If you’re looking for the best forex brokers for trading gold (XAU/USD), you’re in the right place. After analyzing over 100 brokers, I’ve narrowed it down to the top 8 brokers that offer the best conditions for gold trading.

Below, you’ll find my handpicked list of the best gold trading forex brokers, along with details on how I selected them and the key factors to consider when choosing a broker for trading XAU/USD.

Top Forex Brokers for Gold Trading (XAU/USD)

Here are the best forex brokers for trading gold based on my extensive research and testing:

Our Methodology: How We Choose the Best Forex Brokers for Gold Trading

To find the best forex brokers for trading gold (XAU/USD), we rely on our in-house broker monitoring system — a custom-built infrastructure that tracks the spreads and swap rates of brokers’ real trading accounts (not demo) 24 hours a day, 5 days a week.

If you want to learn more about how our review process works in detail, check out our full broker review methodology.

In general, we evaluate brokers based on three key factors:

- Regulation

- Spreads

- Swap rates

This year, we monitor over 100 forex brokers and carefully shortlist about 20 that meet our reliability and transparency standards. From that list, we select the best forex brokers for gold trading based only on regulated brokers. This ensures you’re dealing with trusted companies — because the first rule of trading is don’t lose your money to a scam broker.

Step 1: Regulation

We only include brokers that are licensed and regulated by Regulatory bodies. This gives traders peace of mind knowing that their funds are held securely and that the broker operates under strict oversight.

Step 2: Gold Spreads (XAU/USD)

Next, we analyze each broker’s spreads from real accounts (not demo) on gold. This step is especially important for day traders and scalpers, where every pip matters. Thanks to our advanced system, we continuously collect live gold spreads from brokers’ real accounts every few seconds — giving us accurate and up-to-date data on who truly offers the lowest spreads on XAU/USD.

Step 3: Swap Rates on Gold

Finally, we review each broker’s swap rates for gold trading. Swap costs can significantly impact profitability for swing traders who keep positions open for several days or weeks. Our system automatically fetches and updates the latest swap rates daily, so the data you see in our rankings always reflects current market conditions.

By combining live market data, strict regulatory checks, and years of experience, we ensure that the brokers featured in our list are trustworthy, cost-efficient, and ideal for gold trading.

Forex Brokers with the Lowest Spread on Gold (XAU/USD)

When trading gold (XAU/USD), having a broker with low spreads is crucial for maximizing profits—especially for scalpers and day traders.

As mentioned in our methodology, the swap rates are fetched live directly from the real accounts of the brokers.

In the table below, you can see the average gold (XAU/USD) spreads for each broker based on the last three days of live data. If you want to view spreads over a different time period, you can check our spread monitoring page here.

The brokers in the table are ranked from the lowest gold spread to the highest, making it easy to see which brokers offer the most competitive trading conditions for gold.

Forex Brokers Gold Spread Comparison

| Forex Broker | Account Type | Ranking | Average Spread (pips) | Minimum Spread (pips) | Maximum Spread (pips) | Actions | |

|---|---|---|---|---|---|---|---|

|

Startrader | ECN | #1 | 1.68 | 1.50 | 27.70 | |

|

Moneta | Prime ECN | #2 | 1.69 | 1.50 | 2.60 | |

|

FXPro | ECN | #3 | 2.70 | 0.70 | 15.70 | |

|

FIBOGroup | MT4 NDD | #4 | 3.26 | 0.90 | 29.40 | |

|

xChief | MT4.xPRIME | #10 | 4.43 | 1.70 | 18.90 | |

|

AMarkets | ECN | #11 | 4.59 | 2.20 | 9.40 | |

|

IFCMarkets | ECN | #- |

This forex broker comparison table shows real-time spread data for gold (XAUUSD). Spreads are measured in pips and updated regularly. Rankings are determined by average spread values.

All spreads are taken from brokers real accounts, not demo accounts.

Forex Brokers with the Best Swap Rates for Gold

If you’re a swing trader or position trader focusing on gold (XAU/USD), then swap rates are even more important than spreads. While spreads are a one-time trading cost you pay when opening a trade, swap fees (overnight financing costs) are charged or credited every day you hold your position open.

That means swap rates can have a major impact on your overall trading costs — especially if you keep your gold trades open for several days or weeks.

Below are the brokers that generally offer more favorable gold swap rates, making them ideal for traders who hold long-term positions:

| Broker | RANK | SES SCORE |

|---|---|---|

| AMarkets | 1 | 47.54 |

| Alpari | 2 | 47.16 |

| Moneta | 3 | 45.75 |

| Startrader | 4 | 45.75 |

Because swap rates change frequently depending on market conditions and broker policies, we continuously track them in real time. You can check the live and historical gold swap rates of all monitored brokers on our swap rate monitoring page.

