If you are searching for the best offshore forex brokers for US clients or the top ones accepting US residents, you are definitely fed up with the restrictions, set out by NFA and CFTC, such as low leverage or the FIFO rule that basically prevents you from hedging, and you want to be free from all those shackles.

If you are a newbie, those conditions may save you from yourself and salvage your account from being razed to the ground, however, if you’re a professional trader, it would be a pain in the neck to trade using a $50k fund while you can have the same results only with a $5k account, thanks to a higher leverage.

All in all, it’s up to you whether to pick an offshore Forex broker or not but if you want to know more about the conditions of some offshore forex brokers for US clients, you can find out interesting stuff about them including what are their spreads and commission, their execution speed, the best one for day trading and scalping, the one that is best for long term trading, crypto trading, news trading, or gold trading and many more.

During my attempt to find the best offshore forex brokers, I found a handful of brokers accepting US clients and to top it all, not all of them even close to a standard forex brokerage.

Some of them don’t even answer your email and are not available online and you can only guess they accept US clients because you don’t see anything on their websites opposed to that.

Although there are some low standard offshore forex brokers for US residents, I’ve found some that are up to par and in some cases, even better than some of the best forex brokers in the industry.

We’ll talk about that but first…

…Without further ado, let’s become familiar with the offshore forex brokers that accept US clients.

You can find the methodology of the reviews at the bottom of this post

This video is a summary of this article. You can watch it first and then read the part you want more info about:

Update for 2024: FXChoice, Pax forex, and Trader’s Way don’t accept new clients from the US anymore, however, they continue providing service to their existing US clients.

You'll See in This Article:

Best Offshore Forex Brokers Accepting US Clients

Here’s a list of the best offshore forex brokers accepting US residents and clients as well as a complete review of every one of them.

- N1CM (Best Regulated for day trading & Cent account)

- FXChoice (Best for long term trading)

- Turnkey Forex (Tight spread & commission)

- Coinexx ( The tightest spreads and best for scalping)

- EagleFX (The highest number of Cryptos)

- CryptoRocket (High number of cryptos)

- PaxForex (Cent account)

- Trader’s Way (cTrader platform)

1- FXChoice

FXChoice is one of the few regulated offshore forex brokers for US citizens. It was founded in 2010 and is regulated by International Financial Services Commission (IFSC)

Not accepting new US clients anymore

During my research for the best offshore forex brokers, I came across FXchoice. When I dug deeper, I figure out US traders are satisfied with what they get from this broker so I went through its website to have a look.

Seems OK, you can clearly see what they offer such as types of accounts and different trading instruments.

There’s also a section showing their live spreads, however, I want to see their average spreads as well but no big deal, I know where to find them.

So, let’s see how well they are on live chat.

I start asking many questions about everything and the customer service agent answers them one by one and is willing to give even more info.

Ok, I convinced that this forex broker is a good one so let’s test and see the different aspects of FXChoice.

FXChoice Overview

Location: Corner Hutson & Eyre Street, Blake Building, Suite 302, Belize City, Belize

Foundation Year: 2010

Regulation: IFSC (License number: IFSC/60/191/TS/19)

Types of Accounts: STP and ECN

Spread: floating

Minimum Account Size: $100

Minimum lot size: 0.01

MAX Leverage: 1:200 (forex), 1:50 (Indices), 1:33 (Oil), 1:10 (Cryptos)

Payment Methods for US Clients: Bank Wire, VLoad, Crypto currencies

Trading Instruments: 38 Forex pairs, 7 Indices, Gold, Silver, Oli, 3 Cryptocurrencies (LTCUSD, BTHUSD, BTCUSD)

Trading Platform: MT5 and MT4 (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

FXChoice has two types of accounts: Classic and Pro

Classic account is the STP type of account with floating spreads and no commission.

Pro accounts is the ECN type of account with floating spreads and $3.5 commission per side for every lot ($7 round turn)

The lot size for both accounts start from 0.01 and leverage is 1:200

The minimum deposit for both accounts is $100

There are two differences between the Pro and Classic accounts:

1- Classic doesn’t have a commission but you pay commission for Pro

2- In Classic margin call level is 25% and stop out level is 15% while they’re 100% and 80% for Pro

There’s also a swap free or Islamic account which is not actually swap or interest rate free.

There are no interest rates involved, however, you pay a commission for holding your positions overnight.

The commission is 0.75 swap rates for the pairs with negative swap rates. If a pair has a positive swap, it turns into 0.

(for more info on types of Islamic account see here)

Spread and Commission

The spreads of FXCoice are not something impressive but they’re not bad either and are considered average among forex brokers.

The condition of Pro account is a bit better and you pay less as the cost of trades (spread + commission).

These are the average spreads + commission for some of FXChoice’s trading products:

| Account | EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| FXChoice Pro | 1.35 | 3 | 6.2 | 3.8 | 25.67 |

| FXChoice Classic | 1.45 | 3.25 | 6.5 | 3.13 | 25.67 |

The condition can be more favorable and you can pay less if you trade with a larger size account or more lots.

As we saw in the previous section, Commission is $3.5 per side, however, it becomes lower for the accounts with larger equity and/or more traded lots and it can get to $1.5 per side ($3 round turn)

For example, if you have $10000 in your account, you pay $3 per side as commission.

OR

if you trade $25 million per month (for instance, 250 lots of forex pairs), the commission becomes $2.5 per side.

SwapRates

Swap rates of FXChoice are some of the best ones in the industry. In fact, the swap rates for forex pairs in this broker are the best ones among all the forex brokers on myfxbook and perhaps all the brokers in the industry.

However, the swap rates for gold and bitcoin in this broker are average among forex brokers.

The swap for bitcoin long/short is -25%. I converted them into pips in order to compare them with the one, Coinexx, that is not in percentage.

Here’s a selection of some FXCoice swap rates:

| eurusd long | eurusd short | eurusd average | gold long | gold short | gold average | bitcoin long | bitcoin short | bitcoin average | gbpjpy long s | gbpjpy short | gbpjpy average |

| -0.31 | 0.13 | -0.09 | -0.71 | 0.12 | -0.29 | -0.63 | -0.64 | -0.635 | -0.025 | 0.03 | -0.09 |

Customer Service

There are several options for you to contact FXChoice including: phone call, email, ticket, and online chat.

As I said early on, I chatted with their customer service and asked many questions about different subjects and the agent answered them professionally.

I chatted with them a few times and every time I contacted them, they responded very quickly and I didn’t have to wait to be connected.

