | MT4, MT5 for Desktop, Web, Mobile | No, up to 30 min / No, 48hrs | None | None |

Visit PaxForex | MAX Leverage: 1:500 Min Lot Size: 0.0001 Spread: Floating Min Deposit: $10 Min Withdrawal: 0.01 BTC OPEN DEMO ACCOUNT | FSA | MT4 for Desktop, Mobile | No, during 1 day / 7% + 0.0006, 1 business day | POI, POA | Japan, USA |

Visit IFC Markets | MAX Leverage: 1:400 Min Lot Size: 0.001 Spread: Floating, Fixed Min Deposit: 0.001 BTC Min Withdrawal: 0.001 BTC OPEN DEMO ACCOUNT | CySEC, BVI FSC | MT4, MT5 for Desktop, Web, Mobile NetTradeX | 0.0005 BTC, 3 confirmation of blockchain / 0.0005 BTC, 6 comfirmation of blockchain (Blockchain Fee) | POI, POA | USA, Japan, Russia |

Visit LiteForex | MAX Leverage: 1:500 Min Lot Size: 0.01 Spread: Floating Min Deposit: $10 Min Withdrawal: $10 OPEN DEMO ACCOUNT | CySEC | MT4, MT5 for Desktop, Web, Mobile | No, a few hours / No, up to 24 hrs | POI, POA | EEA countries, USA, Israel, Japan |

Visit Grand Capital | MAX Leverage: 1:500 Min Lot Size: 0.01 Spread: Floating Min Deposit: $10 Min Withdrawal: $10 OPEN DEMO ACCOUNT | FinaCom | MT4, MT5 for Desktop, Web, Mobile WebTrade | 0.0005 BTC, 15 min / 0.0005 BTC, up to 3 days (Blockchain Fee) | POI | USA, Japan |

Visit Trader's Way | MAX Leverage: 1:1000 Min Lot Size: 0.01 Spread: Floating, Fixed Min Deposit: any Min Withdrawal: any OPEN DEMO ACCOUNT | None | MT4/MT5, cTrader (Desktop, Mobile, Web) | No, a few hrs / 0.0005 BTC, 6+network confirmation | POI, POA | USA |

Visit Hankotrade | MAX Leverage: 1:500 Min Lot Size: 0.01 Spread: Floating Min Deposit: $15 Min Withdrawal: any | None | Hankotrade proprietary platform | 0.0005 BTC, up to 30 min / 0.0005 BTC, 1-2 hrs (Blockchain Fee) | None | None |

*POI Stands for Proof of Identity such as ID cards, Passport, Driver’s license, and etc

**POA Stands for Proof of Address such as utility bills, bank statements, and etc

The brokers that have No in their deposit/withdraw fees cover the fees as a bonus

Thank you. This opened up a world of opportunity for me as I want to get into Forex but don’t have a credit or debit card. Have you used any of these services personally? If so, which do you recommend most and why?