If you are searching for the best offshore forex brokers for US clients or the top ones accepting US residents with no KYC, you are definitely fed up with the restrictions, set out by NFA and CFTC, such as low leverage or the FIFO rule that basically prevents you from hedging, and you want to be free from all those shackles.

If you are a newbie, those conditions may save you from yourself and salvage your account from being razed to the ground, however, if you’re a professional trader, it would be a pain in the neck to trade using a $50k fund while you can have the same results only with a $5k account, thanks to a higher leverage.

All in all, it’s up to you whether to pick an offshore Forex broker or not but if you want to know more about the conditions of some offshore forex brokers for US clients, you can find out interesting stuff about them including what are their spreads and commission, their execution speed, the best one for day trading and scalping, the one that is best for long term trading, crypto trading, EAs, or gold trading and many more.

During my attempt to find the best offshore forex brokers, I found a handful of brokers accepting US clients and to top it all, not all of them even close to a standard forex brokerage.

Some of them don’t even answer your email and are not available online and you can only guess they accept US clients because you don’t see anything on their websites opposed to that.

I also check review sites to see what traders are saying about each broker. While many reviews are fake or biased, years of experience analyzing Forex brokers have taught me how to distinguish authentic feedback from noise. This step alone helped me eliminate several brokers from my list.

Although there are some low standard or scammy offshore forex brokers for US residents, I’ve found some that are up to par and in some cases, even better than some of the best forex brokers in the industry in terms of trading costs.

We’ll talk about that but first…

…Without further ado, let’s become familiar with the offshore forex brokers that accept US clients.

You can find the methodology of the reviews at the bottom of this post

Best Offshore Forex Brokers Accepting US Clients

Here’s a list of the best offshore forex brokers accepting US residents and clients as well as a complete review of every one of them.

- Coinexx ( The tightest spreads and best for scalping)

- HankoTrade (Tight spread & commission)

- Fyntura (Best for scalping gold and swing trading)

- DuraMarkets (Best for EA)

Coinexx

Coinexx is one of the forex broker accepting US citizens and clients. It was established in 2018 in Saint Vincent and the Grenadines and is not regulated.

I stumbled upon this broker for the first time when I was checking forex broker’s spreads on myfxbook and its spreads + commission caught my eyes.

The spreads and commission of Coinexx are one of the best and tightest ones in the industry. I’ve seen and reviewed many brokers and I can confidently say that it’s on top 3.

For example, the average spread for EURUSD is less than 0.15 pips and the whole cost you need to pay as spread and commission is 0.35 pips on average — commission is $1 per side per lot.

Ok, let’s take a look at the overall condition of Coinexx.

Coinexx Overview

Location: First St Vincent Bank Ltd Building, James Street, Kingstown, Kingstown 5Q2G+XR, VC

Foundation Year: 2018

Regulation: None

Types of Accounts: ECN

Spread: floating

Minimum Account Size: $10

Minimum lot size: 0.01

MAX Leverage: 1:500 (forex major, metals, oil, Indices), 1:300 (Forex Minor), 1:200 (Forex exotic), 1:5 (Cryptos)

Payment Methods for US Clients: Cryptocurrencies

Trading Instruments: 60+ Forex pairs, 11 Indices, Gold, Silver, Oli, 5 Cryptocurrencies (LTCUSD, BCCUSD, BTCUSD, ETHUSD, XPRUSD)

Trading Platform: MT5 and MT4 (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

Coinexx has only one type of ECN account with floating spreads and the commission of $1 per side per lot.

Margin call level is 70% and stop out level is 50%

Spread and Commission

As I said, they have very competitive spreads and you can get one of the best deals in the industry.

It’s not just spreads, the commission is the lowest one, only $1 per side for every lot or $2 round turn. It’s the lowest one among Forex brokers — average is $6 round turn.

The best one is Bitcoin where, as I said, the average spread is 5.8 and the commission is only $0.2 round turn.

Here’s a list of some of Coinexx the spreads + commission:

| EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| 0.35 | 1.4 | 1.4 | 1.9 | 5.4 |

Swap Rates

Coinexx swap rates are not impressive and are considered average but still one of the best ones in our list. In some instruments such as bitcoin which is its strong suits in terms of spreads, swap rates turn into the Achilles heel of the broker and are not favorable.

That’s not so important if you are a day trader or even if you keep your trade open for a few days because the low spreads make up for that but if you are a position trader holding to your trades for weeks and months, swap rates could be a determining factor.

| Pair | long Swap | Short Swap |

| EUEUSD | -0.73 | 0.27 |

| GBPJPY | 1.06 | -3.54 |

| Gold | -1.91 | -1.84 |

| Bitcoin | -4.6 | 2.3 |

Customer Service

Customer service is another strong point of Coinexx. I contacted them over and over and they answered my questions patiently. Even when I asked them stupid questions such as tell me the spread of this or that pair right now 😀 , they checked that and came back with the answer.

When I asked a lot of questions about their spreads for bitcoin, they even called me to clarify the subject.