There’s also an FAQ page on the website where you can find some of your probable questions and some of them may be on the knowledge base section.

Payment Options and Costs

FXChoice offers a wide range of payment methods but most of them are not available for US clients, however, the ones that are accessible would be enough.

You can use bank wire as well as VLoad and cryptocurrencies such as Bitcoin, Litecoin, Ethereum, Ripple, and Tether.

FXChoice doesn’t charge for bank transaction but your bank may do.

The fee for depositing via VLoad is 6.5%

Funding through cryptos is subjected to a 0.5% fee

If you deposit $3000 or more, the funding costs are reimbursed by FXChoice.

Bonus

FXChoice offers a 15% deposit bonus which means you can receive 15% of your deposit as a bonus.

Bonuses always come with some terms and conditions that you need to meet them in order to redeem the bonuses.

FXChoice 15% bonus has its own conditions that you can read them completely from their bonus page; however, as a rule of thumb, you need to trade 0.5 lots for redeeming every dollar of your bonus.

It’s not exactly like that and it varies according to different instruments that you trade.

2- N1CM

Number One Capital Markets was founded in 2017 and is regulated by Vanuatu Financial Services Commission (VFSC).

After losing FX Choice as a regulated broker I was looking for another one but I couldn’t find any until this broker reached out and told me that they accept US clients too and asked me to put them in our list.

Well, I started searching about them and testing the different aspects of this broker. honestly, I started to like them as I was testing and examining the broker; low spreads (suitable for day trading), favorable swap rates (tailored for long-term trading), and of course being regulated. All in all, a standard Forex broker with satisfactory conditions.

And one more thing…

… They have cent account where you can open positions as low as 0.0001 standard lots or 0.01 cent lots. So if you have a grid/martingale EA that opens incremental positions, this broker is probably what you’re looking for.

ok, let’s dig a bit deeper and see the broker from different angles.

N1CM Overview

Location: Suite T19, First Floor, Tana Russet Plaza, Kumul Highway, Port Vila, Efate, Vanuatu

Foundation Year: 2017

Regulation: VFSC

Types of Accounts: STP, ECN

Spread: Floating, Fix

Minimum Account Size: $5

Minimum lot size: 0.0001

MAX Leverage: 1:1000 (forex ), 1:500 (metals), 1:100 (oil), 1:100 (Indicies), 1:100 (Stocks), 1:20 (Cryptos)

Payment Methods for US Clients: Cryptocurrencies

Trading Instruments: 52+ Forex pairs, 12 Indices, Gold, Silver, Platinum, Gas, Oli, 5 Cryptocurrencies (LTCUSD, BCCUSD, BTCUSD, ETHUSD, XPRUSD)

Trading Platform: MT4 and MT5 (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 7 days

Type of Account

N1CM has three types of account: Cent, Standard, and ECN Pro. Cent and Standard are the STP type of accounts with variable spreads and no commission — you can choose fix spreads too for the Standard account.

ECN pro has variable spreads with $5 commission for every lot round turn which is kind of low in the industry (lower than average which is $6 to $7)

With a Cent account, you can only trade Forex major and minor pairs while other trading instruments such as gold, stocks, indices, and etc are available in the other two types of account. However as mentioned earlier, you can open nano lot size positions on the cent accounts, starting from 0.0001 lots (0.01 cent lots).

In the ECN account, you will see a bit lower spreads however spreads in the Standard account are less volatile and more stable, as a result more predictable.

Find out more about those three types of accounts here

Spread and Commission

The spreads and commission of this broker especially for major forex pairs are better than average in the industry.

Here’s a list of some of N1CM spreads + commission:

| EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| 0.7 | 1.7 | 3.8 | 3.8 | 20 |

Note that spreads on cent accounts in all forex brokers are higher. The above spreads are related to the ECN account.

Swap Rates

N1CM swap rates are in the average category, however, in some pairs such as GBPJPY its swap rates are better than average.

All in all, you receive fair rates so we can say that this broker is suitable for long-term trading.

| eurusd long | eurusd short | eurusd average | gold long | gold short | gold average | bitcoin long | bitcoin short | bitcoin average | gbpjpy long | gbpjpy short | gbpjpy average |

| -0.5 | 0.1 | -0.3 | -0.45 | 0 | -0.225 | -1.9 | -1.9 | -1.9 | -0.08 | -0.5 | -0.29 |

Customer Service

N1CM customer service is far better than many brokers. They have a live chat where they answer your questions professionally, however, it’s not available round the clock, at least the English version. You can only contact them during their working hours.

Payment Options

There are lots of payment options for deposit and withdrawal but the only one available for the US is Cryptocurrencies. You can deposit and withdraw Via Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Dogecoin.

If you don’t have any cryptos, you can use your visa/master card to buy for depositing into your account directly from your client dashboard after registration.

It normally takes 1-2 hours to withdraw your money.

Bonus

N1CM offers a 25% welcome bonus which means you can receive up to 25% of your deposit as a bonus, however, there are always some conditions for such bonuses. For example, you must trade a specific number of lots to release your bonus and if you withdraw money before completing those number of lots, your bonus will be canceled.

In general, it’s not a good idea to use these kinds of bonuses but if you decide to do so, make sure to read their conditions first.

3- Coinexx

Coinexx is another forex broker for US citizens and clients. It was established in 2018 in Saint Vincent and the Grenadines and is not regulated.

I stumbled upon this broker for the first time when I was checking forex broker’s spreads on myfxbook and its spreads + commission caught my eyes.

The spreads and commission of Coinexx are one of the best and tightest ones in the industry. I’ve seen and reviewed many brokers and I can confidently say that it’s on top 3.

For example, the average spread for EURUSD is less than 0.4 pips and the whole cost you need to pay as spread and commission is 0.56 pips on average — commission is $1 per side per lot.

The craziest spread they offer is on BTCUSD or bitcoin. The average spread for BTSUSD in Coinexx is around 5.8 pips and the commission is as low as $0.2 per lot so you only pay around $6 for every lot that you trade on average.

It’s too low that I even talked to them on the phone for about 15 minutes in case I was wrong but they told me that it’s correct and they offer one of the lowest spreads on bitcoin.

Ok, let’s take a look at the overall condition of Coinexx.