Trading Gold CFDs: A Flexible Way to Invest in Gold

Gold has long been considered a safe-haven asset, protecting investors during periods of economic instability, inflation, or recessions. Whenever financial uncertainty arises, many traders and investors flock to gold as a store of value.

However, buying physical gold isn’t the only way to invest in it. Gold CFDs (Contracts for Difference) offer a more flexible and accessible way to trade gold without owning the physical asset.

Why Trade Gold CFDs Instead of Physical Gold?

✅ No Need for Large Capital – Buying physical gold requires significant upfront investment.

✅ Leverage Increases Buying Power – With gold CFDs, you can trade with leverage as high as 1:1000. This means you could control 100 ounces of gold with just $5 (depending on the broker’s margin requirements).

✅ Trade Both Directions (Long & Short) – Unlike physical gold, which you only profit from when prices rise, with gold CFDs, you can profit from both rising and falling markets.

✅ No Storage or Security Concerns – When you trade gold CFDs, there’s no need to worry about storing, insuring, or transporting physical gold.

How Does Trading Gold CFDs Work?

When you trade gold CFDs, you’re speculating on the price movement of gold rather than purchasing the physical metal. Similar to forex trading, you can:

📈 Buy (go long) if you expect gold prices to rise

📉 Sell (go short) if you anticipate a price drop

Gold CFD trading is offered by many forex brokers, making it an accessible and efficient way to trade gold with low capital requirements and flexible trade sizes.

How Much Do You Need to Trade Gold CFDs?

Gone are the days when only the ultra-wealthy could trade massive amounts of gold. Thanks to leverage, you don’t need a fortune to enter the gold market. Your broker essentially “lends” you money, allowing you to trade larger positions with a smaller capital.

How to Calculate the Required Margin for Gold Trading

The amount of money you need to open a trade depends on the margin requirement, which you can calculate using this formula:

📌 Required Margin = (Lot Size × Contract Size × Market Price) / Leverage

Let’s break it down with an example:

- Your broker offers 1:500 leverage (which many of our top brokers for gold trading provide).

- You choose a lot size of 0.01.

- The contract size for gold is 100 ounces per lot.

- The current gold price is $4000 per ounce.

Now, let’s plug these values into the formula:

💡 (0.01 × 100 × 4000) / 500 = $8

Yes, you read that right! You can trade gold CFDs with just a bit higher than $8 in your account.

Leverage: A Double-Edged Sword

While leverage allows you to control larger positions with a smaller deposit, it also increases risk. Here’s how it works:

✅ Higher potential profits – Because you’re trading with more than your actual capital, even small price movements can lead to significant gains.

❌ Higher potential losses – Just as leverage amplifies profits, it also magnifies losses. A sudden price swing against you could wipe out your account if you’re not careful.

🔹 Pro Tip: Use leverage wisely, manage your risk, and always have a solid risk management strategy in place.

With the right broker and proper risk control, gold CFD trading can be accessible, profitable, and flexible.

Gold Volatility and Average Daily Range: Why It’s a Trader’s Favorite

Gold (XAU/USD) is one of the most volatile assets in the forex market, making it an exciting instrument for traders. Based on my research, gold moved an average of 349 pips (3,490 points) per day in 2024, with daily price swings of 400+ pips being common.

This high volatility presents excellent opportunities for day traders, scalpers, and swing traders, but it also means you need to adjust your trading strategy accordingly.

How to Adapt Your Trading Strategy to Gold’s Volatility

📈 Wider Take Profit & Stop Loss

Since gold experiences significant daily price swings, your stop loss and take profit levels should be wider than with less volatile assets. A tight stop loss could get triggered too quickly due to normal price fluctuations.

⚡ Great for Scalping

Gold can hit 10-pip targets with ease, making it a great choice for scalpers who use slightly wider stops than in traditional forex pairs. Plus, as shown in the spread comparison table, the best gold trading brokers offer spreads as low as less than 2 pips on average.

📊 Ideal for Swing Trading & Trend Trading

Gold is also an excellent asset for swing traders because once it establishes a trend, it tends to move strongly in one direction. With an average daily range of 300–500 pips, traders can capitalize on extended price movements, making it suitable for both day trading and longer-term strategies.

Final Thoughts on Gold’s Volatility

Gold’s high volatility makes it one of the most profitable instruments if you know how to manage risk. Whether you’re a scalper, day trader, or swing trader, understanding gold’s price behavior and average daily range will help you maximize your trading potential.

Gold Correlation: Understanding How XAU/USD Moves with Other Assets

In trading, correlation refers to how two financial instruments move in relation to each other. A positive correlation means they move in the same direction, while a negative correlation means they move oppositely.

For example, when USD/CHF is bullish, EUR/USD is often bearish, showing a strong negative correlation. If two assets move in perfect sync—either together or in opposite directions—they have a 100% correlation.

What Does Gold Correlate With?