Overall, I give an A+ to their customer service.

The only thing that I don’t like about their support is not related to the customer service but it’s connected to their website which is out of whack and most of the features don’t work at all.

For example, there are calculators related to swap, spreads, etc that don’t work. You also can’t see the specification of trading instruments.

Long story short, everything on their website sucks except online chat box that works like a champ 👌

Payment Options

There’s only one payment option for deposit and withdrawal, Cryptocurrencies. You can deposit and withdraw using 30 types of crypto Currencies.

It takes 48 hours after requesting a withdrawal to receive your money.

They don’t charge any extra fees and all the fees charged by external wallets such as coinbase will be reimbursed as well, so free of charged transaction.

Bonus

Coinxx has a 100% deposit credit which can be used to support your margin meaning you can open larger size trades.

Bonus rules

- The bonus is not withdrawable and its purpose is to provide you with more margin so you can trade using larger lot sizes.

- For receiving the bonus you need to deposit a minimum of $100.

- There’s no limitation on withdrawing the profits earned over the bonus and you can withdraw your profits with no string attached.

Hankotrade

Hankotrade is one of those brokers that has been popping up a lot on YouTube lately, often mentioned as one of the “go-to” offshore forex brokers for U.S. traders. That buzz made me curious enough to dig deeper and put them to the test myself to see whether they really deserve a place on our list.

I started by opening an account and exploring their different options. Hankotrade offers several account types, starting with the Standard STP account, which only requires a $10 minimum deposit, all the way up to the ECN Plus account, where the entry point is $1,000 but spreads and commissions are at their absolute lowest.

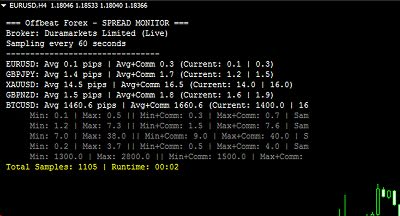

Since Hankotrade isn’t listed on Myfxbook and doesn’t provide MetaTrader, I couldn’t rely on automated tools or EAs to get spread data. Instead, I tested spreads manually by placing trades at different times of day and averaging the results. The outcome was impressive: spreads and commissions are among the most competitive I’ve seen, even on their regular ECN account—let alone the ECN Plus.

That said, this isn’t entirely surprising. When I first reviewed Coinexx a few years back (another broker on our list), I noticed a similar pattern. It seems that offering ultra-tight spreads and low commissions has become the standard tactic for unregulated offshore brokers trying to draw in clients.

One unusual aspect of Hankotrade is their platform choice. Unlike most offshore brokers, they don’t support MetaTrader at all. Instead, they’ve developed their own proprietary platform called HankoX. For traders who rely on MT4—for example, to run EAs—they direct you to a different broker named Fyntura. While Hankotrade doesn’t officially acknowledge the connection, it’s hard not to see Fyntura as one of their sister branches. (We’ll also review Fyntura separately in this article.)

Hankotrade Overview

Location: Hankotrade Global Markets Limited Blake Building, Corner Houston & Eyre Street,Belize City, Belize

Foundation Year: 2018

Regulation: None

Types of Accounts: STP and ECN

Spread: floating

Minimum Account Size: $15

Minimum lot size: 0.01

MAX Leverage: 1:500 (forex), 1:200 (Indices & oil), 1:5 (Cryptos)

Payment Methods for US Clients: Crypto currencies (Bitcoin, ETH, USDT, USDC, BCH, LTC, DOGE)

Trading Instruments: 62 Forex pairs, 7 Indices, Gold, Silver, 4 Cryptocurrencies (LTCUSD, ETHUSD, BTCUSD, BCCUSD)

Trading Platform: HankoX (Hankotrade proprietary platform) for web and mobile app

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

Hankotrade have 4 main types of accounts: Standard (STP), ECN, ECN Plus, ECN Blue

Standard account is the STP type of account with floating spreads and no commission.

ECN accounts with floating spreads and $2 commission per side for every lot ($4 round turn)

ECN Plus accounts with floating spreads and $1 commission per side for every lot ($2 round turn)

ECN Blue accounts with floating spreads and $4 commission per side for every lot ($8 round turn)

All three account types can be converted into swap-free (Islamic) accounts. While these accounts don’t incur swap fees, they do apply an Admin charge: if a position remains open for two days, a fee of 4 pips is applied—currently higher than their standard swaps. However, the website doesn’t clarify whether this fee recurs every two days or is only charged once. I reached out to their customer service for clarification, but the representative I spoke with was unable to provide a clear answer.