Coinexx Overview

Location: First St Vincent Bank Ltd Building, James Street, Kingstown, Kingstown 5Q2G+XR, VC

Foundation Year: 2018

Regulation: None

Types of Accounts: ECN

Spread: floating

Minimum Account Size: 0.001 BTC

Minimum lot size: 0.01

MAX Leverage: 1:500 (forex major, metals, oil, Indices), 1:300 (Forex Minor), 1:200 (Forex exotic), 1:5 (Cryptos)

Payment Methods for US Clients: Cryptocurrencies

Trading Instruments: 60+ Forex pairs, 11 Indices, Gold, Silver, Oli, 5 Cryptocurrencies (LTCUSD, BCCUSD, BTCUSD, ETHUSD, XPRUSD)

Trading Platform: MT5 and MT4 (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

Coinexx has only one type of ECN account with floating spreads and the commission of $1 per side per lot.

Margin call level is 70% and stop out level is 50%

Spread and Commission

As I said, they have very competitive spreads and you can get one of the best deals in the industry.

It’s not just spreads, the commission is the lowest one, only $1 per side for every lot or $2 round turn. It’s the lowest one among Forex brokers — average is $6 round turn.

The best one is Bitcoin where, as I said, the average spread is 5.8 and the commission is only $0.2 round turn.

Here’s a list of some of Coinexx the spreads + commission:

| EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| 0.58 | 1.14 | 5.5 | 1.84 | 6.1 |

Swap Rates

Coinexx swap rates are not impressive and are considered average. In some instruments such as bitcoin which is its strong suits in terms of spreads, swap rates turn into the Achilles heel of the broker and are not favorable.

That’s not so important if you are a day trader or even if you keep your trade open for a few days because the low spreads make up for that but if you are a position trader holding to your trades for weeks and months, swap rates could be a determining factor.

| eurusd long | eurusd short | eurusd average | gold long | gold short | gold average | bitcoin long | bitcoin short | bitcoin average | gbpjpy long | gbpjpy short | gbpjpy average |

| -0.89 | 0.19 | -0.35 | -1.6 | -0.37 | -0.985 | -1.91 | -1.84 | -1.875 | -0.03 | -0.71 | -0.37 |

Customer Service

Customer service is another strong point of Coinexx. I contacted them over and over and they answered my questions patiently. Even when I asked them stupid questions such as tell me the spread of this or that pair right now 😀 , they checked that and came back with the answer.

When I asked a lot of questions about their spreads for bitcoin, they even called me to clarify the subject.

Overall, I give an A+ to their customer service.

The only thing that I don’t like about their support is not related to the customer service but it’s connected to their website which is out of whack and most of the features don’t work at all.

For example, there are calculators related to swap, spreads, etc that don’t work. You also can’t see the specification of trading instruments.

Long story short, everything on their website sucks except online chat box that works like a champ 👌

Payment Options

There’s only one payment option for deposit and withdrawal, Cryptocurrencies. You can deposit and withdraw using 30 types of crypto Currencies.

It takes 48 hours after requesting a withdrawal to receive your money.

They don’t charge any extra fees and all the fees charged by external wallets such as coinbase will be reimbursed as well, so free of charged transaction.

Bonus

Coinxx has a 100% deposit credit which can be used to support your margin.

The bonus is not withdrawable and its purpose is to provide you with more margin so you can trade using larger lot sizes.

For receiving the bonus you need to deposit a minimum of $100.

There’s no limitation on withdrawing the profits earned over the bonus and you can withdraw your profits with no string attached.

For more information, you want to check the bonus page.

4- Turnkey Forex

Turnkey forex was founded in 2016 and is one of the popular offshore brokers among US traders. Most of this popularity and likability come from its tight spreads.

Turnkey Forex has merged with Coinexx

The first time that I was searching for the best offshore brokers, I skipped this broker because their customer service was awful. For instance, they had online chat but no one would answer you, however, it’s been fully changed and they answer you ASAP now, both on the live chat and when emailing them.

That’s why I changed my mind, after asking lots of questions via the chat though, and put them on my list — of course they have other favorable conditions such as their tight spreads.

If you are a scalper or even day trader and look for low spreads, you can find some of the tightest spreads in the industry in this broker, especially for major forex pairs.

With a 2 dollar commission and 0.2 to 0.4 pips spread on EURUSD, your trading cost for this pair is something like 0.5 to 0.6 pips which is the lowest in the industry and as I said, you can find such low spreads on other major pairs as well.

Turnkey Forex Overview

Location: 5th Floor, Ebene Views 66C2 Ebene Quatre Bornes, 72202, Mauritius

Foundation Year: 2016

Regulation: None

Types of Accounts: STP, ECN

Spread: Floating

Minimum Account Size: $10

Minimum lot size: 0.01

MAX Leverage: 1:500 (Forex), 1:500 (metals), 1:500 (Oil), 1:5 (Cryptos)

Payment Methods for US Clients: VLoad, Cryptocurrencies (PayPal via Coinbase)

Trading Instruments: 66 Forex pairs, Gold, Silver, 10 Crypto currencies, Oil, 11 Indices

Trading Platform: MT4/MT5 (Desktop, Mobile, Web), Act Trader

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

Turnkey Forex has two types of accounts, ECN and STP.

All the features between these two types are the same except for the spreads which are more volatile in ECN although you receive tighter spreads in this type of account most of the time.

The commission for the ECN account is $2 per lot round turn ($1 per side) which is the lowest one among forex brokers.

Spread and Commission

Since Turnkey isn’t connected to myfxbook, I couldn’t check its spreads from there so I opened an account with them and run a spread checker EA on it, and followed the results for a few days.

Here’s a list for the spreads + commission of Turnkey Forex:

| EURUSD | GBPJPY | GBPNZD | GOLD | BITCOIN |

| 0.5-0.6 | 1.4 | 4.7 | 2.7 | 18.5 |

Swap Rates

Swap rates of this broker are neither too bad nor good and considered average so if you keep your positions open for weeks, this broker might not be the best option. It doesn’t matter though if you are a day trader or your positions stay open for a few days.

| eurusd long | eurusd short | eurusd average | gold long | gold short | gold average | bitcoin long | bitcoin short | bitcoin average | gbpjpy long | gbpjpy short | gbpjpy average |

| -1.05 | 0.186 | -0.432 | -1.6 | -0.37 | -0.985 | -1.9 | -1.84 | -1.87 | -0.13 | -0.84 | -0.485 |

Customer Service

As I mentioned earlier, I hadn’t been satisfied with their support when I wanted to get a hold on them for the first time but a few months later when I contacted them again, everything was different.

The online agents are helpful and professional to a great extent. I asked several questions about different topics and they answered them well. I also found a small problem in their MT4, nothing important though, and they corrected it. All in all, I’m now satisfied with the customer service.

