Searching for the best brokers for scalping, I became familiar with a broker that I hadn’t heard about, Just2trade online. I was searching for the brokers with the best spreads and commission on myfxbook and the spread + commission of Just2trade online were very competitive on most of the forex pairs.

As I examined Forex Brokers for different factors such as swap, which is important for long term trading, the broker stood out in various fields, so I decided to write a complete review of Just2trade online.

In this review, you‘ll be familiar with the different aspects of Just2trade online as well as some studies I’ve done on various parts of this broker — see methodology.

You'll See in This Article:

About Just2trade online

Just2trade online is a forex broker registered and based in Cyprus. It’s a subsidiary of Score Priority, formerly known as Just2trade.

Score Priority or Just2trade is a US stock brokerage founded in 2006, however, Just2trade online was licensed in 2015.

Just2trade online provides service for traders in more than 80 countries. The services include: Brokerage Services, Portfolio Management Services, Investment Advice Services, Foreign Exchange Services, and Investment Research and Financial Analysis Services.

The broker offers different types of markets including Forex, stock, option, future, bonds, indices, metals, and cryptocurrencies — we’ll talk about them more, later in this post.

Regulation: Is Just2trade Online Safe?

Just2trade online is under the watch of European Securities and Markets Authority (ESMA) and regulated by CySEC (Cyprus Securities and Exchange Commission) with license number 281/15.

CySEC is a tier-2 regulatory body and one of the well-known regulators that authorize investment companies and financial brokerages such as forex brokers in the EU zone.

With that said, the safety score of this broker is 65 out of 100 or B (from A+ to C).

For more information about the safety score, you want to check out this post.

Trading Platform

Just2trade provides different types of platforms for its clients including: MT4, MT5, CQG, ROX.

Meta trader is the most used trading platform among forex traders and almost all the forex and CFD brokers offer this platform.

Just2trade online is not an exception and offers both MT4 and MT5 for desktop, mobile, and web; however, trading instruments are more when trading with MT5.

CQG is another platform of the broker. CQG is a trading platform that has been in the industry for about 40 years. It’s one of the first trading platforms for the traders who started their trading career long time ago.

The platform is not designed for charting and technical analysis; however, it has many sophisticated features that come in handy when you are a professional trader.

For example, CQG integrated client version has many options for auto trading. You define some conditions for the platform and let it trade for you. It’s like having different EAs in Meta trader.

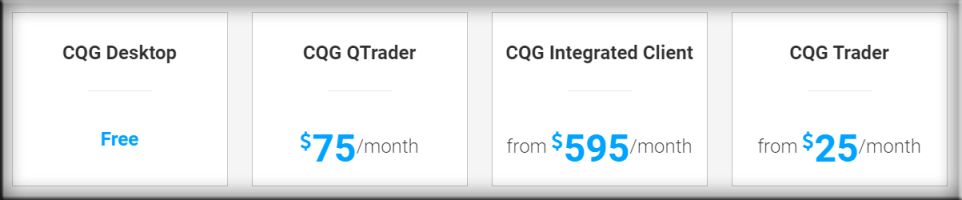

Other versions of CQG are: CQG Desktop, CQG QTrader, and CQG Trader.

If you want to know more about CQG, you can watch this video which is about QTrader:

The different plans that Just2trade has for CQG platform are:

For more information, check out the COG page on the broker’s website.

ROX is the next platform of Just2trade and is dedicated to stock and option trading. You can trade stocks via MT5 of this broker as well; however, the commissions become less on ROX when you trade more shares.

In other words, this platform is for professional stock traders who trade at least 10000 shares per month.

The minimum deposit to open an account with ROX platform is $3000.

Types of Accounts

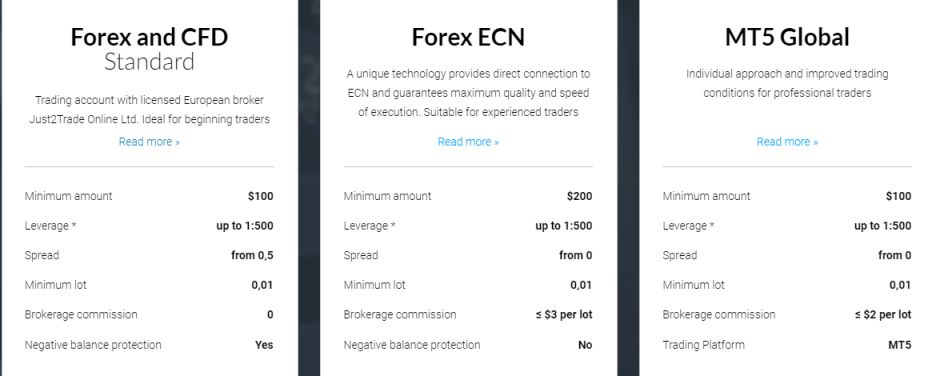

Just2trade has three different types of accounts:

