Forex scalping is the fastest way of trading and as a scalper, you have more on your plate than other types of traders such as swing traders or position traders who stay in a trade much longer, therefore, you see difficulties that they might not even see in their career.

Of course, there are some factors that if you know in the first place, you’ll lose less and become profitable sooner.

Some of the factors are internal and related to the strategy you use and the approach you take to handle a position such as setting TP and SL or analyzing the chart as fast as possible or even paying attention to the volatile news. Others are more external like spread, slippage or execution speed.

As a scalper, you need to be more vigilant and sharper to cope with all those difficulties. You have to be aware of them and the way you can manage them especially if you are new to scalping or you’ve decided to choose this kind of style for trading.

What Is Scalping?

Scalping is kind of a hit-and-run method in the trading world except you don’t need to hit somebody, you have to hit as many pips and TPs as you can by entering as many trades as your strategy allows in a short period of time.

It’s not like you have to press the buy/sell button as fast as you can, but your strategy should be designed in a way that can take advantage of more movements of the market. Each position can take something between 5 to 10 pips regarding the timeframes, m1 to m15, however, you can rip a little more especially if you are scalping based on 15 min chart.

In my opinion, scalping is the hardest among all types of trading and needs far more concentration. You should be a more experienced trader if you even want to consider that otherwise, you end up down and out.

The reason that most beginners get fascinated by this tricky method is that it’s really fascinating 😀

It’s more like you’re making money in the biggest market in the world by going through charts and monitors and taking positions after positions in minutes and then you are all free. You can do what you desire with all that money then. It’s not like that and as I said it’s the hardest one.

Before you start scalping, the first thing you need to notice is whether you are a kind of scalper in nature or you need to work on your personality if you really want to become one.

What’s Your Character?

Scalper or Swing Trader

This is a very important question to ask yourself before everything else. Scalping is a quick-pace task and it needs to focus a lot.

A misclick or hesitation can be the difference between winning and losing a trade. Having a ready mind to perform fast can be really useful in scalping, however, I think it’s more like a behavioral approach that can be taught and trained.

I’ll get to this one later but first, you’d better know your personality.

Some people like to do a task meticulously and go through each step of their strategy over and over. They tend to have a strategy that has several components and is somehow complicated.

They’ll never be a good scalper. It’s not a bad thing at all, but this kind of trading is not their type.

Others may not be comfortable with small profits even if there are many of them. They like to take a more relaxing approach by swing or position trading.

They enter a position and stick to it and squeeze it as many pips as possible. They might even lose concentration and feel panicky if they try to put themselves in scalpers’ shoes.

So if you are in this category you’d better avoid scalping because even if you are already a profitable trader, you would probably become a losing trader.

On the other hand, there are people who can’t stand slowness. They have a shorter attention span and can’t focus on a specific long task for hours.

They are traders that switch to several charts in a minute. These kinds of traders enjoy several small profits. They are good at multitasking and they don’t get stressed out when there are several red positions moving to hit SL.

Before you start scalping, you should step back and evaluate yourself to see if you are a good fit for this kind of trading.

If the answer is yes, you can go on but if the answer is no and you still want to be in this category you should work on the necessary skills you need to be a successful scalper.

Improve Your Scalping Character

One of the things that I learned from multitabling in playing poker online is you should hone your skill little by little. I couldn’t open several tables when I was playing one table. I’d lose focus every time when I tried to do so.

You are used to one table and now there are several of them beeping and telling you that you are out of time and you need to make a decision fast. You start misclicking and spending money on the wrong hands.

So I decided to add only one table. It wasn’t hard to manage one more table and I got used to that after two days so I could add more. Two months later I was playing at 10 tables simultaneously and I was really comfortable with that.

So if you want to be good at any skill you need to nurture that and enhance it gradually otherwise you get overwhelmed and you would probably quit.

To solve this problem in scalping, you can add charts one at a time. When you feel you can handle the situation then you can add more.

You’d better start with those currency pairs that you are more familiar with, the ones that you’ve traded normally and you know about their movements and characteristics.