Although I couldn’t find out about the swap free account, after several back-and-forth exchanges, I finally received clarification about the ECN Blue account. This account type is designed for service providers such as trading mentors, signal sellers, or gurus. Instead of charging clients directly, they can ask them to open an ECN Blue account. Since this account carries a higher commission rate, and brokers typically share part of their revenue (from spreads and commissions) with affiliates, the service provider receives greater compensation from their clients’ trading activity.

| Account Type | Standard | ECN | ECN Pluse | ECN Blue |

| Min Deposit | $15 | $100 | $1000 | N/A |

| Max leverage | 1:500 | 1:500 | 1:500 | 1:500 |

| Min Lot Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Commission | No | $2 per side | $1 per side | $4 per side |

| Spread Type | Floating | Floating | Floating | Floating |

Spread and Commission

As I mentioned earlier, Hankotrade’s spreads and commissions are exceptionally tight—tighter than the lowest levels offered by many well-known forex brokers. For instance, while most popular brokers charge between $2.50 and $3.50 per side in commissions, Hankotrade’s ECN Plus account charges only $1 per side, making it highly competitive.

What sets Hankotrade apart is that it doesn’t offset low commissions with wider spreads, as some brokers do. Instead, both the commissions and spreads remain extremely tight. As a result, you can see an average all-in cost (spread + commission) as low as 0.4 pips on EUR/USD, which is among the most attractive pricing models in the industry.

The following are the average spread + commission costs for Hankotrade’s ECN and ECN Plus accounts:

| Account | EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| ECN Plus | 0.4 | 1.4 | 1.9 | 1.9 | 9.5 |

| ECN | 0.6 | 1.6 | 2.1 | 2.1 | 12.2 |

SwapRates

Hankotrade’s swap rates are generally not favorable and fall below the industry average. While swap rates naturally fluctuate daily or weekly, the sample I reviewed indicates they tend to favor the broker. As a result, Hankotrade may not be the best choice if you plan to hold positions open for several days or weeks.

Here’s a selection of Hankotrade swap rates:

| Pair | long Swap | Short Swap |

| EUEUSD | -1.14 | -0.16 |

| GBPJPY | -3 | -2.16 |

| Gold | -2.44 | -0.42 |

| Bitcoin | -3.41 | -2.24 |

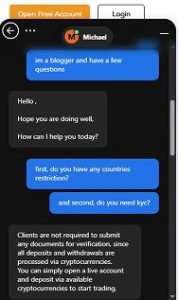

Customer Service

To test Hankotrade’s customer support, I went straight to their website to see how their service really is. The first time I chatted with them, I asked if they accept clients from anywhere—US in my case—and whether I’d need to submit KYC documents. The answer was simple: yes, they accept clients worldwide, and no, you don’t need to submit documents, even for withdrawals.

But my experience was very different second time when I had more detailed questions—about the swap-free account, the ECN Blue account, and a few other specifics. This is where things got frustrating. Their support is okay for general questions, but if you dig a little deeper, they often don’t really know what they’re talking about.

The first agent disappeared on me after my second question. The second agent was a bit more helpful, answering most of my questions, though with long pauses—probably checking with a colleague. But in the end, she also vanished when I asked about the swap-free account.

Overall, I’d say their support is very average. It’s fine if you have general questions, but if you want clear answers on the more technical stuff, you might be left hanging.

Payment Options and Costs

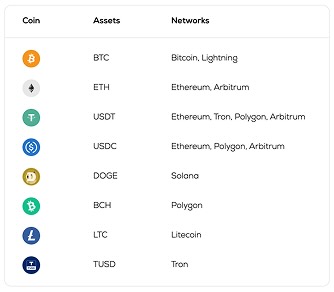

As I mentioned in the customer service section, Hankotrade only accepts cryptocurrencies for deposits and withdrawals. The available options include Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Tether (USDT), USD Coin (USDC), TrueUSD (TUSD), and Dogecoin (DOGE).

Transaction fees vary depending on the blockchain you use. For example, Lightning Bitcoin, Doge on Solana, and USDT or USDC on Polygon or Arbitrum usually have lower fees compared to Ethereum and Tron networks. So choosing the right network can save you a bit on costs.

According to Hankotrade, deposits and withdrawals should take 1–3 business days, but from what I’ve seen in some reviews, it’s taken some people up to 5 business days to actually get their money.

Bonus

Hankotrade offers a 100% Matching Deposit Bonus to new traders, effectively doubling your initial deposit up to a specified limit. This bonus is available upon account registration and is credited automatically.

Bonuses always come with terms and conditions, and you’ll need to meet those requirements before you can actually redeem or benefit from them.

Bonus Rules:

- Hankotrade’s 100% Deposit Bonus (up to 200% during promos) is available on all new deposits.

- The bonus cannot be withdrawn until the trading requirement is met.

- Condition: You must trade a volume equal to Bonus ÷ 2 in standard lots.

Example: A $1,000 bonus requires 500 standard lots before it can be withdrawn.

Fyntura

While exploring the Hankotrade dashboard in search of MT4 platform, I came across Fyntura. Since Hankotrade itself doesn’t offer MetaTrader, selecting MT4 in their dashboard redirects you to Fyntura. That’s how I discovered this offshore broker, and learning that they accept US clients, I decided to take a closer look.

Being unfamiliar with Fyntura, my first step was to check online reviews. I didn’t find any serious red flags, which was reassuring. Next, I explored their website. It’s simple and straightforward, similar to other brokers I’ve come across, like Hankotrade or Coinexx — almost as if they’re built from the same template with minor tweaks.

