Are you interested in investing in forex without trading, or you might know a little more about that and have heard of PAMM accounts and now are looking for the best PAMM accounts or best PAMM managers.

Let me say that you are probably in the best place to discover that because in this article not only do you meet the best PAMM managers and their accounts but you also learn how to choose the best PAMM accounts or managers by reading their statements and looking into their results.

Yes, you heard that right, you are going to be an expert, or at least rather expert, after this article so you’d better not skip any part of this post if you want to have a profitable investment in forex without trading.

I went through almost all the brokers that either have PAMM accounts or they claim to have PAMM and looked into the results of their PAMM managers to see which ones are worth investing in.

I didn’t need to scrutinize every PAMM manager in every broker because first, some brokers were removed in the first place because they don’t offer statistics or comprehensive statistics for their PAMM accounts.

And second, the brokers that provide the statistics that I need also have filters so that you can filter PAMM accounts and managers based on different factors.

In the end, from thousands of PAMM accounts, I needed to analyze a few of them.

We are going to talk about all those things thoroughly but first, let’s start with the definition of PAMM accounts for those of you who are not familiar with this concept.

If you prefer to watch videos rather than read this post, this is a video of some important parts of this article.

What Is PAMM?

Percent Allocation Management Module or as we know it in forex, PAMM is a type of account where there are three parties involved; a trader or PAMM manager, an investor, and a forex broker that provides PAMM service.

The goal behind this type of account in forex is to give the opportunity to the good traders who have been in trading for a long time and know how to trade profitably but don’t have enough money so they can attract investments.

On the other hand, the people who don’t like trading but are interested in an attractive market like FOREX have the chance to be in the game through PAMM accounts and invest in Forex without trading.

Not to mention, the more people involved in trading, whether traders or investors, the more trades are made and the happier brokers become because they receive more commissions or spreads.

That might seem appealing to many people who like investing. What else better than this. I will find and choose the best PAMM managers with good track records and invest in them and become rich without even lifting a finger, Hooray!

I wish it were that easy.

I searched almost everywhere and looked into hundreds of PAMM accounts and I only found a handful of them worth mentioning and investing.

So how can you find which PAMM accounts and managers are really profitable and you can rely on them to some extent?

How Can You Choose the Best PAMM Accounts/Managers

There are lots of PAMM managers out there that claim to be profitable but in reality, most of them aren’t and to top it off, lots of them either are scam or they don’t know how to trade at the best.

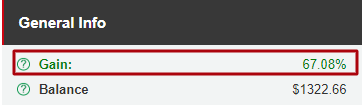

So long as PAMM accounts are really attractive for investors and most of the investors don’t know much about the ins and outs of this form of investing, so-called traders or PAMM managers try to grab investor’s attention by showing absolutely profitable results with a nice rising profitable graph.

Graphs such as these ones:

Most of them are not actually profitable traders and just want to lure potential investors and others are just scam.

They don’t use any kind of stop loss and risk as much as possible, as high as their accounts and margins allow.

Investing in them just exactly like gambling. These kinds of trading are exposed to growing fast and then being razed to the ground in a blink of an eye.

They keep their positions open until either the market gets back and hits their take profits and the positions are closed in profit or the market doesn’t reverse and continues moving in the opposite direction of their trades and finally, the accounts blow up.

They might keep the accounts for a while but sooner or later the second scenario happens and the accounts will be burnt.

Martingale is one of those strategies that some of these people use to have a spiky graph and loss-free statement or results.

It’s a gambling strategy that you can use for any kind of gambling with 2 probabilities, either win or lose.

In simple words, you place a bet on something and every time you lose, you double your wager so when you finally win, your losses are covered plus you win the first bet amount.

For example, you flip a coin and bet $1 on heads. Then it lands on tails and you lose. The second time you bet twice the previous amount which is $2 and again you lose. Now you’ve lost $3. The third time you bet $4, double of the previous one ($2), and this time you win.

So not only are your previous losses, $3, covered, but you also have won your first bet, $1.

There are various versions of martingale that traders or PAMM managers can use so that they show profitable results.

The problem is your losing streak, your sequence of losing trades, can continue and your account blows up.