Payment Options

Like every other offshore broker in our list, the main viable option for deposit and withdrawal is cryptocurrencies, however, you can use your credit cards or PayPal to buy bitcoin through Coinbase.

The withdrwal time takes between 12 to 24 hours

The transaction fee via bitcoin, 0.0005 BTC, is reimbursed after depositing. You just need to share the screenshot of the crypto transaction showing the fee deducted by your vendor along with the TurnkeyForex crypto address to which the funds are sent.

Bonus

They offer a 100% deposit bonus if you deposit $100 and a 250% deposit bonus if you deposit $200 or more, however, the bonus is not withdrawable and acts as margin supporter, so basically you can use larger size lot size when using the bonus.

5- CryptoRocket

If you like to trade more instruments such as various stocks as well as more than 30 cryptocurrencies and can’t get enough of crypto trading, even on weekends, this offshore forex broker is right up your alley.

CryptoRocket was founded in 2019 in St Vincent and is not regulated.

The spreads of this broker are not too high nor too low and its commission is $6 round turn which is considered average.

The broker seems to be doing well and its clients are satisfied everywhere I see on the net, no nagging or noticeable concern or complaint.

Crypto Rocket Overview

Location: First Floor, First St Vincent Bank Building, James Street, Kingstown, St. Vincent and the Grenadines

Foundation Year: 2019

Regulation: None

Types of Accounts: ECN

Spread: floating

Minimum Account Size: No Minmum

Minimum lot size: 0.01

MAX Leverage: 1:500 (Forex and metals), 1:200 (Indices and energy), 1:100 (Crypto), 1:20 (Stock)

Payment Methods for US Clients: Bitcoins

Trading Instruments: 50+ Forex pairs, 12 Indices, Gold, Silver, platinum, palladium, Oil, Gas, 30+ Crypto currencies, 60+ Stocks, 1 Future (dollar)

Trading Platform: MT4 (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 7 days

Type of Account

Crypto Rocket has only one type of account which is an ECN account with $6 round turn as commission.

There’s no minimum deposit and the maximum leverage is 1:500. The maximum leverage for cryptos is 1:100 which is one of the highest ones among Forex brokers.

The minimum lot sizes across all markets are 0.01 and the following are the maximum lot sizes.

- Forex: 1,000 Lots

- Crypto: 10 Lots

- Indices: 1,000 Lots

- Stocks: 10,000 Lots

Margin call is 100% and stop out level is 70%

Spread and Commission

Spreads of CryptoRocket aren’t too tight and considered average in the industry. The commission of this broker is $3 per side per lot or $6 round turn.

The following table shows the spread + commission of some pairs.

| EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| 1.33 | 2.6 | 5 | 2 | 20.95 |

Swap Rates

The swap rates of CryptoRocket are a little bit better than average and in some pairs such as EUR/USD, this broker has quite favorable rates.

The long and short swap rates for bitcoin is -25% and are converted into pips for comparison purpose.

| eurusd long | eurusd short | eurusd average | gold long | gold short | gold average | bitcoin long | bitcoin short | bitcoin average | gbpjpy long | gbpjpy short | gbpjpy average |

| -0.42 | 0.09 | -0.165 | -0.58 | 0.11 | -0.235 | -0.63 | -0.64 | -0.635 | -0.18 | -0.34 | -0.26 |

Customer Service

Phone call, ticket, email, and 24/7 online support are the available options you can contact CryptoRocket.

What I like about their service is that unlike the other two, this one has a 24/7 online support which is also very quick at responding.

I chatted with them on several occasions and asked them lots of questions and they were responsive and professional every time I contacted them.

The only problem that I have is not related to customer service but it’s with their websites.

There isn’t much helpful information on the website and you can’t even find their account type and its specifications because there’s none — you need to ask them about that kind of information.

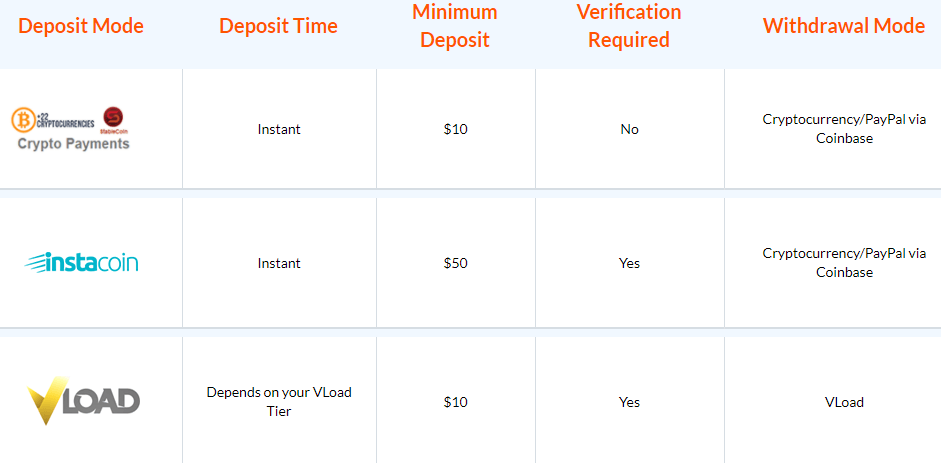

Payment Options

Bitcoin and Coinbase are the transaction methods you can use for deposit and withdrawal, however, they have an option that you can use your credit cards to purchase bitcoin from your cabinet using a third-party provider and then charge your account.

The withdrawal time is very fast, and it takes only one hour on average to receive your money.

A Bitcoin network fee of 0.0005 BTC will be deducted from your deposit, which is implemented via the Blockchain on all transactions.

Bonus

CryptoRocket doesn’t offer any type of bonus at this moment.

6- EagleFX

EagleFX was established in 2019 and has rapidly become popular among US traders. It’s very much like the previous broker, Cryptorocket, from spreads to swap rates or trading instruments.

They are too similar to each other that first I thought they are running by the same people but when I asked them; they told me there is no connection. By the way, EagleFX is not regulated either.

Anyway, with 32 cryptocurrencies, this broker is one of the best choices for crypto trading, plus they have a good portfolio of other trading instruments as well.

The spreads of the broker are neither too high nor too low and its $6 commission puts it in the category of average brokers in terms of the cost of trades.

Everywhere I searched about the reputation of this broker, I found some happy clients. Traders seem to be really satisfied with this broker especially in terms of deposit and withdrawal time. Apparently, it’s very fast as they’ve mentioned on their website too.