Gold (XAU/USD) has both positive and negative correlations with different assets.

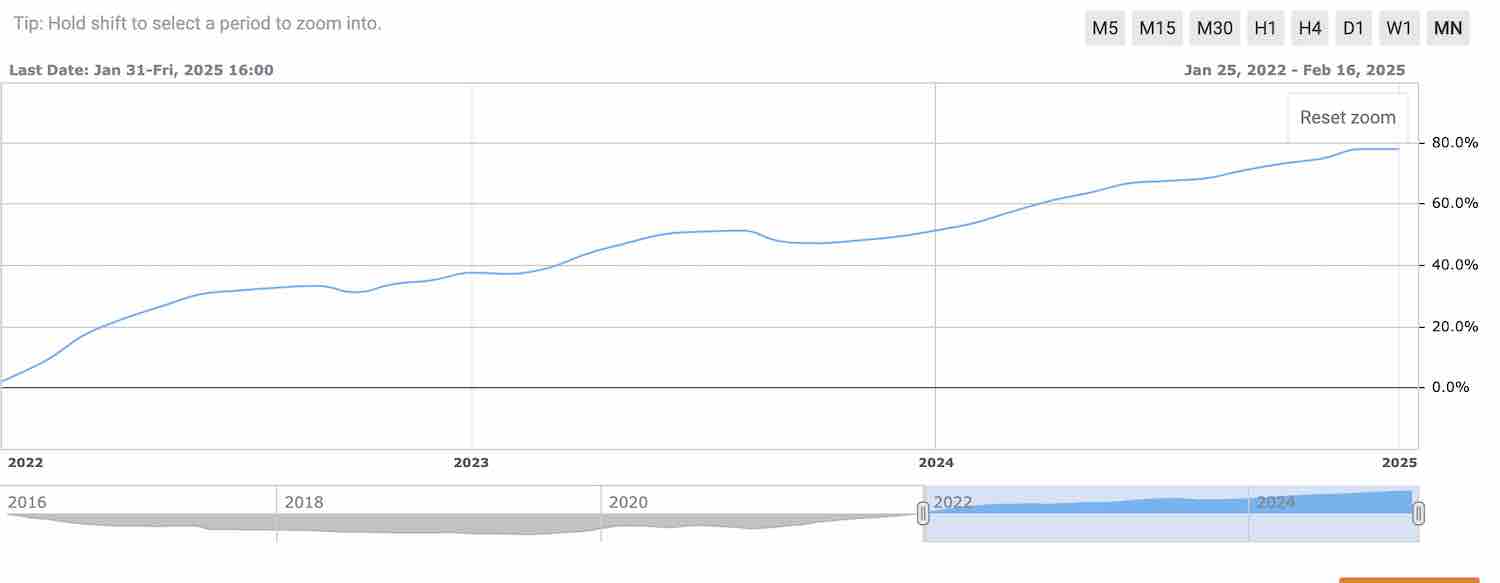

✅ Most Positively Correlated Forex Pair: GBP/JPY

The currency pair with the strongest positive correlation with gold is GBP/JPY. In 2026, it showed up to a 78% correlation with XAU/USD, meaning both tend to move in the same direction most of the time.

Why? Because both gold and GBP/JPY are influenced by risk sentiment—when investors seek safety, both tend to rise, and when risk appetite returns, both can decline.

❌ Gold’s Negative Correlation with USD & US Assets

Gold typically has a negative correlation with the US Dollar (USD) and US stock indices. When the USD strengthens, gold prices tend to fall, and vice versa. This is because gold is a safe-haven asset, meaning it becomes more attractive when economic uncertainty increases.

Why Does Correlation Matter in Gold Trading?

Understanding gold’s correlation with other assets allows traders to:

🔹 Diversify risk by avoiding highly correlated trades.

🔹 Confirm trade signals by checking related assets.

🔹 Hedge positions by using negatively correlated instruments.

Why Correlation Matters in Risk Management

By looking at the correlation between gold and other currency pairs, you can make more informed decisions when your analysis is unclear. It can help you avoid entering trades based on emotions or incomplete setups, improving both your confidence and risk management.

If correlated pairs are moving in the same direction as your gold setup, it’s likely that your trade idea has additional support. Conversely, if correlated pairs are moving oppositely, it could be a signal to either adjust your strategy or wait for clearer conditions before entering the market.

In Conclusion

Using correlation can help you feel more secure in your trades. It serves as a secondary confirmation, helping you make more strategic decisions and increasing the likelihood of successful trades in the volatile gold market.

If you’re a US resident looking for the best forex brokers for gold trading, check out this post

Thank you for this comprehensive list and comparative details. I used your link to create an FPMarket account.

Happy to hear that you found the broker suitable for your trading style.

I can understand this better. I found fx leaders to have a broker connected to them. Might need to re-evaluate my options.

Thanks for this post!