Swap Arbitrage Opportunities

| Date | Symbol | Broker A | Position A | Broker B | Position B | Profit (pips) | Description |

|---|---|---|---|---|---|---|---|

| 2026-02-09 | XAUUSD | AMarkets LLC | short | Fyntura Limited | long | 2.54 | Short AMarkets LLC, Long Fyntura Limited |

| 2026-02-09 | XAUUSD | Fyntura Limited | long | Alpari | short | 2.23 | Long Fyntura Limited, Short Alpari |

| 2026-02-09 | XAUUSD | Startrader Financial Markets Limited | short | Fyntura Limited | long | 2.11 | Short Startrader Financial Markets Limited, Long Fyntura Limited |

| 2026-02-09 | XAUUSD | Moneta Markets (Pty) Ltd | short | Fyntura Limited | long | 2.11 | Short Moneta Markets (Pty) Ltd, Long Fyntura Limited |

| 2026-02-09 | XAUUSD | xChief Ltd | short | Fyntura Limited | long | 1.49 | Short xChief Ltd, Long Fyntura Limited |

| 2026-02-09 | XAUUSD | FXPRO Financial Services Ltd | short | Fyntura Limited | long | 1.47 | Short FXPRO Financial Services Ltd, Long Fyntura Limited |

| 2026-02-09 | XAUUSD | Fyntura Limited | long | FIBO Group, Ltd | short | 0.87 | Long Fyntura Limited, Short FIBO Group, Ltd |

| 2026-02-09 | GBPJPY | xChief Ltd | long | Fyntura Limited | short | 0.71 | Long xChief Ltd, Short Fyntura Limited |

| 2026-02-09 | XAUUSD | Duramarkets Limited | short | Fyntura Limited | long | 0.67 | Short Duramarkets Limited, Long Fyntura Limited |

| 2026-02-09 | EURJPY | Duramarkets Limited | long | Fyntura Limited | short | 0.60 | Long Duramarkets Limited, Short Fyntura Limited |

| 2026-02-09 | GBPJPY | AMarkets LLC | long | Fyntura Limited | short | 0.55 | Long AMarkets LLC, Short Fyntura Limited |

| 2026-02-09 | XAUUSD | TW Corp LLC | short | Fyntura Limited | long | 0.55 | Short TW Corp LLC, Long Fyntura Limited |

| 2026-02-09 | EURJPY | xChief Ltd | long | Fyntura Limited | short | 0.47 | Long xChief Ltd, Short Fyntura Limited |

| 2026-02-09 | CADJPY | xChief Ltd | long | Fyntura Limited | short | 0.35 | Long xChief Ltd, Short Fyntura Limited |

| 2026-02-09 | GBPJPY | Duramarkets Limited | long | Fyntura Limited | short | 0.35 | Long Duramarkets Limited, Short Fyntura Limited |

| 2026-02-09 | CADJPY | Duramarkets Limited | long | Fyntura Limited | short | 0.29 | Long Duramarkets Limited, Short Fyntura Limited |

| 2026-02-09 | USDCAD | xChief Ltd | short | FIBO Group, Ltd | long | 0.24 | Short xChief Ltd, Long FIBO Group, Ltd |

| 2026-02-09 | USDCAD | xChief Ltd | short | Alpari | long | 0.22 | Short xChief Ltd, Long Alpari |

| 2026-02-09 | GBPJPY | TW Corp LLC | long | Fyntura Limited | short | 0.21 | Long TW Corp LLC, Short Fyntura Limited |

| 2026-02-09 | USDCHF | xChief Ltd | short | Coinexx Limited | long | 0.20 | Short xChief Ltd, Long Coinexx Limited |

What Is Forex Swap Arbitrage?

In trading, arbitrage simply means finding and exploiting differences in pricing or data between brokers to make a profit. When applied to swaps, forex swap arbitrage involves identifying a positive difference between the swap rates of two different brokers and using that gap to earn a daily return.

Let’s break it down with an example.

Suppose Broker A has a swap rate of –5.7 pips on long positions for gold (XAU/USD) and +4.3 pips on short positions. This means if you buy gold and hold the position overnight, you’ll pay 5.7 pips per day, while if you sell gold and hold it, you’ll receive 4.3 pips per day. The difference between those rates benefits the broker, not you—a common situation in forex trading.

Now, imagine you compare those rates with Broker B, which offers –1.6 pips for a long position on gold and +0.4 pips for a short position. Individually, both brokers still structure swaps to their advantage—but look what happens when you compare them against each other.

The difference between Broker A’s short swap (+4.3 pips) and Broker B’s long swap (–1.6 pips) is +2.7 pips.

That’s a swap arbitrage opportunity.

By selling gold with Broker A and buying gold with Broker B, your positions are perfectly hedged—meaning price movements cancel each other out. You’re not making or losing money from gold’s price fluctuations, but you’re earning 2.7 pips per day from the positive swap differential as long as the rates hold.

That’s the essence of forex swap arbitrage: finding brokers whose swap rate discrepancies let you collect daily swap income with minimal exposure to market direction.

How to Find Swap Arbitrage Between Forex Brokers

To spot swap arbitrage opportunities between forex brokers, you need to monitor each broker’s swap rates regularly and look for positive differences between their long and short positions. In simple terms, you’re searching for a pair of brokers where the combined swap (one long, one short) results in a net positive value — meaning you earn interest daily while your positions remain hedged.

However, doing this manually is far from easy. Swap rates might change daily and not all brokers present their data in the same format. Some list swaps in pips, while others use base currency, margin currency, or even interest rate percentages. Before you can accurately compare brokers, you’d have to standardize these values, converting everything into a common unit like pips.

That’s exactly why we built our Swap Arbitrage Infrastructure.