What really caught my attention was their trading fees. Spreads and commissions are extremely low, especially on the Prime account, which you can open with as little as $100. For day traders or scalpers, this makes Fyntura particularly appealing.

The only available platform on Fyntura is MT4 and the broker even doesn’t offer MT5. Despite this limitation, their MT4 execution speed is impressive — in fact, it ranks among the top three out of more than 100 brokers I’ve tested.

Overall, Fyntura gives US clients a low-cost, fast MT4 trading experience with a straightforward setup, making it a broker worth considering.

Fyntura Overview

Location: Oliaji Trad Centre 1st floor, Victoria, Mahé, Republic of Seychelles

Foundation Year: 2023

Regulation: None

Types of Accounts: STP and ECN

Spread: floating

Minimum Account Size: $10

Minimum lot size: 0.01

MAX Leverage: 1:500 (Forex and metals), 1:500 (Indices), 1:500 (energy), 1:5 (Crypto)

Payment Methods for US Clients: Crypto currencies (Bitcoin, ETH, USDT, USDC, BCH, LTC, DOGE)

Trading Instruments: 70+ Forex pairs, 8 Indices, Gold, Silver,, Gas, 5 Cryptocurrencies

Trading Platform: MT4 (Desktop, Web, Mobile)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

Fyntura offers three types of trading accounts to choose from: Zero, Pro, and Prime.

The Zero account is an STP type, which means you’ll get more predictable spreads with less fluctuation, though spreads are generally a bit higher compared to their other accounts.

Both the Pro and Prime accounts are ECN type, which usually provide tighter spreads but include a commission fee. The difference between the two is minimal:

- Prime account – $2 commission (round turn) with a $100 minimum deposit.

- Pro account – $4 commission (round turn) with just a $10 minimum deposit.

Other than those differences, Pro and Prime are basically identical. If you’re aiming for the lowest possible trading costs, Prime is the better pick, while Pro is a good low-barrier entry point if you just want to test the broker with a small deposit.

| Account Type | Zero | Pro | Prime |

| Min Deposit | $10 | $10 | $100 |

| Max leverage | 1:500 | 1:500 | 1:500 |

| Min Lot Size | 0.01 | 0.01 | 0.01 |

| Commission | No | $2 per side | $1 per side |

| Spread Type | Floating | Floating | Floating |

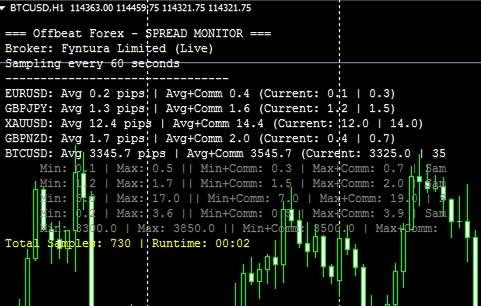

Spread and Commission

I put Fyntura to the test by running a live account spread check for over three hours, and the results confirmed what I mentioned earlier: Fyntura, much like Coinexx, offers some of the lowest spreads and commissions in the entire forex industry. You simply don’t find these kinds of costs at regulated brokers. It’s one of the tactics offshore brokers use to stay competitive against the big, established names in the market.

If you’re a scalper or day trader, the Prime account is your best bet since it combines ultra-low spreads with minimal commission. On the other hand, if you’re more of a news trader, you might find better conditions in the Zero account, where spread volatility is generally lower and more predictable.

| Account | EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| Zero | 0.8 | 1.9 | 2.3 | 4.2 | 3.54 |

| Pro | 0.6 | 1.9 | 2.3 | 1.6 | 5.3 |

| Prime | 0.4 | 1.6 | 2 | 1.4 | 5.3 |

Swap Rate

When it comes to swap rates, Fyntura is about average compared to the broader forex industry. However, among the offshore forex brokers I’ve reviewed, their swap rates are actually some of the best. This makes Fyntura a strong option if you’re a swing trader or position trader, since lower overnight costs can make a big difference over time.

| Pair | long Swap | Short Swap |

| EUEUSD | -0.89 | 0.18 |

| GBPJPY | -0.026 | -0.71 |

| Gold | -1.63 | -0.37 |

| Bitcoin | -1.91 | -1.84 |

Customer Service

I reached out to Fyntura’s customer service several times via live chat to ask a few questions. My first question was whether they accept US clients and if any KYC is required. The answer was simple: yes, they accept clients worldwide, and no KYC is needed — basically the same response I got from Hankotrade. Even their customer service template seems very similar. That said, I have to give them credit: they’re much faster than Hankotrade in responding.

On the flip side, when it comes to more technical questions, their support team lacks the depth to provide detailed answers. So, if you’re looking for help with basic inquiries, they’re sufficient, but for anything more technical, don’t expect expert guidance.

Payment Option

For US clients, and actually for all clients, Fyntura only supports crypto payments. They accept BTC, ETH, USDT, LTC, DOGE, and TUSD. There are no extra fees for deposits or withdrawals, apart from the standard blockchain transaction fees.