EagleFX Rocket Overview

Location: 8 Copthall, Roseau Valley 00152, Dominica

Foundation Year: 2019

Regulation: None

Types of Accounts: ECN

Spread: floating

Minimum Account Size: $10

Minimum lot size: 0.01

MAX Leverage: 1:500 (Forex and metals), 1:200 (Indices), 1:100 (energy), 1:100 (Crypto), 1:20 (Stock)

Payment Methods for US Clients: Bitcoins

Trading Instruments: 55 Forex pairs, 6 Indices, Gold, Silver, Platinum, Oil, Gas, 33 Cryptocurrencies, 64 Stocks, 1 Future (dollar)

Trading Platform: MT4 (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 7 days

Type of Account

EagleFX offers one ECN account with floating spreads and a $6 commission round turn.

They offer two main deposit methods; Bitcoin [min. 10USD] or Instacoins [min. 50USD/EUR/GBP].

If you are a crypto trader, you can trade them on this broker 24/7, even on weekends — not suggested go and do something like making a baby or some other family stuff :).

Spread and Commission

As I said earlier, you don’t get the best deal in terms of trades costs here, however, the spreads + commission of this broker are not too high either and considered average.

These are the spread + commission of some pairs.

| EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| 1.32 | 2.6 | 4.2 | 2.1 | 20.9 |

Swap Rate

EagleFX swap rates are better than average that makes the broker a suitable option for long term trading.

This is another factor that makes this broker like Cryptorocket, they have the same swap rates.

| eurusd long | eurusd short | eurusd average | gold long | gold short | gold average | bitcoin long | bitcoin short | bitcoin average | gbpjpy long | gbpjpy short | gbpjpy average |

| -0.42 | 0.09 | -0.165 | -0.58 | 0.11 | -0.235 | -0.63 | -0.64 | -0.635 | -0.18 | -0.34 | -0.26 |

Customer Service

Their customer service is 24/7 and are very professional. Since I couldn’t find the answers to my questions, I made a long list of questions and their online support answered all of them completely. I mean although there isn’t much info on the website, you can get all the answers from the live chat.

Actually, I’m kind of liking this type of service, I mean not much on the site, because you don’t need to browse through the site, just ask and they come back with the answer fast.

Anyway, A+ to the customer service.

Payment Option

Bitcoin is the available option for US clients in EagleFX. If you have bitcoin in your bitcoin wallet you can directly deposit to your EagleFX account otherwise you can buy bitcoin from Instacoins (a financial service that allows you to purchase Bitcoin) using your Debit/Credit Card or bank wire, and then they charge your EagleFX account.

You can do all that after registration and inside your EagleFX cabinet.

A Bitcoin network fee of 0.0005 BTC will be deducted from your deposit, which is implemented via the Blockchain on all transactions.

Bonus

EagleFX doesn’t offer any types of bonus.

7- PaxForex

PaxForex was founded in 2011 in St.vincent & the Grenadines and registered by Financial Services Authority (FSA) but it’s not regulated.

The broker considers itself neither too big that can’t provide unique service to its customers nor small that is not able to meet their clients’ demand on time.

Not accepting new US clients anymore

Ok, let’s take a look at this offshore forex broker.

PaxForex Overview

Location: 1825, Cedar Hill Crest, Villa, Kingstown, St. Vincent and Grenadines

Foundation Year: 2011

Regulation: None but registered by FSA, Registration Number 21973 IBC 2014 1825,

Types of Accounts: STP

Spread: floating

Minimum Account Size: $10

Minimum lot size: 0.0001

MAX Leverage: 1:500 (Forex, Indices), 1:100 (metals), 1:5 (stocks, Cryptos)

Payment Methods for US Clients: Bitcoins, Ethereum, Bank Wire, Skrill

Trading Instruments: 60 Forex pairs, 10 Indices, Gold, Silver, 4 Crypto currencies, 40+ Stocks, 2 Futures

Trading Platform: MT4 (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

PaxForex has 5 types of accounts which helps it to cater to a variety of traders.

Whether you want to get your feet wet with a small size account or you’re a professional trader seeking better conditions, you can find them all on PaxForex.

Cent account: The minimum deposit for this type of account is $10 and you can only have access to forex pairs. The spreads are floating and higher than other types of accounts but the good news is you can trade with lot size as low as 0.0001.

Mini account: The minimum deposit for mini account is $100 and you have access to all the available trading instruments except cryptocurrencies. The minimum lot size is 0.01. Spreads are lower than Cent account but they’re still above average and considered expensive.

Standard account: There’s a minimum deposit of $2000 for this type and you have full access to all the trading instruments. The minimum lot size is 0.1 and spreads are lower than mini accounts but they are considered average and not too low.

VIP account: This one is like standard account to a great extent except two main differences. First, you need to deposit at least $10000 and second, the minimum lot size is 0.01.

Islamic account: If you follow Sharia law and consider interest rates haram, you may want to use this type of account. You can turn every type of PaxForex accounts into an Islamic one. The conditions are the same except there are no swap rates but there are some commissions instead which are based on trading instruments.

So basically, just like FXChoice, this one is not free from overnight charges.

Spread and Commission

The spreads of PaxForex are rather high especially on cent and mini accounts. Standard and VIP account have better conditions but yet they are not inexpensive.

The spread for EURUSD is somehow low in standard and VIP accounts but this broker is not the right choice for crypto trading — the spread for bitcoin is 95.

I think the strength of this broker is not their spreads but the minimum lot size of 0.0001 is its trump card that provides a desirable condition for some style of trading and money management.

| Type of Account | EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| PaxForex standard | 0.8 | 3.5 | 10 | 6.5 | 95 |

| PaxForex Mini | 1.8 | 5.5 | 12 | 7.5 | n/a |

| PaxForex Cent | 2.4 | 5.5 | 12 | n/a | n/a |

Swap Rates

PaxForex swap rates are not good for a position trader. They are above average in general.

The long swap for bitcoin is -45% and the short swap is -35%.

| eurusd long | eurusd short | eurusd average | gold long | gold short | gold average | bitcoin long | bitcoin short | bitcoin average | gbpjpy long | gbpjpy short | gbpjpy average |

| -0.72 | 0.09 | -0.315 | -1.15 | 0.105 | -0.5225 | -1.13 | -0.77 | -0.95 | -0.25 | -0.6 | -0.425 |

Payment Options

PaxForex offers several options for deposit and withdrawal but not all of them are for its US clients.

The available payment methods for US traders are: Bitcoins, Ethereum, Bank Wire, Skrill

PaxForex doesn’t charge any fees for transactions, however, regarding your payment service you need to pay some fees.