Standard is an STP type of account with floating spreads and no commission. The minimum deposit for this account is $100 and maximum leverage is 1:500.

The spread for this account starts from 0.5 pips which is probably for EURUSD, however, there is no data regarding average spreads of different instruments.

The study that we did on its spreads is related to the ECN account so we don’t have extra information about the average spreads of the standard account.

Available instruments for this account are: 48 forex pairs, metals (Gold, Silver, Platinum, Palladium), Crypto (Bitcoin, Ethereum), oil, indices, and US and Russian CFD stocks.

MT4 is the trading platform for this type of account.

Forex ECN as the name implies is the ECN account of the broker with floating spreads starting from 0 and $3 per side ($6 round turn) commission. The maximum leverage is 1:500 and minimum deposit is $200.

According to the study we conducted, the average spread for this broker on EURUSD is 0.2 pips. Regarding $6 commission, you’ll receive 0.8 pips as spread + commission on EURUSD.

We’ll talk about the spreads and commission of Just2trade online later on this post.

There are 52 forex pairs available for this account. Other trading instruments are: metals (Gold, Silver), Crypto (Bitcoin, Ethereum), oil, indices. No stocks are available for this type of account.

MT4 is the platform for this account.

MT5 Global is the next type of account of the broker. Trading conditions are more favorable in this account with the spreads starting from 0 and $2 commission per side.

Maximum leverage is 1:500 and minimum deposit is $100.

Regarding our study on the broker’s spreads and $4 commission, the average spread on EURUSD for this account becomes 0.6 pips which is one of the tightest average spreads for this currency pair.

The favorable conditions don’t end here and you have more trading instruments compares to other types of accounts.

You can trade all the mentioned instruments as well as more cryptos such as Litecoin, Ripple, and Bitcoin cash; more stocks, futures, and bonds.

Obviously MT5 is the trading platform of this account.

Is Just2trade Good for Short-term Trading (Scalping, Day Trading)?

Ok, this is where our study weighs in!

Drumroll!

For figuring out whether a broker fits for short term trading or not, what factors should we consider?

Spread and Commission

Obviously the cost of trades plays a major role in this type of trading and the main cost for daily trades is spread, or spread + commission in ECN accounts.

We did a study on more than 100 regulated forex and CFD brokers and found the top 20 ones that have the best spread + commission on 9 main forex pairs.

Just2trade showed an impressive performance on the test and took a very good position in our list. It’s even on the top 5 for 6 of those pairs and in the middle of the list for the other 3.

If you want to see the entire study, you can check out this post.

The average spreads + commission of Just2trade online for the one month of our study are:

These spreads + commissions are a mixture of different accounts of the broker

so you probably see even tighter ones if you open an MT5 Global account because

as we saw early on, commission is lower on this account.

With all that said, we give an A to the spreads + commission of Just2trade online and it can turn into A+ if you choose MT5 Global.

Order Execution Speed

Another parameter that is important for short-term trading especially scalping is the execution speed of orders which means how fast a broker can execute or open your positions.

We did a thorough test on both MT4 limit and market order execution of all the brokers in the study using two EAs — one for limit order and one for market order.

You can find the study on this post.

In general, Just2trade online has an acceptable MT4 execution speed, especially if you don’t run several EAs (trading robots) that open many positions in a row.

The market order execution speed for this broker is 500ms (0.5 sec) and the limit order execution speed is 100ms (0.1 sec).

The result for limit order execution of the broker is really excellent and ranks 2 among the tested brokers, however, the market order doesn’t show an impressive performance and stand on the last spot — it’s still good in general.

Market order execution speed score: B

Limit order execution speed: A+

Remember very high speed is only helpful for some automatic scalping strategies and a few M1 time frame scalping strategies.

All in all, Just2trade online has reliable conditions for day trading and scalping.