According to their website, withdrawals can take up to 24 hours, while deposits are usually processed in under 30 minutes. From what I’ve seen in reviews online, this timeline is generally accurate, though there was one report of a user waiting three days to receive their funds. Overall, their crypto payment system seems straightforward and efficient.

Bonus

Fyntura offers a 100% deposit bonus, which at first glance seems appealing because it can double your trading capital. Like many offshore brokers, bonuses can be tricky, but in this case, the conditions are better than what you usually see elsewhere.

Bonus Rules:

- Maximum Bonus: Up to $50,000 per client.

- Withdrawals: The bonus itself cannot be withdrawn, but any profit earned from it can be withdrawn. There’s no requirement to trade a specific number of lots or meet other complicated conditions, which I double-checked with their customer service — they confirmed it.

- Eligibility: For new clients making a deposit of at least $100.

In short, while the bonus is primarily a marketing tool, it’s more flexible than most offshore brokers’ bonuses.

DuraMarkets

Another offshore forex broker I came across is DuraMarkets. I actually discovered this broker while browsing through a forex forum, and my first thought was to check if they really accept US clients. Sure enough, they do — and to be honest, you can almost tell that from the vibe of their website and the way their features are laid out.

To dig deeper, I looked around for trader feedback and reviews across the web. Interestingly, I didn’t come across any strong complaints or serious withdrawal issues. That’s a big deal, because with offshore and unregulated brokers, trust is usually the first concern.

Next I looked into their website to find more details.DuraMarkets offers four account types, but the one that really stands out is the VIP account. It’s an ECN account with just a $2 round-turn commission — that’s roughly 0.2 pips on EUR/USD. Since the spreads start from 0, you’re basically looking at all-in trading costs as low as 0.2 pips, which is about as low as it gets in the forex industry. Of course, spreads do fluctuate, so the average will be a little higher, but still impressively tight.

When it comes to platforms, DuraMarkets sticks to MT4 only. While that limits platform choices compared to brokers that also offer MT5 or cTrader, I found the MT4 execution speed here surprisingly fast — probably one of the quickest I’ve tested among all brokers.

One thing that really sets them apart is leverage. While most offshore forex brokers cap it at 1:500, DuraMarkets pushes it up to 1:1000 leverage. Combine that with ultra-low spreads and fast execution, and it’s easy to see why this broker could be a strong fit for traders running forex robots (EAs).

All in all, DuraMarkets comes across as a solid option for US traders looking for an offshore broker: low trading costs, lightning-fast MT4 execution, and high leverage all make it an attractive choice worth considering.

DuraMarkets Overview

Location: P.B. 1257, Bonovo Road, Fomboni, Comoros, KM

Foundation Year: 2023

Regulation: None

Types of Accounts: STP/ECN

Spread: floating

Minimum Account Size: $10

Minimum lot size: 0.01

MAX Leverage: 1:1000 (Forex, Indices, metals), 1:5 (Cryptos)

Payment Methods for US Clients: Crypto currencies (Bitcoin, ETH, USDT, USDC, LTC, UGold)

Trading Instruments: 80 Forex pairs, 12 Indices, Gold, Silver, oil, 5 Crypto currencies

Trading Platform: MT4 (Desktop, Mobile, Web)

Trading Strategy: Automated trading (EAs): Allowed Scalping: Allowed Hedging: Allowed

Crypto trading: 5 days

Type of Account

DuraMarkets gives traders a choice between four account types: Standard, Zero, VIP, and Swap-Free.

The Zero account is a classic STP setup with floating spreads and no commission. It’s a straightforward choice for traders who prefer to keep things simple.

The Standard account, on the other hand, is an ECN account with a $5 round-turn commission and spreads starting from 0. That puts your minimum trading cost at about 0.5 pips, with the average running slightly higher depending on market conditions.

Then comes the VIP account, which is hands-down the most attractive option if you’re chasing low-cost trading. It’s also ECN, but with just a $2 round-turn commission. Combine that with raw spreads starting from 0, and you’re looking at trading costs as low as 0.2 pips on EUR/USD. The catch? You’ll need at least $500 as your minimum deposit to unlock this account. For active traders, though, that’s a small barrier considering how competitive the pricing is.

