After doing an unbiased study for finding the best forex brokers for scalping, I noticed that half of them are either Australian or ASIC regulated and have an office in Australia. They are basically the top 10 Australian ECN forex brokers too because we tested them based on low spreads and commission, order execution speed, and regulation and they ranked up there on our list.

ASIC is one of the top-tier regulatory bodies in the industry so Australian forex brokers already have an acceptable score in terms of regulation but we had to test them based on other factors to see which one is better.

We didn’t ask brokers to send us information about their performance or just searching their websites to find the info we needed because we wanted unbiased data. Hence, we rolled up our sleeves to find them via a third-party website where their clients have accounts there and we could access to the data such as the average spreads and commission of many brokers.

Now let’s see how we found our best Australian forex brokers with an ECN account.

Methodology

We use a third-party website and brokers’ websites for examining the spreads and commission of these Australian forex brokers and two EAs for analyzing the speed of their MT4 order execution.

Spread and Commission Analysis

The information about the spreads and commission of the brokers are gathered from myfxbook and double-checked with the websites of the brokers.

There are more than 10000 registered accounts of more than 100 forex brokers’ clients so the statistical population for our examination is greatly reliable.

Since the information on myfxbook has a limited time period so we keep gathering data for one month to have more credible results.

Among all these top 10 Australian forex brokers, Pepperstone isn’t registered on myfxbook. As long as I know the broker to some extent and it is one of the best Australian brokers, we added this broker to our list and collected the information of spreads and commission of the broker from its website.

Order Execution Speed Test

For testing the speed of brokers’ MT4 order execution, we use two EAs.

One of them sends several limit orders and calculates the time between sending the orders and placing them by the broker.

The other one takes instant orders at market price and calculates the time between sending the requests and filling the orders.

For more information about this, you can check a post that I wrote about brokers’ execution speed here.

Safety

We consider all ASIC regulated brokers safe to a great extent because they are regulated by a top-tier regulatory body; however, we add more scores to the safety section of the brokers based on the number and strength of additional regulations.

For more information about the process of examination, you can check this post.

Now that you understood how we’ve picked the brokers it’s time to introduce our best Australian ECN forex brokers.

Best Australian Forex Brokers in 2026

1- FP Markets

FP Markets has shown a very good performance on our test. Founded in 2005, FP Markets is a forex and CFD broker with more than 50 forex pairs, Metals, Indices, and Commodities in its portfolio.

With 5 types of accounts, it caters to different types of traders.

Standard account is an STP MT4/MT5 account with floating spreads, no commission, and the minimum deposit of AUD $100.

Another MT4/MT5 account of the company is called Raw with the minimum deposit of AUD $100, spread starts from 0, and $3 commission per side for one lot.

The maximum leverage for both types of accounts is 1:500

They also have three other types of accounts that are CFD accounts based on IRESS platform.

MT4, MT5, Webtrader, and Iress are the platforms of this broker.

We examined the forex side of the broker based on spreads and commission on 9 currency pairs and MT4 order execution speed both for limit orders and market orders.

FP Markets is the best Australian forex broker for scalping because:

The market order execution speed of FP Markets is 95 milliseconds and receives an A+ for that.

The limit order execution speed of FP Markets is 80 milliseconds and receives another A+.

The spreads + commission of the broker are very competitive and receive another A+.

See FP Markets General Information and Test Scores

2- Go Markets

Besides Australia, Go Markets has other offices in different parts of the world including the UK, Taiwan, and Hong Kong. They claim they are the first recognized MT4 broker in Australia.

The broker was founded in 2006 and holds ASIC regulation.

They have two types of accounts: Standard and Go Plus.

Standard account is an STP account with floating spreads starting from 1 pip and the minimum deposit of AUS $200.

Go Plus is the ECN account of the broker with the commission of AUD $3 per side and a minimum deposit of AUD $500.

MT4, MT5, Webtrader, and mobile trading are the platforms of the broker.

140 milliseconds is the speed we saw for market order execution speed of the broker on our tests and 130ms is the speed of limit order.

The broker has very tight spreads especially on EUR/JPY and USD/CHF on which they are number one in terms of the lowest costs among the brokers we’ve examined.

See Go Markets General Information and Test Scores

3- IC Markets

Founded in 2007, IC market is an Australian-based broker regulated by ASIC.

It has three types of accounts: Standard, Raw Spread (Metatrade), and Raw Spread (cTrader).

Standard account is an STP account with floating spreads starting from 1 pip and the minimum deposit of $200.

Both Raw accounts are the ECN accounts of the broker with the minimum deposit of $200, however, the commission is different between them, $3 per side for cTrader and $3.5 for Metatrader.

MT4, MT5, Webtrader, mobile trading, cTrader are the platforms of IC Markets.

180 milliseconds is the speed of market order execution of IC markets and 130ms is for the speed of limit orders execution.

A+ is the score that the spreads + commission of this broker deserve.