However, there are some kinds of martingales or semi-martingale that have some kinds of stop-loss that might make them profitable but this is not our subject here.

All in all, you should know that not every profitable graph or green statement means a good opportunity for investment and you should consider some factors before making any decisions for investment in a PAMM account or manager.

That’s why I eliminated some brokers from my study in the first place because they don’t provide the statistics of their PAMM managers.

Let’s see what factors we need to look into and what each of them means.

Profit percentage

Obviously, this is the first metric that you should look at for choosing a PAMM account before everything else because no one invests in a losing PAMM manager or trading strategy.

This doesn’t give you any important information other than the above reason but this is the first thing you need to look at.

Account Age and Number of Trades

In order to have more reliable data, PAMM accounts should be old enough and at the same time have enough trades.

There’s not actually a unique number for the age and trades and the general one is the more the better, however, I look for the PAMM accounts with more than 6 months old and at least 300 closed trades.

Almost all brokers have a filter to set the PAMM managers according to the age of their PAMM accounts.

MAX Drawdown

Drawdown is one of the factors that shows how risky a trading strategy is. It shows the decrease in your account before it gets back to the highest point it was before.

For example, you have a $100 account. Then you trade and lose $10. In this case, you’ve lost 10% of your account so your drawdown is 10%.

It happens in different steps of your trading, so every time your account suffers such a thing, it experiences a drawdown so your strategy has different drawdowns.

The largest one is called maximum drawdown.

In the above example, you trade and your account reaches $130. Then you lose $30. In this case, your account suffers around 23% drawdown, (30/130)*100= 23.07%.

The max between 10% and 23% is 23% so your MAX drawdown is 23%.

For more information about drawdown, you can check out this post.

There are some factors in a trading strategy that we can consider to determine the suitable drawdown for that but I don’t want to go into technicalities more than this so as a general rule, every strategy that has more than 30% drawdown is considered too risky.

When you set this filter on 30% for the PAMM accounts in PAMM brokers, more than 80% of PAMM managers are removed from your choice.

Now you’ve already eliminated lots of risky choices and probably saved your investment to a great extent.

Profit Factor

Profit factor is another analytical factor that you can find in the statistics of PAMM accounts and shows the profitability of a trading strategy.

If a broker doesn’t show this factor in its statistics, you can easily calculate that by this formula:

Profit factor= Gross profit/Gross loss

Gross profit and gross loss are the parameters that you can find in the statistics of a PAMM account.

However, some brokers don’t provide those parameters so we need to look at other factors in their statistics.

Any profit factor larger than 1 shows that a strategy is profitable. It simply means the amount of your profits is bigger than the amount of your loss, so your trading strategy is profitable.

I personally prefer the PAMM managers that have a strategy with a profit factor of 1.5 or higher, the higher the less risky.

Recovery Factor

Recovery factor shows how well a trading strategy can overcome a drawdown. When I look for a PAMM account, I prefer a recovery factor larger than 1.6.

Some PAMM accounts don’t offer this parameter but you can calculate it yourself using two parameters, profit ratio, and MAX drawdown.

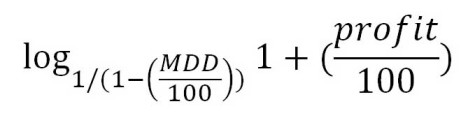

This is the formula of recovery factor:

The logarithm of (1 + Return to date / 100) to the base (1/(1 – Maximum drawdown / 100))

Example: a PAMM account has a profit of 150% and a MAX drawdown of 30%. Let’s put it in the above formula.

The argument of the log is:

1+ (profit/100)

Our profit is 150 so it becomes:

1+ (150/100) = 2.5

The base of the log is:

1/ (1-(MDD/100))

The maximum drawdown in our formula is 30 so it becomes:

1/ (1-(30/100)) = 1.428

So we have log 2.5 to the base of 1.428 and the answer is 2.57 — you can use a logarithmic calculator.

So the recovery factor here is 2.57 which is a very good number and makes this strategy attractive based on the recovery factor.

Unrealized Gain/Loss

This is a very important parameter to look at when checking the statistics of a PAMM manager’s account.