| Account Type | Zero | Standard | VIP |

| Min Deposit | $10 | $10 | $500 |

| Max leverage | 1:1000 | 1:1000 | 1:000 |

| Min Lot Size | 0.01 | 0.01 | 0.01 |

| Commission | No | $2.5 per side | $1 per side |

| Spread Type | Floating | Floating | Floating |

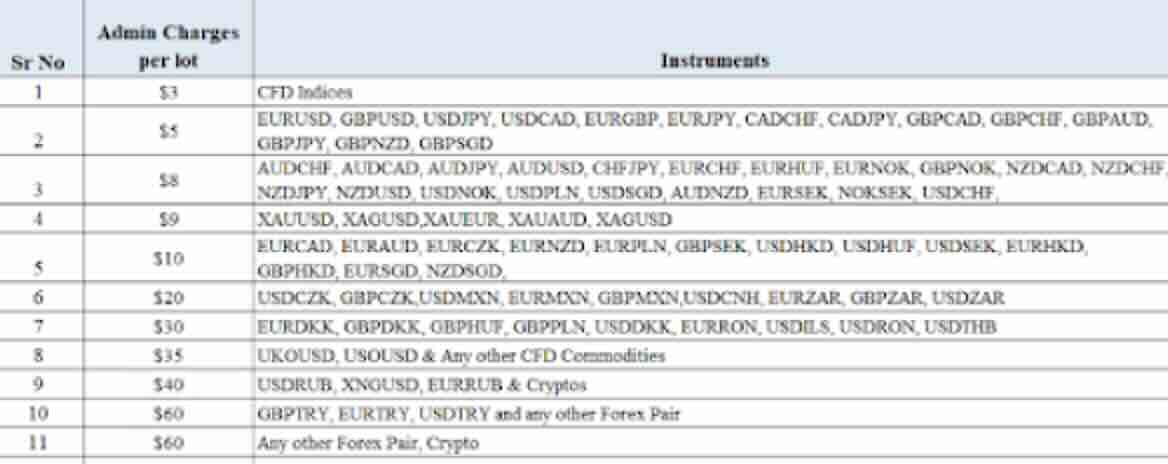

Finally, there’s the Swap-Free account. This one is especially interesting for swing traders who hold positions for days or weeks. I actually reached out to DuraMarkets directly about this because the details weren’t listed on their site. They confirmed that instead of swaps, they charge a maintenance fee — and after reviewing the numbers they sent me, I can say the fees are often more favorable than traditional swaps. For example, while gold swaps usually run about 2.5 pips (long or short), the swap-free account charges closer to 0.9 pips. That’s a big difference if you’re holding positions for the long haul. You can open a swap free account with $100.

Spread and Commission

When it comes to spreads and commissions, DuraMarkets really stands out. Their pricing structure is among the tightest in the industry. On the VIP account, you get a commission of just $2 round turn, which is the lowest I’ve seen offered by any forex broker. By comparison, the Standard account charges $5 round turn — not outrageous, but obviously not as competitive.

I also tested their spreads on both Standard and VIP accounts using live accounts (not demo, since those can be misleading). The results were clear: the Standard account spreads were consistently higher, meaning you don’t really get the best trading costs DuraMarkets has to offer with that option. Still, the pricing is in line with the industry average, so it’s not a bad choice either.

As for the Zero account, the structure is a little different. Since it’s commission-free, you’d expect it to be cheaper, but in practice the spreads are higher, which makes the overall cost roughly the same as the Standard account. In other words, if you’re aiming for the lowest possible costs, the VIP account is where DuraMarkets truly shines.

| Type of Account | EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| VIP | 0.3 | 1.7 | 1.8 | 2.15 | 1.7 |

| Standard | 0.6 | 2.1 | 2.1 | 3.5 | 1.9 |

| Zero | 0.8 | 1.9 | 1.9 | 3.6 | 1.7 |

Swap Rates

The swap rates at DuraMarkets are pretty much identical to what you’ll find at Coinexx. They’re not terrible, but they’re also not the most competitive in the industry. If you’re the type of trader who holds positions overnight, you’ll probably notice the difference compared to brokers with cheaper swaps.

That said, this is exactly where their Swap-Free account becomes valuable. As I mentioned earlier, instead of swaps they apply a maintenance fee, which often works out cheaper. For long-term traders who keep positions open for days or weeks, the swap-free account is hands down the better choice at DuraMarkets.

| Pair | long Swap | Short Swap |

| EUEUSD | -0.73 | 0.27 |

| GBPJPY | -1.06 | -3.54 |

| Gold | -4.5 | -2.3 |

| Bitcoin | -1.91 | -1.84 |

Customer Service

I also reached out to DuraMarkets’ customer support on a few different occasions. My first questions were the usual ones I ask every offshore broker: “Do you accept US clients?” and “Do you require KYC?” — their answers were the same as others on this list: yes to US clients and no to KYC.

After that, I dug deeper and asked about the details of their account types, especially the Swap-Free account, since I couldn’t find that information on their website. The support team was responsive and gave me the answers I needed. What stood out was that once I mentioned I was reviewing their broker for my site, they went the extra mile by even checking with their relevant department (about the swap free maintenance fees) and shared additional details that weren’t publicly listed.

Overall, I’d say their customer service was solid. They weren’t dramatically better or worse than other offshore brokers I tested, but they were polite, tried to answer everything thoroughly, and provided the info I asked for.

Payment Options

When it comes to payment options, DuraMarkets supports crypto deposits and withdrawals, which is the norm for offshore non-KYC forex brokers. You only pay the transaction fee of the relevant blockchain — the broker doesn’t add any extra fees.