See IC Markets General Information and Test Scores

4- Pepperstone

Aside from Australia and being regulated by ASIC, Pepperstone has another branch based in London and regulated by FCA. The broker was established in 2010 in Melbourne, Australia.

They have two types of accounts: Standard and Razor.

The standard account is the STP account of the broker with the floating spreads from 1 pip and no commission. The minimum deposit for this account is AUD$200

The Razor account is the ECN account of the broker with the commission of AUD $3.5 per side for one lot and the minimum deposit of AUD $200.

MT4, MT5, Webtrader, mobile trading, cTrader are the platforms of Pepperstone

Pepperstone set the record of 85ms for its MT4 market execution speed on our test which is the fastest one among all the brokers we’ve tested.

100ms is the speed of the limit order execution of the broker.

The spreads + commission of the broker are considered low and receive A for that on our test.

See Pepperstone General Information and Test Scores

5- Axitrader

Axicorp was founded in 2007 in Australia and holds ASIC regulation. It also has a UK subsidiary which is regulated by the Financial Conduct Authority (FCA)

The accounts of Axitrader are: Standard and Pro.

Standard is an STP account with the floating spreads starting from 1 pip and no commission. There’s no minimum deposit and you can open an account with any amount you want.

Pro is the ECN account of the broker with a commission of $3.5 per side for one lot. There is no minimum deposit for this type of account either.

The maximum leverage for both accounts is 1:400.

MT4, Webtrader, mobile trading, and MT4 NEXGEN are the platforms of this broker.

MT4 NexGen or next generation is MT4 with extra tools such as Sentiment Indicator, Correlation trader, Alarm manager, Economic Calendar, Session Map, and some other features.

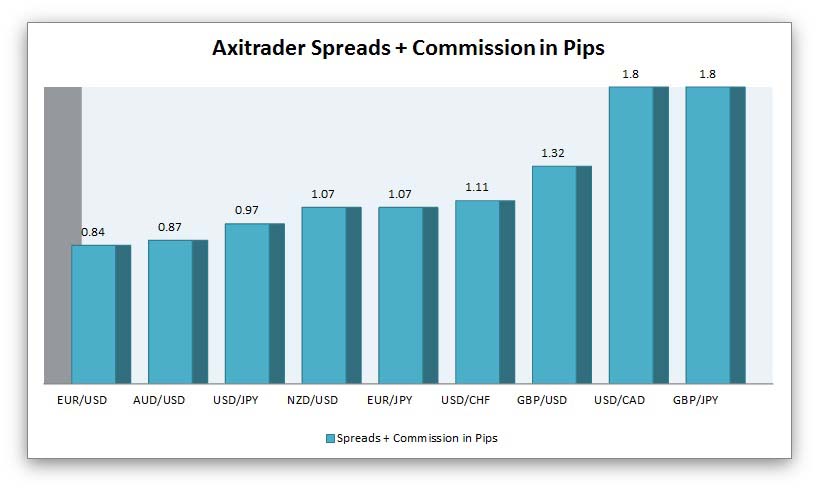

130ms is the speed of Axitrader Market order execution and 100ms is for its limit order execution.

A is the score we can give to the spreads + commission of the broker.

See Axitrader General Information and Test Scores

6- FXCM

FXCM is a British forex broker founded in 1999 and has several offices around the world including in Australia. It’s regulated by several important regulators such as ASIC in Australia, FCA in the UK, and FSCA in South Africa.

The broker has two types of accounts: Standard and Active Trader.

The Standard is a type of account with floating spreads of EURUSD starting from 1 pip (or an average of 1.3, as per FXCM’s Spread Report (2020 Q4) ).

Active Trader is a type of account with a commission of $4 per side that becomes lower based on your equity and the number of traded lots per month and can get to $2.5 per side.

Trading station (web, desktop, mobile) and MT4 are the platforms of this broker.

The market order execution speed of the broker is 150ms and the limit order execution speed based on our test is 125ms.

B+ is the score of FXCM average spreads + commission.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.31% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

See FXCM General Information and Test Scores

7- Global Prime

Global Prime is an Australian based company founded in 2010.

They have only one type of ECN account.

The commission of the account is AUD $3.5 per side for one lot and the minimum deposit is AUD$200. Maximum leverage for the account is 1:200.

MT4, Webtrader, and mobile trading are the platforms of the broker.

140ms is the speed of the market execution of the broker and 115ms is the speed for the limit order execution of Global Prime.

The broker stands in the middle of our list in terms of spreads and commission and receives a B+ for them.

See Global Prime General Information and Test Scores

8- FXOpen

FXOpen Australia was founded in 2012; however, the company was initially established in 2004 and has several offices in different countries including the UK. The UK branch is regulated by FCA and the Australian one is ASIC regulated.

It has 4 types of accounts: Micro, STP, ECN, and Crypto.

Micro account is a cent account with the minimum deposit of only $1. The spreads are floating with no commission. The maximum leverage is 1:500.

STP is an account with floating spreads with no commission and a minimum deposit of $10. Max leverage is 1:500.