For more than $3000 deposits, the cost of your transaction is covered by PaxForex.

Deposit Fees and Time

| Deposit Methods | Deposit Time | Min Deposit | Fees |

| Bank Transfer | 3 – 5 working days | 100 USD | Bank commission |

| Skrill / Moneybookers | 1 hour | 10 USD | 2.9% – 3.9% + 0.38 USD |

| Bitcoin | During one day | 0.01 | 0 |

| Ethereum | During one day | 1 | 0 |

Withdrawal Fees and Time

| Withdrawal Methods | Withdrawal Time | Min Withdrawal | Fees |

| Bank Transfer | Processed within 1 business day, however takes 4 to 7 business days for the funds to be credited to your bank account, depending on your Bank | 100 USD | Bank commission |

| Skrill (Moneybookers) | 1 Working Day | 10 USD | from 1% up to 3,9% + 0,35 USD |

| Bitcoin | 1 Working Day | 10 USD | 7% + 0.0006 BTC |

| Ethereum | 1 Working Day | 10 USD | 7% |

Bonus

PaxForx has a 100% deposit credit which is offered to the clients who deposit $1200 or more.

The bonus is not withdrawable and acts as margin support.

100% of your deposit is divided into 12 slices and each portion is given to you every month if you’ve trade 10 lots within the previous month.

For example, you deposit $1200 and request for 100% credit ($1200). for the first month, you get $100, the next month another $100, and so on.

For more information check out the terms and conditions of PaxForex bonus.

8- Trader’s Way

Trader’s Way is the next offshore Forex broker on our list that accepts US clients. It was founded in 2011 in Dominica and is not regulated.

Not accepting new US clients anymore

The broker has various types of accounts from fixed spreads to STP, ECN, and Islamic accounts.

When I looked at their websites, aside from its design, I saw everything a standard forex brokerage should have.

Besides a standard range of account types, they offer cTrader along with MT4/MT5 as trading platforms in all versions (mobile, web, desktop).

They also provide free VPS for the clients who have at least a $1000 account and trade 10 lots per month — see more about Trader’s way VPS here.

Trader’s Way Overview

Location: 8 Copthall, Roseau, Dominica

Foundation Year: 2011

Regulation: None

Types of Accounts: Fixed Spread, STP, ECN

Spread: Fixed, Floating

Minimum Account Size: $1

Minimum lot size: 0.01

MAX Leverage: 1:1000 (Forex), 1:500 (metals), 1:125 (Oil & Gas), 1:20 (Cryptos)

Payment Methods for US Clients: Credit/Debit Cards via VLoad, Bank Wire, Cryptocurrencies

Trading Instruments: 40+ Forex pairs, Gold, Silver, 9 Crypto currencies, Oil, Gas

Trading Platform: MT4/MT5, cTrader (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

Trader’s Way has 6 types of accounts that are different from each other in some ways.

The differences such as the type and size of spreads, minimum deposit, leverage, commission, number of trading instruments, and trading platforms.

Let’s take a look at them

MT4.FIX: it’s a fixed spread account and obviously no commission. There’s no minimum deposit and the maximum leverage is 1:1000. You have access to all the trading instruments except cryptocurrencies. The spreads are higher in this type but you know what deal you get in advance. MT4 is the trading platform in this account

MT4.VAR: It’s an STP type of account with floating spreads and no commission. The average spreads are lower than MT4.FIX and the maximum leverage is 1:1000. There’s no minimum deposit and you can trade all the available instruments. MT4 is the trading platform of this type of account.

MT4.ECN: as its name implies, this is an ECN account with floating spreads and a $3 commission per side for every lot ($6 round turn), however, the commission is calculated based on margin currency — see more in the next section.

The max leverage is 1:1000, the minimum deposit is $100, and you have full access to all available instruments. MT4 is the trading platform of MT4.ECN.

MT5.ECN: Everything in this type of account is like MT4.ECN except for the trading platform which is MT5.

CT.ECN: This account is based on cTrader platform. Just like the previous two, it’s an ECN account with floating spreads and a $3 commission per side per lot. The maximum leverage is 1:500 and the minimum deposit is $50. You can only trade Forex and metals having this type of account.

Islamic: Islamic or swap free accounts are only available for MT4.FIX, and MT4.VAR. You can turn them into Islamic one by sending an email to the support center and states your intention of such a request. There’s no swap involved, however, a $10 fee per lot is charged for every trade that goes to the next day.

Spread and Commission

Trader’s Way has various spreads for its types of accounts. The best deal in terms of trades’ cost is for ECN accounts where you pay less spread + commission.

On the website it’s mentioned that the commission is $3 per side per lot, however, as I said before, the commission is calculated based on margin currency.

For example, for usdjpy or usdchf, the commission is $6 but for gbpjpy or gbpusd ,the commission is $7.8, for eurusd is &6.5, for audcad is $4, and etc.

The spreads + commissions of ECN accounts are considered a little tighter than average for forex pairs and in some cases such as GBPNZD, which has the highest spread among minor/major FX pairs, it is one of the lowest in the industry.

You can see our spread + commission selection for the MT4.ECN account of Trader’s Way in the following table.

I wanted to show the spreads of other types of accounts as well but it seems the only type of account on myfxbook is related to the ECN account.

The information about some of the spreads of those types of accounts on Trader’s Way website don’t seem correct because I opened different types of demo accounts to double-check them and they don’t match

Anyway, you can open a demo account before a real account and check them all.

| EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| 0.9 | 2.08 | 2.8 | 3.38 | 25.8 |

Swap Rates

The swap rates of this broker are considered high and if you keep your positions open for weeks or even days, this broker is not the best choice for you.

| eurusd long | eurusd short | eurusd average | gold long | gold short | gold average | bitcoin long | bitcoin short | bitcoin average | gbpjpy long | gbpjpy short | gbpjpy average |

| -1.56 | 0.33 | -0.615 | -1.6 | 0.04 | -0.78 | -0.1 | -1.53 | -0.815 | 0 | -0.74 | -0.37 |

Customer Service

You can contact trader’s Way in several ways including phone call, email, ticket, and live chat.

During some contacts that I had with them, they were responsive and answered all of my professional and stupid questions, however, you don’t need to contact them if you have general questions because you can find most of them on the website.

Payment Options

Trader’s Way has several payment methods, however, some of them available for US clients. You can deposit and withdraw via bank wire, VLoad, and a variety of cryptocurrencies such as bitcoin, Ether, Litecoin, Ripple, USD coin, Tether, and TrueUSD.