According to their FAQ, deposits and withdrawals can take up to 1 business day. I also checked user reviews online, and this seems accurate in most cases. There were a few exceptions, like someone mentioning it took 48 hours for their withdrawal, but overall, their claim about withdrawal times appears reliable.

Bonus

DuraMarkets offers a 250% deposit bonus, meaning traders receive 2.5 times their deposit amount as a bonus. This bonus is not withdrawable; instead, it functions as extra margin, allowing you to open larger trade sizes and increase your trading capacity.

For example, a deposit of $1,000 would add an extra $2,500 in bonus funds to your account, which can be used as margin support alongside your own equity.

Bonus Rules:

- Accounts with an active bonus are limited to 200x leverage.

- The bonus requires a minimum deposit of $100.

- The maximum bonus a client can receive is $40,000, either through a single deposit or multiple deposits combined.

- The bonus remains active as long as there are personal funds in the account. If only bonus funds are left in equity, the bonus will be removed.

Note: For understanding the process of ranking the offshore Forex brokers for the following categories, you may want to read the methodology section

Best Offshore Forex Broker for Day trading and Scalpers

According to the examination that I had, Coinexx is the best offshore Forex brokers for US day traders and scalpers with the tightest Spreads + commission, however, all the other brokers also have very competitive spreads and in some pairs better than coinexx.

When you are a day trader, your targets and limitations such as stop loss and take profit are not wide so spreads and commissions play a tangible role in your final results. This is even more crucial when you are a scalper with small targets.

For finding the best offshore Forex broker for US day traders and scalpers, we should look into the spreads and commissions of them to find the lowest ones.

Having very low spreads and only a $2 commission round trip puts all our brokers on the top spots for day trading and scalping however since we want to pick one as the winner, Coinexx is the best.

Spreads Comparison

| Broker | EURUSD | GBPJPY | GBPNZD | Gold | Bitcoin |

| Coinexx | 0.35 | 1.4 | 1.4 | 1.9 | 5.4 |

| DuraMarkets | 0.35 | 1.7 | 1.8 | 2.15 | 1.7 |

| Fyntura | 0.4 | 1,6 | 2 | 1.4 | 3.54 |

| Hankotrade | 0.4 | 1.4 | 1.9 | 1.9 | 9.5 |

For more accurate and up-to-date spread information, check out the live spreads here.

The best forex brokers for US clients who trade on a daily basis is Coinexx.

Best Offshore Forex Broker for EAs

If I had to pick the best offshore broker for automatic trading or EAs, the title would go to DuraMarkets. The mix of tight spreads, low commissions, and fast execution speed makes them a strong choice not only for EAs but also for scalpers.

With EAs, execution speed is critical — especially if the system is sensitive to market conditions. This becomes even more important when opening multiple trades in quick succession or running a scalper EA that relies on rapid order flow.

I personally tested both market and limit order execution speeds on MT4 across the brokers in this list, and DuraMarkets consistently delivered the fastest results. That speed gives them a real edge for traders who rely on automated systems.

Execution Speed

| Broker | Market Order Execution Speed | Limit Order Execution Speed |

| DuraMarkets | 40 | 37 |

| Fyntura | 93 | 85 |

| Coinexx | 105 | 95 |

| Hankotrade | n/a | n/a |

The best offshore forex brokers for US clients who are chosen scalping as their trading strategy is DuraMarkets .

Best Gold Trading Offshore Forex Broker for US Clients

If you’re a day trader or scalper, Fyntura offers the best spread + commission setup for gold, which makes it one of the top offshore choices for US gold traders specifically.

Fyntura is also the favorite choice if you’re more of a swing trader or position trader, thanks to its more favorable swap rates on gold.

So the best offshore forex broker for gold really depends on your trading style.

| Broker | Spread | Swap Long | Swap Short | Swap Score |

| Fyntura | 1.4 | -1.63 | -0.37 | 45.19 |

| Coinexx | 1.9 | -1.9 | -1.84 | 40.67 |

| HankoTrade | 1.9 | -1.9 | -1.84 | 40.67 |

| DuraMarkets | 2.15 | -2.44 | -0.42 | 43.28 |

With that said…

The best offshore broker for US clients interested in short and long term gold trading is Fyntura.

Methodology

To find, test, and evaluate the best offshore forex brokers for US traders, I went through numerous broker websites to check whether they accept US clients and if they meet at least the basic standards of a forex broker.

After narrowing down the list to those that do accept US traders, I ran several tests on each broker. This included contacting their customer service, checking their spreads and commissions, evaluating swap rates, and measuring execution speed.

We’ve developed Expert Advisors (EAs) to test broker performance by placing multiple limit and market orders in MetaTrader. These tests are designed to accurately measure and compare the execution speed of different brokers.

For spreads, we’ve developed a comprehensive infrastructure specifically to monitor live spreads from real trading accounts. On top of that, we also built a proprietary scoring system to evaluate and rank each broker’s swaps, giving us a structured way to compare them fairly.

To test the brokers, I selected five different pairs — each chosen to highlight a specific aspect of their performance.