It helps with your concentration and decreases your stress so you can make better decisions, but you still need to take actions fast and the most important factor that can help you with that is your strategy.

Trading Strategy

Swing Strategy

There is a huge difference between scalping strategies and other types of trading particularly in performance speed. You have to find setups really fast and take quick actions if you don’t want to have problems with losing them.

When you design a strategy for example for swing trading, you don’t need to pay attention to how you can find setups quickly.

You have a lot of time to immerse in each chart and analyze that thoroughly. You can even get back and change any setups by reanalyzing it again, or when you see a change that you didn’t expect.

When you finally in a position, you can analyze the situation step by step and as the price moves. You may decide to move your stop loss or use trailing stop and take advantage of a trend and squeeze as many pips as possible out of it.

You don’t need to stick to your monitor and look at every movement of the charts to find many setups so that you can wring a few pips. It’s not that you aren’t committed to your positions, it’s not necessary to do so naturally. You can even take a set-and-forget approach by using pending orders.

Scalping Strategy

On the contrary, you don’t have any extra time to mull over your setups and analyze the chart with several tools. You need a straightforward strategy. You don’t have time to spend on each chart for hours because every setup that you detect will disappear very soon.

For example, you use a moving average in a one-min chart and say if the price comes back to it, I’ll enter a position. Then you go find other setups in other charts and when you switch to the first chart after a few minutes, the price has touch the MA and moved away so it’s too late to enter.

That’s why it’s suggested that you should pick strategies with static tools such as trend lines or static support and resistance if you want to trade several charts.

However, you might want to scalp only one currency pair and try to open several positions on that. That way you can also choose dynamic tools such as indicators.

There is a useful way that you can apply when you want to implement your strategy. It’s a very good idea to prepare your charts in advance for a particular session of trading.

Let’s assume that you want to scalp for a two-hour session in one-min charts. Before opening any position you can open charts one by one and see if they are in a good status regarding your strategy and if there are potential setups.

Then you can set whatever tool you use and mark the probable positions you can enter. That way you have a ready roadmap so that you can enter fast if the setup appears just by taking a quick peek.

It comes in handy more if you are trading multiple charts. It’s the tactic I used for the first time when I started multitabling in poker.

For instance, you have a strategy based on support/resistance. You find them on different charts and draw a line, or whatever tools you use.

Then you mark the points wherein you expect to enter a trade. You can do the process for every chart that has potential setups based on your strategy. It won’t take more than ten minutes to do it for several charts if you’ve got a good hang of your strategy.

Then you are all set and you can trade multiple charts with great precision, however, there are other factors that paying attention to them can improve you as a scalper and make your strategy (more) profitable.

Most Volatile News

Scalping is all about getting a few pips or profits from a trade so moving 50 pips in a few seconds can be dramatic especially against your trade.

Some scalpers don’t set a stop loss for their trades and it can be disastrous for their accounts if volatile news is released and it is against their positions. First of all, it’s not a good idea not to set stop loss particularly if you don’t have any plan to exit from a losing position.

If you do have a plan for exiting but you don’t want to set up an SL, you should be careful about those kinds of news.

I can remember the first time that I saw the waves of EUR/USD go up and down in a jiffy and I wondered what’d just happened. It was Friday and the crazy guy was NFP (Non-Farm Payroll) report. This is the wildest one by far.

It can hit you before you can blink. Luckily, I was at my early stage of trading and I was playing with demo accounts and I learned the lesson the easy way.

If you are a scalper that profit from news and your strategy is designed for that, you probably wouldn’t have any problems with this, but if you are new to scalping or this hasn’t hit you yet you’d better be aware of that.

You don’t need to know much about news or check news calendar all the time. There is only a handful of them that you need to know so that you can either avoid them or take some extra measures when they are about to come.

As I said, NFP is the most important one that normally happens on the first Friday of every month. Others are:

- GDP (Gross Domestic Product)

- FOMC (Federal Open Market Committee)

- CPI (Consumer Price Index)

- Retail sales

- Trade balance

- Before your trading session, you can check an economic calendar to see if any of them is going to be released so that you can be more careful about that.