It basically shows the floating loss or profit of an account, the profits and losses of trades that are not closed yet so they are not included in the final results such as profit percentage or drawdown.

Imagine a PAMM account starts with a $2000 investment and its statistics show a $2000 profit. That’s interesting, a 100% return.

Not necessarily

You look at its floating or unrealized gain/loss and you see it shows -$3500 which actually comes from the trades that the PAMM manager hasn’t closed yet and they are deeply in the red.

Some brokers don’t show that but they have current drawdown instead that basically shows how deeply an account is suffering loss.

In the above example, the account has 87.5% current drawdown; in other words, the manager has lost $3500 of $4000 so far, which becomes 87.5%.

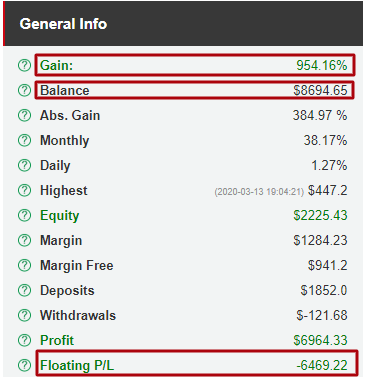

This is a PAMM account from Hotforex broker. As you can see the balance shows $8694.65 but $6469.22 of that is floating or unrealized. It means it has 74.4% current drawdown.

This is another PAMM account in Alpari broker that shows this metric as current drawdown.

Both of the above accounts are not reliable. The first one has a large current drawdown or unrealized loss and the second one has a massive MAX drawdown of 96.98%.

Conclusion

As you saw, there are some factors that can help us to find and choose the best PAMM managers or accounts.

Basically, I should look for a PAMM account that has more than 6 months old with at least 300 trades. It should have a drawdown of 30% at the most and a profit fact or of 1.5 at the least.

Recovery factor should be at least 1.6, however, the higher the better, and the current drawdown or unrealized loss should be under 30%, just like MAX drawdown.

When you filter PAMM managers based on those factors, you can see that from thousands of accounts, there are a few of them that check all the boxes.

Even with taking all those measurements, there’s no guarantee that the PAMM managers you choose bring you profits 100 percent because past performance is not indicative of future results.

But we can do one more thing to increase our chance of having a profitable investment in forex…

….and that is

Making a portfolio of the best PAMM managers we’ve selected

PAMM Portfolio

You’ve probably heard of this maxim that goes:

Don’t put all your eggs in one basket

And for increasing our chance of having a profitable investment in PAMM accounts, we should follow that motto as best as possible.

Instead of investing only in one PAMM account, we should find and choose some of the best PAMM managers, according to what we’ve talked about so far, and allocate a portion of our investment to each of them.

That way, if one PAMM account suffers loss or goes to its drawdown stage, other PAMM accounts in our portfolio can make up for that and keep our basket or portfolio still profitable.

For having a reliable portfolio, you’d better allot larger portions to the PAMM managers with a lower-risk system which basically means lower drawdown or higher recovery factor.

Let’s imagine this scenario:

Manager 1: Drawdown: 15% recovery factor: 2

Manager 2: Drawdown 22% recovery factor: 2

Manager 3: Drawdown 30% recovery factor 2.1

They all seem to have good strategies, regarding just these 2 factors, so we look at other factors and if everything else seems fine we’d better take something like the following approach.

If we want to invest $1000, it’s better to give $450 to manager 1, $350 to manager 2, and $200 to manager 3.

Best PAMM Managers

After searching all forex brokers and looking into the PAMM managers’ results and statistics, I chose these best PAMM managers and strategies from hundreds of PAMM accounts:

Note: More PAMM managers may be added to the list every now and then, so you may want to check out this post monthly.

