What are the best forex pairs to trade today? What are the best currency pairs for me as a beginner? Which currency pair has the potential to trade regarding my strategy? I wish I had a forex scanner to do the trick for me.

These are some of questions and thoughts that various traders ask themselves every day and because thinking is not gonna find the pairs, you blow your bubble and grab your laptop or PC or whatever you wanna grab — don’t even think about kitty cat :).

Generally, you have to go through a bunch of currencies one by one to find the one that suits your strategy.

It’s not like that you can’t do that or it’s impossible, sometimes it is, but even if you’ve prepared your charts and added your indicators or drawn lines, finding the ones right up your alley for today is not walking in the park.

This is when you are an experienced trader and at least you know what you are looking for. But what if you are still a beginner and don’t even know what currency pair is good for your strategy because you are not fully familiar with them, or at least some of them.

In this post, first I’m going to talk about what currency pairs is more suitable for which strategies or traders and then, we’re going to see a cool screener that can help us to choose from hundreds of pairs and narrow them down to what we like to trade for today — this today means every day you wake up.

For answering the first part of the above paragraph, we need to talk about these subjects:

- Types of currency pairs

- Liquidity

- Volatility

- spread

Then we’ll talk about the screener.

you can choose the following table to go to every part you want if you know about some sections.

**Is it really necessary to say that!**

I dunna but I like it 😛

Types of Currency Pairs

Generally, we have 3 types of currency pairs

- Major currency pairs

- Minor currency pairs

- Exotic currency pairs

Major Currency Pairs

Main or major currency pairs are those with USD as one side of the pair and the other side is one of the main currencies; EUR, GBP, JPY, AUD, CHF, NZD, CAD.

- EUR/USD

- USD/JPY

- GBP/USD

- AUD/USD

- USD/CHF

- NZD/USD

- USD/CAD.

Minor Currency Pairs

Minor currency pairs are the combination of above currencies without USD.

- EUR/JPY

- EUR/AUD

- EUR/CHF

- EUR/NZD

- EUR/CAD

- GBP/JPY

- GBP/AUD

- GBP/CHF

- GBP/NZD

- GBP/CAD

- AUD/JPY

- AUD/CHF

- AUD/NZD

- AUD/CAD

- NZD/CHF

- NZD/CAD

- NZD/JPY

- NZD/CHF

- CAD/JPY

- CAD/CHF

- CHF/JPY

Exotic Currency Pairs

Exotic currency pairs are those with one of the main currencies and other currencies mainly those from developing countries. I’m not going to list them because the list will go on and on, and you’ll get bored even more than now. 😀

Liquidity

Liquidity in forex means how much currency pairs are traded. The larger the more liquid. For example, if 2 million dollars of a currency pair are traded per day and 1 million dollars of another pair, the first one is more liquid and has more liquidity compared to the second one.

The most liquid currency pair is EUR/USD and in general, major currency pairs are more liquid than others.

After major pairs, minor pairs are in the second rank in term of liquidity and then exotic currency pairs that have less liquidity compared to two other categories.

In the following pie chart you can see the most liquid currency pairs.

Volatility

In a simple definition, volatility in forex means how many pips a currency pair moves during a specific period of time. For example, if a pair moves 100 pips per day, the volatility of that pair is 100 per day.

Different currency pairs have different volatility. Some are more volatile than others and move more. I wrote a thorough post about the most and least volatile currency pairs in forex that you can check it here.

The Most Volatile Pairs

These are the most volatile major and minor currency pairs in order — the first is the most volatile one.

- GBP/NZD

- GBP/AUD

- GBP/CAD

- GBP/JPY

- GBP/CHF

- GBP/USD

- EUR/NZD

- EUR/AUD

- EUR/CAD

- EUR/JPY

- USD/JPY

The Least Volatile Pairs

These pairs have the least movement among major and minor currency pairs.

- EUR/CHF

- EUR/GBP

- AUD/CHF

- AUD/USD

- NZD/CHF

- NZD/USD

- AUD/CHF

- USD/CHF

- AUD/NZD

- AUD/CAD

In general, exotic pairs are the most volatile ones. After them minor pairs and then major pairs, however, it’s not always true and pairs like GBP/USD or USD/JPY is the major pairs that are in the category of the most volatile pairs and are more volatile than many of the minor pairs.

Spread

I don’t think that I need to talk about the meaning of spread because everyone who hears the name of forex, spread is the second or third name they come across.

Just for the sack of review, spread is the difference between bid and ask.