In the ECN/STP brokers, sometimes spread are widened or you get slippage (we’ll talk about that) on these occasions, so it may hurt you as a scalper because a scalper can’t afford any extra spread. These traders are supposed to gather less than 10 pips, and even 1 extra pip for spread or any extra commission can ruin the profit in the long term.

Currency Pairs Personality

Each currency pair has a unique character in terms of volatility and average daily range. Some are milder like EUR/USD and others are wilder like GBP/JPY. Some move more during a day and have a larger average daily range such as GBP/JPY with 120+ and others aren’t that much volatile such as USD/CHF with 60-.

Getting a pip from low volatile currency pair is harder than generous high-volatile ones. If your strategy can take 8 pips out of USD/CHF it can get 12 pips from USD/JPY and 15 from GBP/JPY. As long as getting every pip is vital for a scalping strategy, scalpers should pay heed to this factor when they want to set TPs and SLs.

If you set a fixed SL for all the currency pairs, the probability that you hit more SLs in a high-volatile one like GBP/JPY increases. It’s the same for TPs. You gain less profit when you can earn more from more volatile pairs and it can affect your final result.

It can even turn a profitable strategy into a losing one. Although you might hit more TPs as well, you are not in the moving range of that high-volatile currency pair and because the spread is higher in such pairs you’ll end up losing or at least gaining less profit if you have a strategy with a high win rate.

There are some solutions for this problem, but the easiest one is to check the average range of each currency pair that you don’t know well by using ATR indicator. You can set an ATR for each pair in daily timeframe with the period of 20 to 22 which is the candles of one month so that you can see the average range of the pair in your indicator window.

You can also check Forex Average Daily Range Table that I made for this purpose.

So far we’ve covered the internal probable problems which are related to you as a scalper or your strategy and also the factors that are related to you to pay attention to in order to improve your scalping.

There is another significant factor that you should consider before starting to trade as a scalper which is an external one.

Broker

Choosing the right broker can help you a lot and prevent you from painful problems that you would encounter. The last thing that a scalper wants is to be beaten by their broker whether by asking them not to scalp or by unreasonable spreads.

You don’t even notice these factors when you are a swing trader because they’re not that much important. When you have a position with 50 SL and 100 TP, a few extra pips don’t matter, but when you aim for 5 or 10 pips it does matter.

What you need as a scalper is a reliable broker with small spreads and fast order execution with the least slippage, requotes or widened spreads, so we need to look at different types of brokers and the features they offer to see which one is better for scalping in general and types of scalping strategies in particular.

Types of Brokers

DD (Dealing Desks)

Dealing desk or market maker brokers are the ones that give you fixed spreads. They fill your orders in different ways such as

- Other clients (such as you)

- Different liquidity providers such as other brokers or any financial

institution - By themselves — taking the other side of your trade

As you can see they potentially can earn money in two ways:

- Spread

It’s the legit way that the good ones choose to benefit from your trades. When you place an order, they take the price from their liquidity providers or their other clients who take the opposite position (you want to buy, ask, they want to sell, bid) and add spreads to it. You know in advance that for example the spread for EUR/USD is 2 and it’s fixed.

- Their clients directly

They can provide the liquidity needed to fill orders by investing directly from their own pocket so if you lose they win. This potentially makes them evil but not necessarily.

The bad side is when they really want you to lose so that they win. In this case, they can make an environment that makes you lose such as giving you requote.

Requotes happen when you want to open a position but there is no offer at that time or the price you ask or bid for is not available, so you see a message telling you that you can’t buy/sell at this time.

Normally it happens on impotent news announcements and release but if a broker wants to drive you out of itself, they can give you a lot of requotes so that you get fed up with them and close your account. It happens in different ways.

Sometimes the broker gives you several requotes in a row so that you don’t get to take any positions for minutes and when you do have a chance, there isn’t a good entry point. Other times they manipulate the price and give you a different price than you requested to enter your position.

As a scalper both of them are disruptive and you can’t trade when they happen.