ECN is the account that the results of our study are based on. The commission has different structures based on the size of your account and the number of lots you trade per month. The bigger account size and more traded lots per month the lower commissions. The minimum deposit for opening an ECN account id $100 and the maximum leverage is 1:500.

Crypto, as the name implies, is for trading cryptocurrencies with more than 43 pairs. The minimum deposit for this account is $10 and the maximum leverage is 1:3.

MT4, MT5, Webtrader, and mobile trading are the platforms of the broker.

230ms is the market order execution speed of FXOpen based on our test and 125ms is the number we saw for the limit order execution.

The spreads and commission of the broker receive a B+. It can change and you pay less if you trade more lots per month and have more equity on your account.

See FXOpen General Information and Test Scores

9- Admiral Markets

The company was founded in 2001 and has an Australian branch which is regulated by ASIC. Other regulations of the broker are FCA and SySEC.

The broker has three types of accounts: Admiral.Markets, Admiral.Prime, and Admiral.MT5.

Admiral.Markets is an account with floating spreads starting from 0.5 with no commission on forex pairs. The minimum deposit for opening this account is AUD $100 and the maximum leverage is 1:500.

Admiral.Prime is the ECN account of the broker with different structures of commission, between $1.8 to $3 per side for one lot. The more lots you trade and the larger equity in your account the lower commission you pay. The minimum deposit is AUD 100 and the max leverage is 1:500.

Admiral.MT5 is an account based on MT5 platform and has similar conditions as Admiral.Markets.

MT4, MT5, Webtrader, mobile trading, and Metatrader Supreme Edition are the platforms of the broker.

Metatrader Supreme Edition is the Metatrader with extra features. One of the handy ones is an add-on for manual backtesting. Economic news and additional indicators are some of the other ones.

150ms is the market order execution speed of the broker we get on our test and 105ms is for limit order execution.

The results of our study for spreads+ + commission of this broker is an average of all size of accounts so you would probably pay less if you trade more lots with a larger size account.

See Admiral Markets General Information and Test Scores

Australian Brokers Execution Speed Comparison

If you are swing trader and trades based on higher timefreames, you probably wouldn’t care about milliseconds when it comes to opening positions. Everything lower than 2 seconds suffices.

On the other hand, if you are a scalper or you use automated trading and EAs or a news trader milliseconds do matter.

You don’t want to lose a trade or be late at getting your favorite price because of the slowness of your broker’s execution speed.

In general, everything between 400 or 300 milliseconds is considered good for scalping.

Best Australian ECN Forex Brokers Comparison Table

The following comparison table is based on order execution speed, regulation or safety, and 9 currency pairs including major pairs plus GBP/JPY and EUR/JPY.

Guideline

Click on each headline (Moes, Loes, eur/usd, etc) to sort the brokers based on them. For example, if you click on eur/usd, the table sorts the brokers based on the spreads+commission on eur/usd — from low to high and vice versa

MOES stands for Market Order Execution Speed

LOES stands for Limit Order Execution Speed

The numbers for these two columns are in ms (milliseconds). To convert them to second, divide them by 1000

| Brokers | loes | moes | safety | eur/usd | gbp/usd | aud/usd | nzd/usd | usd/cad | usd/jpy | usd/chf | gbp/jpy | eur/jpy |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FP Markets | 80 | 95 | 75 | 0.59 | 0.98 | 0.62 | 0.93 | 0.89 | 0.67 | 1.02 | 1.53 | 0.91 |

| Go Markets | 130 | 140 | 75 | 0.63 | 1.12 | 0.71 | 0.85 | 1.5 | 0.76 | 0.99 | 1.77 | 0.8 |

| Admiral Markets | 105 | 150 | 95 | 0.7 | 1.18 | 0.97 | 2 | 2.14 | 0.86 | 2.58 | 2.57 | 1.53 |

| IC Markets | 130 | 180 | 75 | 0.75 | 1.06 | 0.86 | 0.88 | 1.8 | 0.82 | 1 | 1.44 | 0.93 |

| Global Prime | 115 | 140 | 75 | 0.8 | 1.49 | 0.87 | 1.36 | 1.67 | 1.21 | 1.47 | 1.92 | 1.41 |

| FXOpen | 125 | 230 | 90 | 0.78 | 156 | 1.14 | 1.26 | 2.04 | 0.96 | 1.84 | 1.93 | 1.1 |

| AxiTrader | 100 | 130 | 85 | 0.84 | 1.32 | 0.87 | 1.07 | 1.8 | 0.97 | 1.11 | 1.8 | 1.07 |

| FXCM | 125 | 150 | 99 | 0.93 | 1.49 | 1.01 | 1.18 | 1.46 | 1.08 | 1.17 | 1.83 | 1.16 |

| Pepperstone | 100 | 85 | 90 | 0.88 | 1.2 | 0.89 | 1.07 | 1.23 | 0.9 | 1.39 | 1.91 | 1 |

You’re welcome