Withdrawal requests are processed within 48 hours on business days.

Transaction through VLoad is subjected to a 5% fee.

Bank wire transfers are through VLoad and the fee is 2% that will be reimbursed if you deposit $2500 or more.

Trader’s Way doesn’t charge any fees for cryptos withdrawal but the crypto networks charge a fee which is 0.0005 BTC.

Bonus

Trader’s way offers a 100% deposit bonus, up to $5000.

The bonus is not withdrawable in the first place but you can trade and redeem it.

For every dollar to be redeemed, you need to trade 2 lots.

For example, you deposit $1000 and receive a $1000 credit in your account.

Then, you trade 2 lots with the $2000 account on the first day.

$1 is redeemed and added to your account. You can do the same to release the whole 1000 dollar credit.

It’s more like rebate or cashback systems.

Trader’s Way’s bonus is the winner in the bonus category of our list of the best offshore Forex brokers for US citizens.

Find more information on the bonus page.

Note: For understanding the process of ranking the offshore Forex brokers for the following categories, you may want to read the methodology section

Best Offshore Forex Broker for Day trading

According to the examination that I had, Coinexx and Turnkey Forex are the best offshore Forex brokers for US day traders with the tightest Spreads + commission, however, N1CM also has very competitive spreads and fast execution, plus it’s regulated.

When you are a day trader, your targets and limitations such as stop loss and take profit are not wide so spreads and commissions play a tangible role in your final results.

For finding the best offshore Forex broker for US traders, we should look into the spreads and commissions of them to find the lowest ones.

Having very low spreads and only a $2 commission round trip puts these two brokers on the top spots of not only offshore Forex brokers but also all the Forex brokers in the industry.

| Broker | EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| Turnkey Forex | 0.58 | 1.4 | 4.7 | 2.7 | 18.5 |

| Coinexx | 0.58 | 1.4 | 5.5 | 1.84 | 6.1 |

| N1CM | 0.7 | 1.7 | 3.8 | 3.8 | 20 |

| PaxForex standard | 0.8 | 3.5 | 10 | 6.5 | 95 |

| Trader’s Way ECN | 0.9 | 2.08 | 2.8 | 3.38 | 25.8 |

| EagleFX | 1.33 | 2.6 | 4.2 | 2.1 | 20.9 |

| CryptoRocket | 1.33 | 2.6 | 5 | 2 | 20.95 |

| FXChoice Pro | 1.35 | 3 | 6.2 | 3.08 | 25.67 |

| FXChoice classic | 1.45 | 3.25 | 6.5 | 3.13 | 25.67 |

| PaxForex Mini | 1.8 | 5.5 | 12 | 7.5 | n/a |

| PaxForex Cent | 2.4 | 5.5 | 12 | n/a | n/a |

The best forex brokers for US clients who trade on a daily basis are Coinexx and Turnkey Forex, and the best regulated one is N1CM.

Best Offshore Forex Broker for US Scalpers

The title for the best offshore forex brokers for US scalpers goes again to Coinexx and Turnkey forex with the lowest spreads and commission and fastest execution speed.

When you’re a scalper, not only do you need the tightest spreads but it’s also necessary that your orders are executed fast.

of course, fast execution is important when you open several positions in a row or use a scalper EA that works based on such a method otherwise only spread is the determining factor.

I tested the MT4 market and limit orders execution speed of the forex brokers on our list and EagleFX, Turnkey, and Coinexx showed the best results.

Execution Speed

| Broker | Market Order Execution Speed | Limit Order Execution Speed |

| EagleFX | 104 | 110 |

| Coinexx | 105 | 95 |

| N1CM | 107 | 100 |

| Turnkey Forex | 109 | 100 |

| FXChoice | 120 | 130 |

| CryptoRocket | 150 | 190 |

| Trader’s Way | 160 | 200 |

| PaxForex | 230 | 180 |

The best offshore forex brokers for US clients who are chosen scalping as their trading strategy are Coinexx and Turnkey Forex.

Best Gold Trading Offshore Forex Broker for US Clients

If you are a day trader or scalper, Coinexx has the best spread + commission for gold so in this case, Coinexx is the best offshore broker for US gold traders.

On the other hand, if you are a longer-term trader such as a position trader, you may want to consider N1CM because it has the most favorable swap rates for gold.

| Broker | Spread | Swap Long | Swap Short | Swap Average |

| Coinexx | 1.84 | -1.6 | -0.37 | -0.985 |

| CryptoRocket | 2 | -0.58 | 0.11 | -0.235 |

| EagleFX | 2.1 | -0.58 | 0.11 | -0.235 |

| Turnkey Forex | 2.7 | -1.6 | -0.37 | -0.985 |

| N1CM | 3.8 | -0.45 | 0 | -0.225 |

| FXChoice Pro | 3.8 | -0.71 | 0.12 | -0.29 |

| FXChoice classic | 3.13 | -0.71 | -0.12 | -0.29 |

| Trader’s Way | 3.38 | -1.6 | 0.04 | -0.78 |

| PaxForex standard | 6.5 | -1.15 | 0.105 | -0.5225 |

| PaxForex Mini | 7.5 | -1.15 | 0.105 | -0.5225 |

With that said…

The best offshore broker for US clients interested in short term gold trading is Coinexx and for long-term gold trading is N1CM — in terms of trades’ costs.

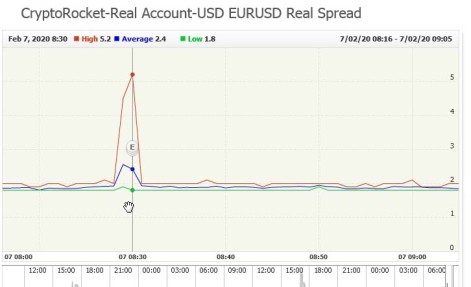

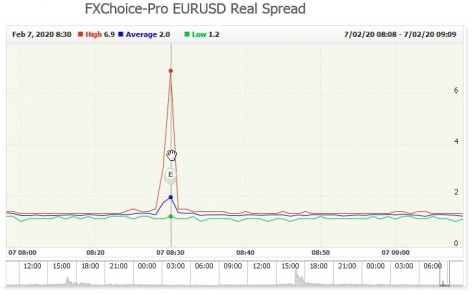

Offshore Brokers Slippage and News Trading

The best times for testing broker’s slippage are when the most volatile news events are released.