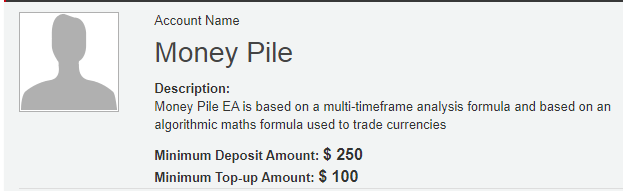

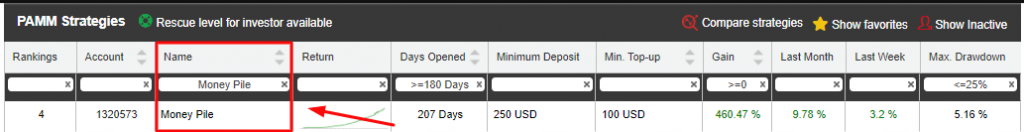

1- Money Pile

This PAMM account is related to a PAMM manager in HotForex broker. At the time of writing this post, the account’s profit is 460.47%, the age of this account is 207days, and has 2216 closed trades.

The maximum drawdown of this PAMM accounts is 5.16% which is really impressive, not really. Although the MAX drawdown is 5.16 there is a larger current drawdown which is around 32%. As you know now, you can figure that out by looking at floating P/L which is $29693 at the time of writing this article. The balance of the account is $92959.87 so as I said, here we have around 32% drawdown, not 5.16%.

This PAMM account is not suitable for people with lower risk tolerance but if you want to enter a riskier PAMM account in your portfolio, this one seems worth risking. Just don’t forget to take profit periodically so if things go south, you’ve gained your profits.

Profit factor is 5.2 which is way above what we expect from a profitable strategy, however, that’s because the EA in this strategy keeps some trades open until they get to profit so the win rate and consequently profit factor is high.

Conditions

The minimum investment that you can make in this PAMM account is $250.

You pay 10% of the profit to the manager which is charged monthly.

For example, you invest $1000 and the manager makes a 10% profit for the first month so your profit is $100.

You have to pay the manager $10 and the rest of that, which is $90, is yours.

The next month, the manager can’t make any profits or even the account suffers a $50 loss. In this case, you don’t pay any money to the manager but you’ve lost $50.

The trading period is one month minimum and the penalty fee is 3%. It means when you invest, you can’t withdraw your money sooner than 1 month unless you pay 3% as a penalty.

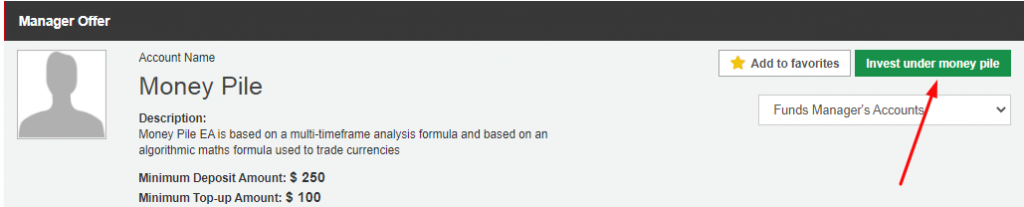

How to Invest in Money Pile

In order to invest in this PAMM manager, and the next managers that are from HotForex Broker you need to do the following steps:

1- Open an account in HotForex broker

2- Go to PAMM manager performance page

3- Enter the name of the manager (for example, Money Pile) in the name section and press enter.

4- In the result page , press invest from the top right of the manager offer section

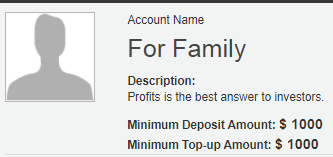

2- For Family

The next PAMM account from Hotforex is a little bit different from the previous 2 accounts from different perspectives. First of all, it has a low-risk strategy. Not only the Max DD is as low as 9.27% but the current DD is also low, around 11%.

Combining that with being up and running for 965 days, 512 closed trades, and a profit factor of 5.4 and you can see why this account sounds interesting to invest in.

Condition

With all that said, it has a big downside. The profit share that the manager of this account asks for is 50%. Therefore, every profit gained is split in half. Even with this real bummer, having such a low-risk PAMM account in your portfolio can be a good idea.

The trading period is one month minimum and the’s no penalty — I really don’t know if there’s no penalty, why would be a one-month limitation!

To register with this manager, see the process in the first manager above.

3- Vesperium

Vesperium is another PAMM account that I chose which is in Alpari broker and is 2.5 years old with a profit of 109.4% at the time of writing this post.