This system automatically collects and processes swap data from multiple forex brokers every day, converts all values into pips, and calculates potential arbitrage spreads between brokers. The results are then displayed in the table above, showing you live forex brokers swap arbitrage opportunities ranked from the most profitable to the least.

Each value in the table represents the daily profit in pips you could earn from a given arbitrage setup — making it easy to see which opportunities are worth your attention without the tedious manual work.

Best Time for Swap Arbitrage

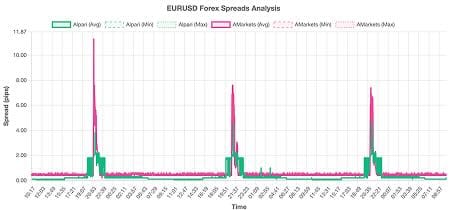

Timing matters a lot when it comes to swap arbitrage, but not in the way most traders think. While swaps are applied once per day at the broker’s rollover time, entering or closing trades right around rollover isn’t ideal — spreads tend to widen dramatically during those minutes, which can eat into your profits or even turn a profitable setup into a loss.

Instead, use the period before rollover to check the next day’s swap rates. If you’re already holding an arbitrage position and the updated swaps show that your positive difference will turn negative, it’s usually best to close your position before the new rates take effect.

When it comes to opening new swap arbitrage positions, aim for times when volatility is low but liquidity is high — typically during overlapping market sessions like London–New York. During these periods, spreads are at their narrowest, helping you enter positions with minimal cost.

Most brokers apply swaps around 5 p.m. New York time (10 p.m. GMT), though this can vary. If you want to identify the exact rollover times for each broker, you can use our Spread Scanner tool — it visually shows when spreads widen sharply on the chart, revealing each broker’s rollover window.

It’s also worth noting that Wednesdays are unique in the forex world. That’s when the triple swap is applied to account for weekend interest The triple swap makes Wednesday arbitrage opportunities particularly lucrative, since you’re effectively locking in three days of swap without worrying about rate changes until after the weekend.

In short, successful swap arbitrage isn’t just about finding the right brokers — it’s about executing at the right time, when spreads are tight and swap conditions are working in your favor.

How to Use a Swap-Free Account for Arbitrage

Another interesting approach to forex swap arbitrage is using a swap-free (Islamic) account on one side of your setup. With this strategy, you open a position in a swap-free account—where you don’t pay or earn any swap—and then open the opposite position with another broker that offers positive swap rates on that same pair.

The idea is simple: by combining a swap-free account with a regular account, you remove the negative swap cost on one side while still collecting the positive swap from the other.

However, there are a few important things to keep in mind before using this strategy.

First, swap-free accounts are primarily designed for Muslim traders, as paying or receiving interest (riba) is prohibited under Sharia law. Some brokers do allow non-Muslim traders to open swap-free accounts, but this depends entirely on the broker’s policies.

Second—and this is crucial—swap-free accounts aren’t swap-free forever. Most brokers apply an administrative fee after a certain number of days to offset the missing swap charges. This period can range from just one day to two weeks, depending on the broker. Once that period ends, the administrative fee can significantly reduce (or even erase) your arbitrage profit.

So, if you plan to use a swap-free account for arbitrage, make sure you understand exactly how your broker handles these fees and how long positions can remain truly swap-free.

If you’d like to dive deeper into this topic, I’ve written a full article explaining swap-free (Islamic) accounts and listing brokers that offer them—you can check it out [here].

When using a swap-free account for arbitrage, it’s also important to choose the most favorable positive swap for the other side of the trade. Since the swap-free side earns nothing, your profit potential depends entirely on how high the positive swap is from your second broker.

For example, let’s say the long swap rate on gold (XAU/USD) is positive, but varies by broker:

- Broker A: +1.5 pips

- Broker B: +2.0 pips

- Broker C: +2.5 pips

In this case, Broker C clearly offers the best condition for your swap arbitrage setup. To find such opportunities, head over to our Swap Scanner and sort the positive swap rate column (whether short or long) from highest to lowest — the brokers at the top will give you the best results for this strategy.

Will Forex Brokers Allow You to Arbitrage Swaps?

Here’s the truth: most forex brokers don’t like swap arbitrage — and many explicitly prohibit it in their terms of service.

The reason is simple. Swap arbitrage doesn’t generate trading volume or exposure risk, which are the main ways brokers make money. Instead, it involves holding offsetting positions across two brokers to earn daily swap differences with virtually no market risk. From a broker’s point of view, that’s what they call “toxic flow.”

This is especially true for B-Book brokers — the ones that take the opposite side of your trades rather than passing them to liquidity providers. When a trader runs a swap arbitrage strategy, the broker ends up paying swaps without any chance of recovering those costs through spread or price movement, which directly hurts their bottom line.

Even A-Book or hybrid brokers, who pass trades to external liquidity providers, might flag or restrict accounts that show unnatural trading behavior — for example, holding perfectly hedged positions with minimal trading activity. Some brokers might quietly widen your spreads, reduce leverage, or even cancel swap payments if they detect arbitrage-like activity.

In short, while forex swap arbitrage is not illegal, it’s not welcomed by most brokers. The key is to understand each broker’s policy and read their terms carefully. Some brokers tolerate it as long as it doesn’t abuse their liquidity or systems, while others will immediately classify such trading as a violation.

If you plan to engage in swap arbitrage, it’s smart to:

- Use brokers with transparent swap policies, ideally those explicitly stating that holding long-term positions is allowed.

- Diversify across several brokers instead of relying on just one.

- Keep positions moderate and trading activity natural to avoid drawing unnecessary attention.

Swap arbitrage can be a powerful strategy — but like any edge in trading, how you manage your relationships with brokers matters just as much as the math behind the swaps.