One factor that affects spread is liquidity. When a currency pair is not liquid enough it means that there aren’t always enough sellers or buyers for that. As a result, the difference between bid and sell can be larger than the liquid ones.

You want to sell it but you can’t find the price you want and buyers give you the price that is lower than you bid so the spread you pay is larger.

Another factor is volatility. In general, the most volatile a currency pair is the wider its spread is. Sometimes because they are not liquid enough.

But it’s not always the case.

For example; GBP/USD, GBP/JPY, and USD/JPY are among the most volatile pairs but they have high liquidity and low spread, compare to their volatilities.

In conclusion, as long as exotic pairs are the most volatile currency pairs and have the least liquidity, therefore, they have the largest spread. After them, minor pairs have the second largest spread and at the end of ranking, we have major pairs with the lowest spread.

What Are the Best Currency Pairs to Trade in General?

According to what we have learned so far, the best currency pairs to trade are the ones that move the most or high volatile ones and have low spread, as a result of high liquidity.

Thus, the best currency pair to trade in general are; GBP/USD, GBP/JPY, and USD/JPY because not only do they have rather large volatility and move widely enough, they are also well liquid.

After them, the best currency pairs are the one with high liquidity first, and good volatility second.

Most major currency pairs are in that category. These are the best second ones in order:

- EUR/USD

- AUD/USD

- USD/CAD

- NZD/USD

And then the minor one with the same criteria as mentioned above

- EUR/JPY

- AUD/JPY

- EUR/AUD

- USD/CHF

However, it’s a general assumption which can be changed depending on a trader’s strategy and skill level of traders.

By the way, the most profitable currency pairs are the most volatile ones in general but this also depends on your strategy and timeframe. We’ll talk about both of them later in the strategy section

What Are the Best Currency Pairs to Trade for Beginners?

The best currency pairs to trade for beginners are the major ones. They are liquid enough and have sufficient volatility; therefore, they have lower spreads.

As a beginner, you don’t want to plunge into a wavy sea and the wavy sea here is the most volatile currency pairs. Even if they have a good condition such as GBP/JPY, you are not a skillful swimmer in them.

Choosing exotic currency pairs is the worst scenario and that’s the most awful decision to choose from them as a beginner. They have the most volatility and the least liquidity. They are usually calm and then they jump lots of pips out of the blue.

They are not what you are used to. In most cases, there are lots of gaps as the result of liquidity shortage.

The second category that you’d better not choose from is minor pairs especially the most volatile one.

I still can remember my early trading days when I decided to choose one of them that I hadn’t been familiar with, the tricky GBP/JPY.

I opened a position. Luck wasn’t on my side that day and the bastard had got up the wrong side of the bed. It was pounding its waves against the edge of my MT4 as if I would have owed it, and I was trying to run away with the least loss. Finally, I got to do that but learned the lesson the hard way.

All in all, you should avoid them as a beginner until you get more experienced.

Best Currency Pairs to Trade for Different Strategies

So far we’ve covered the general ideas on how to choose the best currency pairs but choosing the best pairs should be optimized according to our strategy.

We can’t just say because I’m an experienced trader so I need to pick from for example the most volatile pairs. We should look at what we want from a pair.

Here we narrow down trading strategies into two categories.

- Trend following

- Range trading

Best Currency Pair to Trade for Trend Following Strategies

In the trend following strategies, we look for big trends to ride and squeeze as many pips as possible. We don’t want to let a trend go until we come to the concussion that we can’t milk it anymore.

The best options for this method can be, picking from the minor pairs because they are more volatile and move the most, plus, they are liquid enough so when they get momentum, they continue. You can use them for medium tends and long trends.

Exotic one is another option because they normally have large volatility, however, they don’t have enough liquidity so if you have a trend following strategy and want to trade exotic pairs, you should try to take larger trends. It means you should trade in higher timeframes. In other words, you should be a swing trader trying to take the longest moves.

In lower timeframes your trades might not meet your expectations. Even if you enter a winning trade and find a good trend, you may have to come out of it with the least profit, the one that you didn’t expect in the first place.

For example, you enter a trend and take a position based on that, with a 40-pip target while the spread is 8 pips at the time. Then the pair moves in your favor and gets to your target but the liquidity is dramatically low by then. As a result of that, you are given a very large spread like 20 or 30 pips, something that you didn’t expect or predict at first, so even a winning trade probably wouldn’t as prolific as you think.

Major pairs can be good options, especially the most volatile ones. Actually they all are good candidate except USD/CHF which is the slowest among them. it is in the least volatile category.

As a general rule of thumb, the least volatile a currency pair is the higher timeframe you should trade in.