- EURUSD: The most liquid and traded Forex pair

- GBPJPY: One of the most volatile pairs with high liquidity

- GBPNZD: The pair with the highest average daily range in major and minor forex pairs

- Gold: To assess Metal trading condition

- Bitcoin: As the representative of cryptocurrencies

This is the process that I use to do a comprehensive review of forex brokers. You can find more details on the mentioned tests in the flowing links:

The Bottom Line

When it comes to picking an offshore forex broker, US traders don’t have many options. It gets even trickier if you’re looking for brokers that could qualify as the best forex brokers.

My initial list included a lot more brokers, but I had to narrow it down, removing those that didn’t meet the standards I look for. Still, a few brokers remain that provide good quality for their clients..

I evaluated them carefully from multiple angles to ensure they offer reliable trading service.

To wind up this review, let’s summarize our findings of the best offshore forex brokers for US clients.

If you are a day trader or scalper all brokers on our list have the tightest spreads and commission in the industry but Coinexx and Fyntura are a bit better options.

For anyone planning to run an EA, I’d say DuraMarkets is the broker to look at. In my tests, their MT4 execution was among the fastest I’ve seen, which means your trades get filled almost instantly — a big plus for automated strategies.

For longer-term trading such as swing or position strategies, Fyntura offers some of the most favorable swap rates. However, when I checked DuraMarkets’ Swap-Free account, I found that while the spreads are slightly higher, the maintenance fees are very competitive. So, if you usually keep trades open for just 2–3 days, Fyntura comes out ahead. But if your positions stay open for longer periods, DuraMarkets’ swap-free account can end up being the better deal.

You need to update this site. Turnkey is out of business AND some of these other brokers DON’T TAKE US CLIENTS anymore.

Thanks Jack. Turnkey Forex has merged into Coinexx recently. Their website was up though and now that I checked, it’s down (thanks for the heads up). Of course, you can still log into your account using your Tuenkey credential through the Coinexx website. Regarding other brokers, I’ve already updated the ones that don’t accept US clients anymore.

This was an amazing post thank you for your hard work ! & Info this really helped me out I been looking at off shore brokers for weeks this really helped.

I had one question for you tho , regarding taxes when withdrawing Bitcoin: how do you usually go about It report these income payments to the IRS as “other income” via IRS Form 1099-MISC or 1040 maybe

I know your not a CPA or anything just looking for little help , thanks you

Thanks Will. Well as you can see in the disclaimer of the site, on the footer, I neither talk about taxes on this website nor I’m an expert in that subject. I watched some useful videos about taxes on trading though, you can search that on youtube as well. I’m sure you’ll find what you look for.

David,

Thank you for all the information and the work that you put forth; it was outstanding. I reside in the USA and am looking for an offshore broker for trading US30. Any recommendation?

Hi Grant,

Thanks, Both n1cm and Coinexx are the best options among our brokers for trading us30.

This article is a result of oustanding effort, reserach, knowlege all put together in the simplest way possible. Loved it

And do you have a linkedin account?

Thanks Sultan! No, I don’t have a LinkedIn account.

Wow! The extent of research and aggregation & translation of data in this post is outstanding. I found exactly what I was looking for after skimming through many incoherent articles & YouTube videos.

Your hard work is appreciated, David!

– 2 yr Forex Trader

Thanks, happy to hear that you found what you were looking for.

David, thank you for the fantastic job! The info you provide is very helpful.

Hello.

I have a question for you. I need a broker that accepts US clients, and offers a pamm account with swapfree option.

I am a longterm trader using an EA and i am using Coinexx currently. The only problem with Coinexx is they dont offer me swapfree…and sometimes i stay 2 weeks in my trades and swap is killing it. Which broker do you think is best for this ?

Hey Dan, Well, there are a handful of brokers for US clients and there isn’t a broker among them with all those features. First off, so called swap free accounts are offered to Muslims. Very few brokers offer such an account to non-muslim traders. plus, that’s not actually swap-free in many cases and some brokers charge a commission for that or have a time limit for free swaps. Anyway, I’ve written a post about all that, you can find it here. Coinexx is probably your best option, at least it has PAMM.

Thank you for the info. However, unfortunately, CryptoRocket no longer accepts U.S. clients. Too bad, since they look like one of the best regarding what you can trade with them.

You can use Eaglefx. They are very much like Cryptorocket.

Hello , Thank you for information. I just completed an online chat with CryptoRocket. Although he stated that they accept from all over the world, he did state that I need to check with my local law & regulations. I cant find anything. Is this to say that I can’t use them as a US Resident. And will Eagelfx tell me the same?

Thank you in advance

Anthony

You can use both of them but since they’re not regulated in the US and are considered offshore, they’re required to give you that line I think.

This is brilliant!! Thank you!

You’re welcome. Happy to hear that

Thank you, very helpful!

happy to hear that!

Hi! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would

really enjoy your content. Please let me know.

Cheers

Why not! glad that you liked it

This was a nice compilation of brokers. Do you happen to know if fx leaders is can help me as I am starting up my trading journey? My friend recommended it and just checking all infos I can online.