They can also have a policy of not accepting some types of traders, such as scalpers, or trades like automated trading using robots or EAs. Thus they don’t let you open an account with them in the first place, or if they see you’re for example scalping they can close your account and freeze your money.

Having said that, however, it’s not all about forcing you to lose.

There are DD brokers that categorize their clients as winning traders and losing traders. What they do here is they fill winning traders’ positions with other liquidity providers they have, so they can benefit from the spread.

On the other hand, they take the other side of losing traders’ trades so they can benefit from those traders’ losses. They not necessarily want you to lose. If you lose they make money from the loss but if you win they enjoy spread.

If you want to choose from this type of brokers, you’d better pick from regulated ones. Most of the times, they can’t help but be accountable if you suffer the above problems, and you don’t often see such problems.

The worst scenario here is either they say that some types of trading are against their policy so they don’t accept you from the first place or if they do accept you they take the ethical way by categorizing traders.

So if they are regulated you probably won’t have a big problem. All in all, if you have those problems with your broker, you can change it.

NDD (No Dealing Desks)

NDD brokers don’t liquidate the orders by themselves and they pass it to other liquidity providers. In other words, they don’t take orders against your orders. This type of brokers are divided into two categories

- STP ( Straight through processing)

- ECN (Electronic Communication Network)

STP

STP brokers have an automated process in which orders are routed to other liquidity providers. In other words, the orders are passed to liquidity providers automatically to be filled which means this type of brokers can’t manipulate the price or take the other side of traders’ positions.

They have several liquidity providers to get the best price to offer to their clients. The more sources they have the better because they can have more options to choose from and they are able to get a better price and as a result of that, traders can get lower spread.

They choose the best price and then add a mark-up as the spread and pass it to their clients (traders)

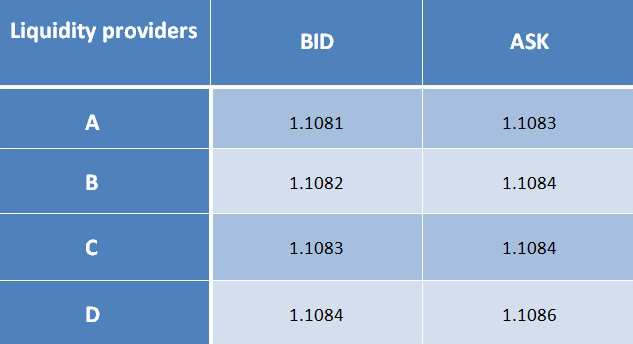

For example, they have four liquidity providers each with different prices for EUR/USD

As you can see each provider offers different prices for selling and buying (bid/ask). For example, if you want to sell to provider A, you have to sell at 1.1081 and if you want to buy, you have to buy at 1.1083. The difference is 2 points which is the spread they take for themselves.

The algorithm in your STP broker checks all the providers and their prices to find the best one. as you can see in three of them, the difference between bid and ask is 2 points but the provider C offers the best one with 1 spread (1.1084-1.1083=1).

Therefore, your broker chooses that one and adds a markup, for example 1 pip, and delivers it to you. So you can take the position with a 2-pip spread.

As long as everything is executed automatically, it’s easier to accept that you get the best price. It is possible that you even get less than 1-pip spread from them which is an advantage for scalpers but they also have their disadvantages.

Since they have several liquidity providers they can instantly execute your order which is naturally an awesome feature. You don’t get requotes which is necessary for scalping but sometimes the spread may be widened and your position is opened with a larger difference than you expect.

It mostly happens in volatile situations like major news or when there isn’t enough liquidity. Because the orders are filled automatically, they don’t have access to the process so that they can control it and your orders are placed anyway.

For example, you take a position that you expect a 2-pip spread and all of a sudden your order is opened with a 5-pip spread which can even be the size of your TP or SL.

The solution for that is either you don’t open positions on important news or if you do that, you should widen your SL and TP according to the spread because the market has more potential than normal.