Is Just2trade Good for Long-term Trading?

When we talk about long-term trading, some other conditions seem to be important. Generally, you don’t have lots of problems with brokers if you are a long term trader such as position or swing trader.

Moreover, some cost of trades such as spreads that are important in short term trading don’t affect your overall results because they are nominal compared to your targets (SLs or TPs).

The only parameter that could have a determining effect on your trades’ cost is swap.

As you probably know, swap is an overnight fee that you either pay or receive so when you are a long-term trader, you may keep your trades open for days, week, or even months and since swap is charged or paid for every day that your positions are open, they accumulate and turn into a notable fee.

Thus, spreads + commissions are not the main trades’ costs here but swap is the dark horse.

In the study we did about the best brokers for long term trading, it turned out that Just2trade has very good swap rates especially on major pairs such as EURUSD and GBPUSD — rank 2 for EURUSD and 4 for GBPUSD overall.

We give an A to the broker for long term trading.

Is Just2trade Online Good for News Trading?

When it comes to news trading, the main factor is slippage.

Since the market becomes too volatile when important news events are released, brokers have difficulty finding the prices they’ve been asked so they fill clients’ orders with different prices, some times better other times worse.

According to the study we did on 100+ brokers during some of the most volatile news events, Just2trade showed very good results and ranked 7 in total.

A is the score we give to just2trade performance for news trading.

Is Just2trade online Good for Beginners?

There are some services that a broker can offer to help beginners start their trading careers more easily such as educational material or research.

Research and Assistance

Just2trade online has a section called trading assistance that you can access after opening an account. There are several sub-sections including trading signals, research, Economic calendar, technical analysis, and subscription.

Research part is more focused on stocks and provides some information about stocks news.

Subscription part includes daily and weekly technical analysis on the Forex market sent to your email.

There is another section, market research, where you can receive stock trading signals and analysis from the experienced advisers of Just2trade online but the minimum deposit for getting such service is $10000 which is their VIP plan and you can also open a $30000 account and subscribe to broker’s exclusive plan.

You also need to pay some fees for those services, $0.02 per share for stock and $5 per contract for option.

In addition to the above services, you can have access to ROX platform when picking any of those plans.

It’s worth noting that the minimum deposit for opening an account with Just2trade is only $100 so if you are a beginner who wants to just get his/her feet wet and give trading a shot, you can do it with a small amount of money.

How Can You Make Money without Trading?

If you’ve been a trader for a while, you’ve probably heard of PAMM accounts.

For those of you who don’t know about that, it simply means: investing in the trading accounts of other traders instead of trading by yourself.

There are traders in the brokers that offer PAMM service who try to attract investors by showing their track records as a sign of profitability.

In simple words, you see their track records and their profits that they’ve made so you decide to invest in them by charging their accounts. They charge a commission, for example 10, 20, etc percent, for profitable trades.

Just2trade is one of the brokers offering PAMM accounts. you can pick from the traders who have PAMM accounts with them and subscribe to them.

You can find the traders on this page.

Just a few tips!

If you are a complete beginner, go with the person who has the most subscribers but if you want to dig deeper, look at these factors on their results.

Maximum drawdown: in general the less max drawdown the better — Ignore the minus sign, -4% is better than -5%.

Look at the amount of money they are managing. The bigger an account the better.

Age: everything less than 6 months (180 days) is not reliable.

Customer Service

We did some tests on the customer service of Just2rade online including online support and phone service and found some pros and cons.

You don’t stay long on the phone before connecting to an agent and they are almost professional at what they do regarding the different questions we asked.

They have a 24/7 online support which is pretty good, some brokers have a 24/5, however, I waited for 3 to 5 minutes every time I contacted them through chat box and there’s no sign of waiting list so that you could at least know someone is online and about to answer.

Moreover, support agents don’t seem so supportive. It’s like they just want to do their jobs and go home ASAP J

All in all, I think B+ is a fair score for their customer service.

Methodology

This review is based on the examination of the broker’s website as well as several studies we conducted on different aspects of more than 100 Forex and CFD brokers. The studies include:

The bottom line

In the review of Just2trade online, we tried to look into the broker from several angles and test it for different types of trading strategies.

The broker seems to have desirable conditions for most types of trading strategies.

The most notable disadvantage could be its MT4 market order execution speed which may be of importance for the traders who use EAs that take many positions especially in volatile situations such as the release of important news events.