With that being said, the best currency pairs for trend following strategies in order of profitability are:

- The most volatile minor currency pairs higher than h1

- The most volatile major currency pairs all timeframes

- Exotic currency pairs in higher than h4 and in some of them daily.

Best Currency Pairs to Trade for Range Trading

Unlike trend trading, we are not looking for long moves here. As a range trader, we are looking for smaller profits so spread becomes more important here especially in lower timeframes.

For knowing what currency pairs are fit for range trading we need to look at this subject from two different perspectives.

What Currency Pairs Range the Most

In general, the least volatile currency pairs are the ones that tend to be in the range state. If your strategy is based on the range market you should look for setups in them.

You should check the most liquid ones as well so you won’t have problems with large spreads. Range market suffers from low liquidity most of the time and if the pair hasn’t enough liquidity as well, you receive larger spread.

The best example for that is exotic pairs which are the worst ones in the range market.

According to the liquid and volatile section, the best pairs that range the most and have sufficient liquidity are:

- EUR/GBP

- EUR/CHF

- USD/CHF

Finding the Best Setups for Range Trading

Unlike trend trading, in range trading we know to some extent how many pips we can expect from a specific setup.

In trend trading, most of the time we don’t have a static target so we use trailing stop loss and try to follow and squeeze the market to the full, however, we can choose next support or resistance as the target but most of the best trend trading strategies surf the trends as far as they can rather than exiting at the first stop.

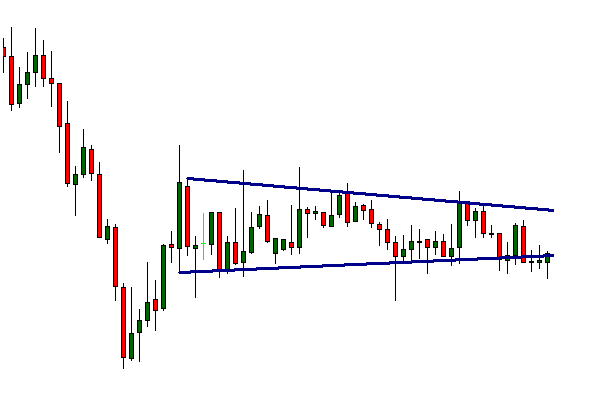

On the other hand, in the range trading we have a limited space to think about and set our targets based on. You probably set the targets on the upper or lower line of a channel or sometimes on the middle line.

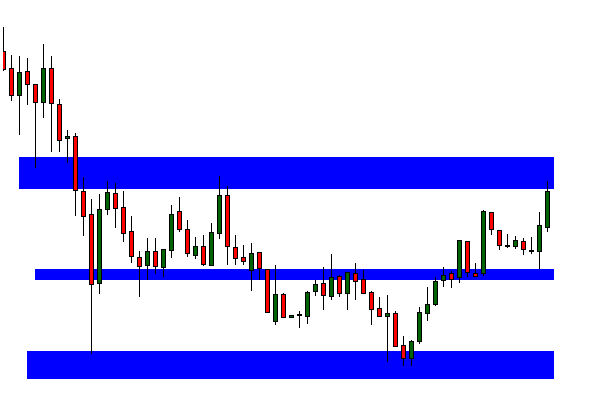

Sometimes traders choose a triangle and enter the market when the price gets to each line. This one is a little bit trickier and needs more experience.

Having said that, we have to choose the currency pairs regarding the size of the range.

If the width of the channel is not enough to give us a good RR we should avoid trading in such situations.

In more volatile pairs we normally have larger range size but we also have bigger spreads especially in less liquid ones, therefore, we should pick from more liquid ones with a reasonable range size based on RR.

On the other hand, in less volatile Paris we have smaller spreads but we also have smaller range size so we need to adjust them so that we can take the positions with a reasonable RR.

What Are the Best Currency Pairs to Trade Right Now?

Ok, now let’s get back to the original question of the topic. You may know your strategy well and have a well-defined one but the problem is you have to go through lots of charts every day, especially if you are a day trader, to find the setups you want.

It’s always been very time-consuming and exhausting for me because I want to find the most perfect setups so I have to look for them in numerous charts.

Even when I make a watch list, I look for setups again because I’m a day trader, therefore, I trade in lower timeframes where setups may be formed several times during a day.

Having a forex screener helps you to create a refreshing watch list and can make finding setups easier and much faster.