ECN

ECN brokers are like STP brokers with a few differences. Way back when I started forex, every time anyone wanted to give you an example of a real broker that connects you to large banks and hedge funds directly, they used ECN expression. It’s actually the simplest explanation of ECN brokers.

They don’t have their own providers that take the price and send it to you with an extra spread. They are in a collection of larger providers such as banks or important market players that provide orders for each other.

For example, they take orders from their clients and pass it to banks or any financial institute that need the orders and take a commission for this service. They are more like a bridge who directly connects two parties.

If you sell something, they find someone who needs it and connects you to them and charge a small fee.

They don’t have nano or micro accounts and the minimum lot size is 0.1 because the size of orders they’re offered to pass to their clients is normally larger so they can’t use small lots.

They also don’t charge spread, and the commission they offer is often less than the spread that DD or STP brokers charge.

The only problem with ECN brokers is slippage.

Slippage is the difference between the order that you place and the order that is really executed. In other words, you get a different price than you expected.

When you place an order, the broker search for the price to fill your order and if it can’t find the exact price it gives you the most favorable one or the closest price to what you’ve ordered.

If the market moves fast during a second or seconds from placing the order to getting one, the broker may not be able to catch that price and so long as the price provided for you in ECN brokers is the current market price and is not manipulated, your order is filled with the latest market price.

There are arguments that mention these kinds of brokers are not merely ECN and they call it STP/ECN and it’s kind of make sense because an ECN broker is a part of huge financial institutions so they have access to massive market liquidity, therefore, they can execute orders instantly without any slippage.

Anyway, slippage is not always supposed to be against you. Sometimes you get a better price than you expected. For example, you sell EUR/USD at 1.1081 and your order is executed at 1.1082 with one pip in your favor. Although it’s possible, most of the time traders complain about unfavorable slippage.

There are two practical solutions to this problem. First, since slippage usually happens on volatile occasions such as important news announcements, scalpers can avoid trading in those times. Of course, the amount of slippage on less important news events is often less than 1 pip, so you can trade if you consider more than 5 pips for your TP or SL.

Another solution is to set limit orders. When you set limit orders, you tell your broker to buy at or below the price you’ve ordered and sell at or above the price you’ve set.

That way when a spike happens due to volatile news events, you don’t stumble upon a huge slippage and just enter the market when the price comes back and touch your ordered price or even gaps in your favor so you get a better price than you expected.

What Type of Brokers Is suitable for Forex Scalping?

Being a DD or NDD broker doesn’t necessarily make a broker fit for one style of trading.

In general, ECN and STP brokers have better spreads, however, there are DD brokers with fixed spreads that have lower spreads than many NDD brokers

Just make sure that they are regulated so you don’t stumble upon the mentioned problems. If you have big problems with them, the best solution is to change your broker.

If you are a news trader, slippage is a headache. I’ve done a study on the slippage of many brokers to find the best brokers for news trading. You can check the post and find the forex broker right up your alley.

If you have a scalping EA that needs low latency and fast execution speed, I’ve done another study on the execution speed of forex brokers that you can check out.

You can also check the best brokers for scalping post of this site where I’ve reviewed and tested several brokers so you can find more information to pick the best one suitable for your strategy.

The Bottom Line

If you want to be a successful scalper, you need to pay attention to both internal and external factors that may affect you and your strategy. Your goal in forex scalping is to gather a few pips from several positions so considering details is very important.

For internal factors, you have to work on yourself and try to grow and improve the habits which are necessary for a fast job. You should take immediate action in a precise fashion. You need concentration so that you can avoid mistakes such as misclicking.

You also need to design a quick-to-detect strategy and prepare the charts in advance especially if you want to trade multiple charts.

News, especially the main ones, are another factor you should consider before scalping. Spending a few minutes skimming an economic calendar can make you aware of upcoming situations so you won’t get surprised.

Knowing the personality of any currency pairs or stocks and being familiar with their movements and daily ranges can help you to choose the best ones for your trading sessions.

Brokers as an external factor can affect your trading both in a good way and an awful way so before everything else, try to pick the one that is suitable for you and your scalping style.