I watched the performance of our offshore forex brokers on one of the most volatile news events, Nonfarm payrolls (NFP) to see the maximum negative slippage you may receive and the deviation of EURUSD spread from average spread.

Unfortunately, I didn’t have access to this data for Paxforex because this broker is not registered on myfxbook.

| Broker | Average Spread | Max Spread on NFP | Max slippage |

| Coinexx | 0.58 | 2 | 245% |

| CryptoRocket | 1.33 | 4.6 | 246% |

| FXChoice classic | 1.45 | 5.9 | 307% |

| Trader’s Way | 0.9 | 4.55 | 406% |

| FXChoice Pro | 1.35 | 6.9 | 411% |

As you can see the lowest maximum spread you may get on NFP is related to Coinexx.

The spreads of eurusd in both Coinexx and CryptoRocket show the least deviation from their average which means you get lower negative slippage.

Lower spreads are better when trading on the news but lower slippage can help you make more precise money management decisions.

So the title of the best offshore Forex broker for US clients who trade on the news goes to Coinexx.

Methodology

For finding, testing and examining the best offshore forex brokers for US citizens or clients I went through many brokers’ websites to see if they accept US clients and if so, whether they have the average standard of a forex broker or not.

After finding some brokers accepting US clients, I did several tests on them including, contacting customer service; finding their spreads and commission, swap rates, and slippage through both their websites and a third party website called myfxbook on which there are many real accounts of around 200 forex brokers; and testing their execution speed using EAs.

For testing the brokers I picked 5 different pairs each can show one aspect of them.

- EURUSD: The most liquid and traded Forex pair

- GBPJPY: One of the most volatile pairs with high liquidity

- GBPNZD: The pair with the highest average daily range in major and minor forex pairs

- Gold: To assess Metal trading condition

- Bitcoin: As the representative of cryptocurrencies

This is the process that I use to do a comprehensive review of forex brokers. You can find more details on the mentioned tests in the flowing links:

The Bottom Line

When it comes to picking an offshore forex broker, US citizens don’t have a wide range of choices.

It’s even worse when you look for an offshore broker that can be included in the best forex brokers category, however, there are a few of them that seem to provide good quality for their clients.

I tried to find the ones with standard quality and looked into them from different angles.

To wind up this review, let’s summarize our findings of the best offshore forex brokers for US clients.

If you are a day trader or scalper Coinexx and Turnkey Forex are good options in terms of spreads + commission, however, N1CM can be the best regulated choice as it has tight spreads as well.

If you like trading cryptos, there are a lot of them in EagleFX and CryptoRocket and their spreads and commission are reasonable.

If you’re looking for a cent account with the minimum lot size of 0.0001, PaxForex and N1CM might be your solution.

If you look for a fixed spread account or you want to enjoy the sophisticated options of cTrader, or even seeking the best bonus, Trader’s Way is all that you need — N1CM has fixed spreads too.

For news trading, Coinexx and CryptoRocket seem to be the right choice — I haven’t tested EagleFX and Turnkey Forex yet to see their slippages on the news.

For longer-term trading such as swing or position trading, EagleFX, and FXChoice are the best picks.

You need to update this site. Turnkey is out of business AND some of these other brokers DON’T TAKE US CLIENTS anymore.

Thanks Jack. Turnkey Forex has merged into Coinexx recently. Their website was up though and now that I checked, it’s down (thanks for the heads up). Of course, you can still log into your account using your Tuenkey credential through the Coinexx website. Regarding other brokers, I’ve already updated the ones that don’t accept US clients anymore.

This was an amazing post thank you for your hard work ! & Info this really helped me out I been looking at off shore brokers for weeks this really helped.

I had one question for you tho , regarding taxes when withdrawing Bitcoin: how do you usually go about It report these income payments to the IRS as “other income” via IRS Form 1099-MISC or 1040 maybe

I know your not a CPA or anything just looking for little help , thanks you

Thanks Will. Well as you can see in the disclaimer of the site, on the footer, I neither talk about taxes on this website nor I’m an expert in that subject. I watched some useful videos about taxes on trading though, you can search that on youtube as well. I’m sure you’ll find what you look for.

David,

Thank you for all the information and the work that you put forth; it was outstanding. I reside in the USA and am looking for an offshore broker for trading US30. Any recommendation?

Hi Grant,

Thanks, Both n1cm and Coinexx are the best options among our brokers for trading us30.

This article is a result of oustanding effort, reserach, knowlege all put together in the simplest way possible. Loved it

And do you have a linkedin account?

Thanks Sultan! No, I don’t have a LinkedIn account.

Wow! The extent of research and aggregation & translation of data in this post is outstanding. I found exactly what I was looking for after skimming through many incoherent articles & YouTube videos.

Your hard work is appreciated, David!

– 2 yr Forex Trader

Thanks, happy to hear that you found what you were looking for.

David, thank you for the fantastic job! The info you provide is very helpful.

Hello.

I have a question for you. I need a broker that accepts US clients, and offers a pamm account with swapfree option.

I am a longterm trader using an EA and i am using Coinexx currently. The only problem with Coinexx is they dont offer me swapfree…and sometimes i stay 2 weeks in my trades and swap is killing it. Which broker do you think is best for this ?

Hey Dan, Well, there are a handful of brokers for US clients and there isn’t a broker among them with all those features. First off, so called swap free accounts are offered to Muslims. Very few brokers offer such an account to non-muslim traders. plus, that’s not actually swap-free in many cases and some brokers charge a commission for that or have a time limit for free swaps. Anyway, I’ve written a post about all that, you can find it here. Coinexx is probably your best option, at least it has PAMM.

Thank you for the info. However, unfortunately, CryptoRocket no longer accepts U.S. clients. Too bad, since they look like one of the best regarding what you can trade with them.

You can use Eaglefx. They are very much like Cryptorocket.

Hello , Thank you for information. I just completed an online chat with CryptoRocket. Although he stated that they accept from all over the world, he did state that I need to check with my local law & regulations. I cant find anything. Is this to say that I can’t use them as a US Resident. And will Eagelfx tell me the same?

Thank you in advance

Anthony

You can use both of them but since they’re not regulated in the US and are considered offshore, they’re required to give you that line I think.

This is brilliant!! Thank you!

You’re welcome. Happy to hear that

Thank you, very helpful!

happy to hear that!

Hi! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would

really enjoy your content. Please let me know.

Cheers

Why not! glad that you liked it

This was a nice compilation of brokers. Do you happen to know if fx leaders is can help me as I am starting up my trading journey? My friend recommended it and just checking all infos I can online.