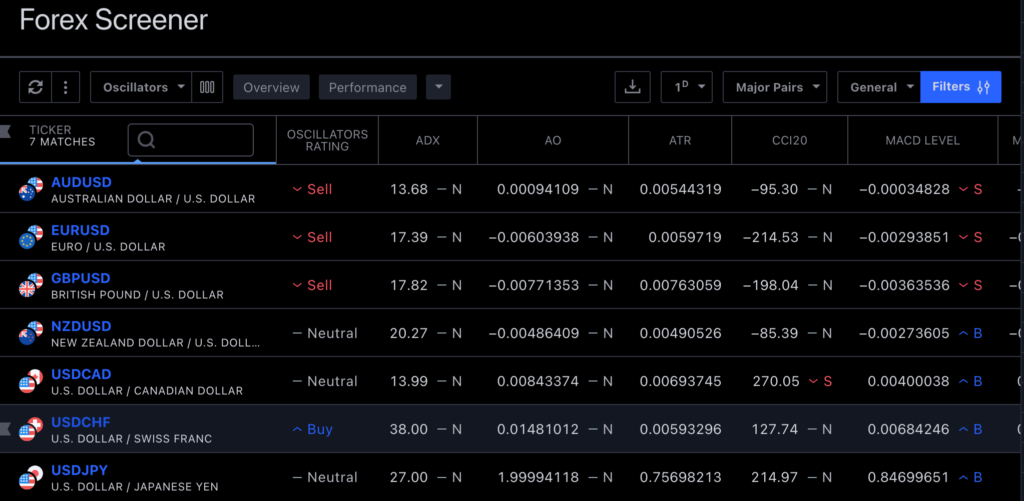

TradingView has a very good software called forex screener. It’s a very cool handy tool that helps you sift through hundreds of major, minor and exotic pairs by setting some conditions and filtering pairs according to at least some rules of your strategy, if not all of them.

You can filter it for the indicators you use. For example, show me the pairs that MA 20 has crossed or is crossing MA 10, show me the pairs that price has crossed or is in the upper/lower band of Bollinger bands, where is the rsi? Is it showing the overbought/oversold? , and many more.

It also shows the state of the market by analyzing all the indicators and gives you an overall result based on that. You can find range markets as well as strong trends.

It’s not all about indicators and it shows all the candlestick patterns too. You can filter that, for example, based on strong reversal patterns for all the major, minor, and exotic pairs and find the best possible options.

In the free version, you can access limited timeframes, D, W, and M so if you want to have other timeframes you have to buy one of their plans that comes with lots of other features as well. For more information, you can check it here.

You can also find more information about TradingView and the registration process on a post that I’ve written about it here.

The Bottom Line

For choosing the best currency pairs to trade, you need to know about the character of them first. Which ones are the most volatile? Which ones have the least volatility? Are they liquid enough or they have low liquidity?

When you have the above information you can guess their spreads to a great extent and choose the best pair according to your strategy and its RR. You can decide if the setup in that pair is worth it.

As a beginner, you probably don’t know most of the pairs well, so you’d better stick to the major currency pairs.

Let’s wind up this post by answering these questions.

The most volatile currency pairs are the most profitable ones providing that you are an experienced trader.

Major currency pairs are the best ones to trade as a beginner. EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, NZD/USD and USD/CAD

You can find them through a forex screener by filtering from hundreds of pairs in order to find the best ones that suit your strategy.

Hi David ,thank you for your time and effort in posting,lots of great info you have shared,never stop posting ! :-]

Thanks, Neil

I think this question is going to be dumb but here goes… The ADR or average daily range, if its 100pips means for example 55 up and 45 down or 33/67. etc etc. or does it mean 100 pips gained in either direction at end of day. hope that’s clear. I am aware markets dont go in a straight line

It’s from the lowest price of a day to the highest price. See this section of the average daily range post

Thanks David for the knowledge. I am presently using Tradingview the free version but I can’t find the Forex screener

You’re welcome. It’s in the main menu on the home page.

Hi David, thank you for the Information.. It has really been helpful.

Hi David I ve been following for while could you please assist me in determining the daily pip movement, what can i analyse the chart in order to make a decision on my take profit

Hi, Joas. If you haven’t read the average daily range post yet, check it out because it might help you. I also take about determining tp using at to some extent in the comment section of that post in response to BT (one of the visitors)

If you read that but still have questions feel free to drop another comment here and I’ll try to answer as soon as I see it.

Do you have any video of that? I’d care to find out more details.

Hello David, I have chosen you to be my online mentor, hope you don’t mind. Thanks for your input to help me as a beginner in Forex Trading. Been looking for someone to follow as i trade alone right now.

Hi David, thank you for the info,much appreciated.

Best,

Linda

glad that you found it useful