The MAX drawdown is 26.39%, the current drawdown is 4.29, and the recovery factor is 2.41 at this time.

The manager of this PAMM account has mentioned on his thread in Alpari’s forum that he doesn’t risk more than 2% for each trade and the strategy is based on news and night-time trading.

Conditions

The minimum investment is $50 and this PAMM manager has a constant fee of 35% of profits.

The fee is charged every month providing that the manager has generated profits.

How to Invest in Vesperium

- Go to Vesperium page

- Press Invest button from the top right on the page

- Register on the page

Any data and information are provided ‘as is’ solely for informational purposes and are not intended for trading purposes or investment advice. Past performance is not indicative of future results.

You can find other Forex brokers offering PAMM accounts here

FAQ

First off, the PAMM service you choose should provide you with the necessary stats for PAMM accounts. Account age, profit factors, recovery factor, drawdown, and unrealized gain loss or current drawdown are the main ones, see more

Yes, you can find PAMM accounts that you can rely on to some extent and are worth investing; however, first, there aren’t many of them and second, there’s always risk involved in investing in the market, like anything else. We need to decrease the risk by looking into PAMM stats and make a portfolio. You can find some of the good PAMM accounts here.

The logarithm of (1 + Return to date / 100) to the base (1/(1 – Maximum drawdown / 100)) See example

Thank you for your thorough, comprehensive and in depth article, it is greatly appreciated and was very informative.

Hello David,

Could you please recommend a PAMM account that I can use in Canada ? we are not allowed to use hotforex and alpari brokers in Canada ( the 3 PAMM accounts here, two of them are on hotforex and the third is on Alpari)

Thanks a lot !

Hey Jean,

I’ve written a post about some PAMM brokers here. Some of them accept Canadians. You can use the method I’ve explained in the above article to find some good PAMM accounts. Believe me, if you read this article and know the metrics you need to look into for finding good PAMM accounts, it’s far more beneficial to you than someone says this or that PAMM account is profitable.

Thank you and God bless you. I have learnt a lot that I would not have known forever . May God reward you for these free information. Am blessed

Hello David! first of all thank you for the informative article

Do you stay up to date on the status of the accounts and update the list in the article from time to time?

Appreciate the help ,

Noa

Hi Noa,

Thanks, yeah I’ve done it and will do it in the future, probably another one next week.

I see Apollo’s drawdown has increased significantly. Any new PAMM investor or recent automated copy trading service you’d recommend?

Hey Maxi,

Yup, I can see. That’s really unfortunate. It’s been consistent for over 4 years but finally took a nosedive. That’s why it’s important to have a portfolio and of course take your profit out regularly. Anyway, I removed that and added some others that look promising.

Hi David,

Thank you for your response. I’d like to know: how often do you suggest taking profits? Also, is it more convenient to take the profits out of the PAMM account and reinvest them in the same account (provided I’m ok with the performance) or is it better to leave the profits grow without withdrawing them. Because it doesn’t make sense for me to withdraw and reinvest again in the same account, but more experienced investors claim we should always take profits. So I’m a bit confused by this.

Thanks in advance

Hi Maximiliano,

It depends on your risk tolerance. The reason that you should take profit is to decrease your risk or even make it risk free. For example take out all or a part of your initial investment so you don’t lose your money and everything is profit and risk free. Now you can take out half of your profit monthly and let the rest half in your account.

Do you now the free copy trading service on etoro? wouldn’t it be more profitable than a PAMM account since the service is free?

I haven’t seen any free profitable accounts. You can find numerous so called free pamm or copy trading services everywhere but none of them have a track record so that their results can be analyzed, why would have they? That’s free after all.

Hi David,

Are there other platforms you’ve invested in? I’m planning to invest in a PAMM account, and some other vehicles with the potential of earning automated passive income. Could you recommend any?

Sincere regards,

Tony

Hi Tony,

For PAMM accounts, you can use the accounts that I introduced in this post. For other options, check out this post I’ve got good reviews from the people that have bought the first EA, Flex.

Very good analysis and write-up. Thanks for researching and sharing.

thanks